Pressure Transmitter Market Top Players, Current Trends, Future Demands and Forecast to 2032

Pressure Transmitter Market to Reach USD 4.71 Billion by 2032, Driven by Industrial Automation and Safety Needs

Market Size

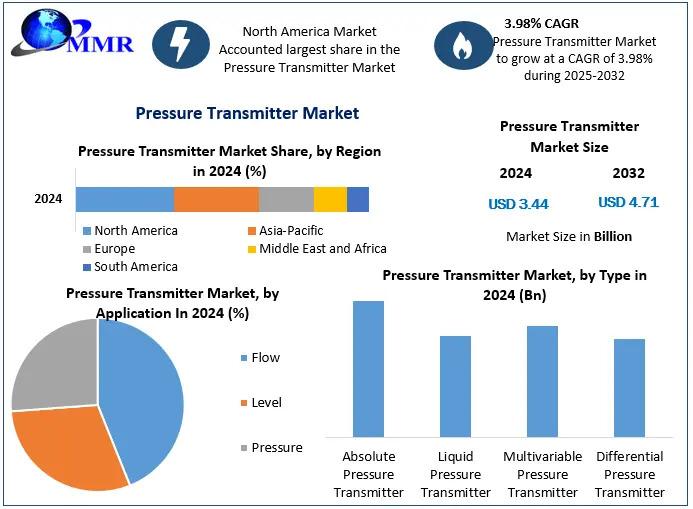

Global market size was approximately USD 3.44 billion in 2024 and is projected to grow to USD 4.71 billion by 2032, representing a CAGR of ~3.98% between 2025 and 2032

USD 2.49B in 2025 growing to USD 3.65B by 2034 (CAGR ~3.8%)

- USD 3.30B in 2024 reaching USD 4.30B by 2033 (CAGR ~2.9%)

Market Overview

Pressure transmitters convert mechanical pressure applied by fluids (liquids, gases, steam) into readable electrical signals for process control. Widely deployed across oil & gas, chemical processing, power generation, water & wastewater treatment, pharmaceuticals, food & beverage, and mining industries, they ensure safety, optimize performance, and support regulatory compliance

Key trends include the adoption of smart communication protocols (e.g., HART, wireless), IIoT integration, and predictive diagnostics, supporting industrial automation and energy-efficient operations.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/27176/

Market Definition & Estimation

Pressure transmitters are categorized by:

- Type: Absolute, Gauge, Differential (largest segment ~40–48.6%), and Multivariable (fastest-growing)

- Fluid Type: Liquid (dominant and fastest‑growing), followed by Gas and Steam.

- Measurement Application: Level measurement leads market usage; flow measurement shows fastest growth

- End‑Use Industry: Water & wastewater treatment (~34% share and fastest CAGR), followed by Oil & Gas, Chemicals, Power, Food & Beverage, Metals & Mining, Pharmaceuticals, and others

Market Growth Drivers & Opportunities

- Industrial Automation & Process Control

Growing digital transformation across industries drives demand for precise pressure instrumentation - Oil & Gas and Chemical Industry Expansion

Highly regulated sectors require accurate pressure monitoring for safety and operational efficiency - Infrastructure & Water Sector Growth

Water & wastewater treatment infrastructure expansion fuels demand for level and pressure transmitters globally - Smart & IIoT-Enabled Devices

Integration of smart calibration, diagnostic and wireless capabilities offers efficiency and reduced downtime opportunities - Shift toward Multivariable Transmitters

Rising adoption due to ability to measure multiple parameters (pressure, temperature, flow) in one device, reducing installation and lifecycle costs - Regulatory Push and Safety Standards

Stringent requirements in pharmaceuticals, food, and power generation drive reliability and compliance expectations.

Segmentation Analysis

- By Type

- Differential pressure transmitters dominate (~40–48.6%) due to critical roles in flow and level control

- Multivariable transmitters are the fastest-growing segment.

- By Fluid Type

- Liquid fluid applications account for the largest share and exhibit highest growth trajectory

- By Application

- Level measurement holds the largest share; flow measurement grows fastest due to automation needs

- By Industry Vertical

- Water & wastewater treatment holds >34.2%. Other key industries: Oil & Gas, Chemicals, Power, Food & Beverage, Mining, Pharmaceuticals, Pulp & Paper.

- By Region

- Asia‑Pacific leads (~46.9% share in 2023), with fastest growth; North America holds strong second position; Europe, Latin America and MEA follow

Major Manufacturers

Key global players in the pressure transmitter market include:

- Emerson Electric Co.

- ABB Group

- Yokogawa Electric

- Honeywell International

- Endress+Hauser

- Siemens AG

- Schneider Electric

- Fuji Electric

- Danfoss

- VEGA Grieshaber

- WIKA Alexander Wiegand

- Dwyer Instruments

- TE Connectivity

- Zemic Group

- Anfield Sensors

- These vendors compete on technology integration, certifications, service networks, and domain-specific customization.

Regional Analysis

Asia‑Pacific

Dominates the market with ~46.9% share in 2023; infrastructure, chemicals, power generation, and water treatment drive strong demand; CAGR around 4–5%.

North America

Robust automation in oil & gas, power, and chemical sectors; steady innovation and strong aftermarket growth contribute ~17–18% share; second-fastest regional growth

Europe

Mature industrial base with focus on renewable energy, water treatment, and chemicals; holds ~20–25% of market.

Latin America & MEA

Emerging, with growth tied to infrastructure investments, water processing expansion, chemicals, and extraction industries.

COVID‑19 Impact Analysis

- 2020: Industrial slowdowns and delayed projects softened demand for instrumentation.

- 2021–2022: Recovery driven by resumed investments in automation and utility upgrades.

- Post-2023: Strong focus on smart, remote interrogation capable, low-maintenance transmitters to support digital operational strategies.

Competitive (Commutator) Analysis

- Smart Device Innovation: Leading suppliers offer integrated diagnostics, remote calibration, and IIoT connectivity to enhance uptime and compliance.

- Regulation-Based Differentiation: Devices compliant with SIL, IEC, and industry-specific certifications are preferred in high-stakes sectors.

- Performance vs Cost Trade-off: Multivariable technology adoption balances overall lifecycle cost and installation footprint.

- Aftermarket & OEM Strategy: Companies offering retrofit solutions, calibration services, and long-term support capture broader customer loyalty.

- Regional Adaptation: Asia-Pacific-based vendors leverage local customization and quicker delivery to better serve emerging markets

Key Questions Answered

- What is the current market size and future forecast?

– USD 3.44 B in 2024, projected to reach USD 4.71 B by 2032 (~3.98% CAGR). - Which transmitter type dominates and which grows fastest?

– Differential pressure transmitters hold the largest share; Multivariable transmitters grow fastest. - Which industry leads usage?

– Water & wastewater treatment (>34% share), followed by oil & gas and chemicals. - Which fluid measurement segment is largest?

– Liquid applications dominate; gas and steam follow. - Which region leads and which grows fastest?

– Asia-Pacific leads market share; North America growth is accelerating; Europe is mature and stable. - Who are key global players?

– Emerson, ABB, Yokogawa, Honeywell, Endress+Hauser, Siemens, Schneider, Danfoss, Fuji Electric, WIKA, and others.

Conclusion

The global pressure transmitter market is on track for steady growth, rising from USD 3.44 billion in 2024 to approximately USD 4.71 billion by 2032, with a CAGR near 4%. Growth is driven by expanding industrial automation, infrastructure upgrades in water and chemical sectors, stricter safety regulations, and the shift toward smart diagnostics and IIoT. As demand for precision, reliability, and safety intensifies, pressure transmitters—especially multivariable and differential types—will remain foundational instrumentation across mission-critical industries.

Manufacturers that offer smart, durable, certified devices with strong service networks are best positioned to lead. With rising need for real‑time monitoring and predictive maintenance, the pressure transmitter market is poised for stable, technology-fueled expansion into the next decade.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com