How Does Apartment Ownership Differ for Locals and Foreigners in Qatar?

Apartment ownership in Qatar is governed by a clear legal framework that distinguishes between citizens and non-citizens. These distinctions impact where individuals can buy property, what rights they have, and how ownership structures operate. For both locals and foreigners, understanding these differences is essential before investing in real estate in Qatar.

Legal Framework for Property Ownership

Qatar’s property ownership laws were revised in 2004 under Law No. 17 and later expanded under Cabinet Decision No. 28 of 2020. These laws define the zones where foreign nationals are allowed to purchase real estate and outline the ownership rights granted to them.

Qatari citizens can buy and own real estate freely across the country. In contrast, foreign nationals are restricted to specific areas designated by the government. The government allows full ownership or leasehold rights depending on the zone classification.

Full Ownership vs. Leasehold Rights

Locals have access to both freehold and leasehold property rights across all areas. This ownership is perpetual and unrestricted, granting them the right to use, sell, or rent out the property at will.

Foreigners, however, are typically limited to freehold ownership in specific zones or leasehold agreements that grant property usage for up to 99 years. In freehold zones like The Pearl or Lusail, expatriates can own apartments outright. While this gives foreigners a level of security, it is still fundamentally different from the rights afforded to citizens.

Residency Through Property Ownership

Another key distinction is the right to residency. Foreign investors who purchase real estate worth at least QAR 730,000 (approximately USD 200,000) in designated zones are eligible for residency permits. If the investment exceeds QAR 3.65 million (about USD 1 million), they may qualify for permanent residency benefits, which include access to health care and education services.

Locals, of course, do not require real estate investment for residency. For foreigners, property ownership becomes both a residential solution and a pathway to more permanent status in the country.

Financing and Mortgage Access

Financing options for property purchases also vary between locals and foreigners. Qatari citizens have greater access to government-backed housing loans and favorable interest rates. Various local banks provide extensive support to nationals looking to purchase apartments, often with longer repayment periods and minimal interest burdens.

Foreigners, on the other hand, can obtain mortgages from select banks but face stricter eligibility criteria. Down payments are generally higher, and repayment terms are less flexible. Mortgage availability also depends heavily on the zone and type of property being purchased.

Documentation and Procedures

For locals, the documentation process for buying property is relatively straightforward. They can register property through the Ministry of Justice with minimal restrictions.

Foreigners, however, must go through additional regulatory steps. Verification of eligibility based on zone, approval from the Ministry of Justice, and background checks are part of the standard process. The legal documentation must clearly specify whether the ownership is freehold or leasehold and comply with the governing property laws for foreigners.

Investment Opportunities

The difference in ownership rights also influences the type of investment opportunities available. Locals can invest across Qatar’s entire real estate landscape, including in commercial, agricultural, and residential zones.

Foreigners are typically steered toward high-end residential developments, especially in designated investment zones. Areas like Lusail, The Pearl, and West Bay have been designed with expatriate investors in mind. These zones offer luxury apartments, high rental yield potential, and full ownership rights, attracting foreign capital while preserving national control over broader land use.

Foreigners looking into Apartments for Sale in Qatar often find these zones particularly attractive due to their modern infrastructure, international schools, shopping centers, and waterfront views. These properties not only provide quality living but are also seen as sound investment assets.

Government Incentives and Changing Policies

Qatar has been actively working to encourage foreign real estate investment. Recent incentives, including relaxed residency laws and reduced ownership thresholds, signal a long-term strategy to attract capital and talent.

However, the government still maintains a balance by limiting foreign ownership to around 25 zones to preserve national control over land use and urban planning. These policies reflect Qatar’s cautious but welcoming approach to foreign investment, ensuring that while foreigners can participate in the market, the core land and housing resources remain in local hands.

Cultural and Social Considerations

Another factor that shapes apartment ownership differences is the cultural context. Qatari citizens often prioritize land ownership and large family villas over apartments. For many locals, apartments are seen as temporary housing or secondary properties.

In contrast, foreigners—especially working professionals and small families—find apartments to be a practical and affordable choice. As a result, developers tailor apartment projects in designated zones to suit expat lifestyles, with amenities such as gyms, pools, and concierge services.

This divergence influences the design, pricing, and marketing of properties. Developers are aware of the preferences and legal capabilities of each group, shaping the apartment market into a dual system that serves both segments distinctly.

Property Management and Ownership Obligations

Property management expectations also differ. Locals often manage their own properties or delegate to local family networks. Foreign owners usually rely on professional property management services due to time constraints or lack of familiarity with local practices.

This reliance has driven demand for specialized property services in expat-heavy areas. According to industry insights on how property management helps landlords maximize returns in Qatar, professional oversight is key to maintaining rental income and ensuring legal compliance, particularly for foreign investors.

Final Thoughts

Apartment ownership in Qatar is shaped by a dual-structured system that balances national priorities with openness to global investment. For Qatari locals, full and unrestricted access to all property types enables broad investment and development opportunities. Foreigners, while limited to designated areas, enjoy clear legal paths to ownership and growing incentives that make Qatar’s real estate sector increasingly attractive.

Understanding these differences helps both groups navigate the market more effectively. For foreign buyers especially, knowing the legal and procedural framework is essential before committing to an apartment purchase. Whether for living, investing, or gaining residency, apartment ownership in Qatar remains a dynamic opportunity shaped by strategic governance and economic vision.

Categories

Read More

In the evolving packaging market, assessing the Cap Compression Moulding Machine Price is a key factor for manufacturers looking to invest in efficient and high-performance equipment. Taizhou Chuangzhen Machinery Manufacturing offers advanced capping solutions that combine precise torque control, energy-efficient motors, and intelligent automation systems. These machines allow manufacturers to...

Introduction — a bright scoop of joy Imagine a scoop that looks like a comic book come to life: bright swirls, three bold flavors, and a smile on every face. That’s the charm of Superman Ice Cream in Westland — a whimsical, nostalgic frozen dessert that delights kids and grown-ups alike. When you want a treat that’s visually stunning and delicious, The Original Dairy Dan...

Đánh giá về Xốc dịa 88 là một trong những điểm đến uy tín và nổi tiếng nhất cho các đứ nhân cầu chơi trực tuyến tại Việt Nam. Với giao diện thân thiện, kho trò chơi phong phú, nền tảng này đã thu hút hàng triệu người chơi từ khắp nơi trên thế giới. Cơ hội cầu chơi rộng...

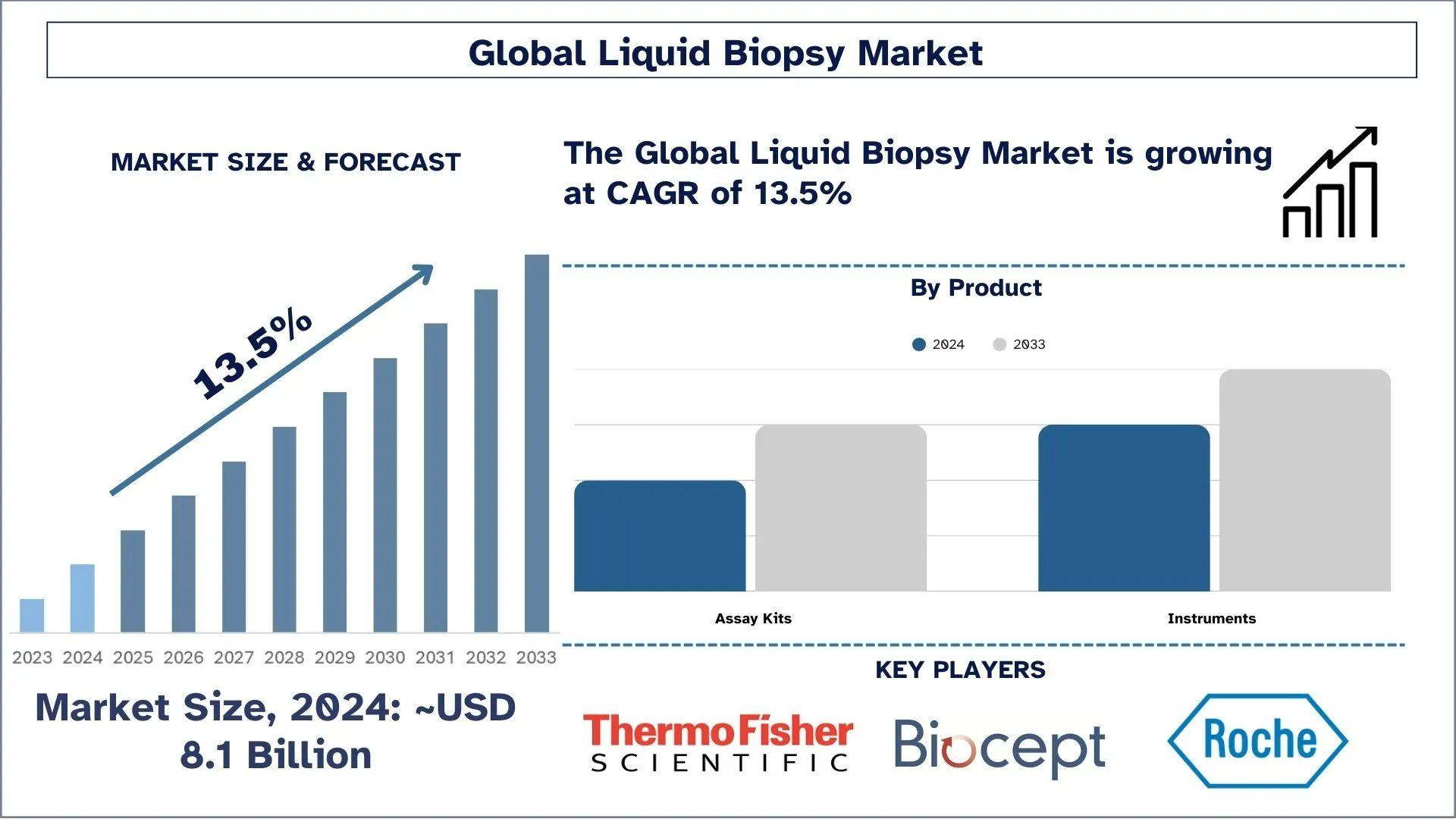

The Liquid Biopsy report has been aggregated by collecting informative data of various dynamics such as market drivers, restraints, and opportunities. This innovative report makes use of several analyses to get a closer outlook on the Liquid Biopsy market. The Liquid Biopsy report offers a detailed analysis of the latest industry developments and trending factors in the market that are...

If you're a pet parent in sunny West Palm Beach, you already know how important grooming is to your furry friend’s health and happiness. But finding the right groomer is more than a quick Google search—it's about trust, safety, skill, and love for animals. So if you're searching for pet grooming in West Palm Beach FL, you’re in the right place. Let us introduce you to your new...