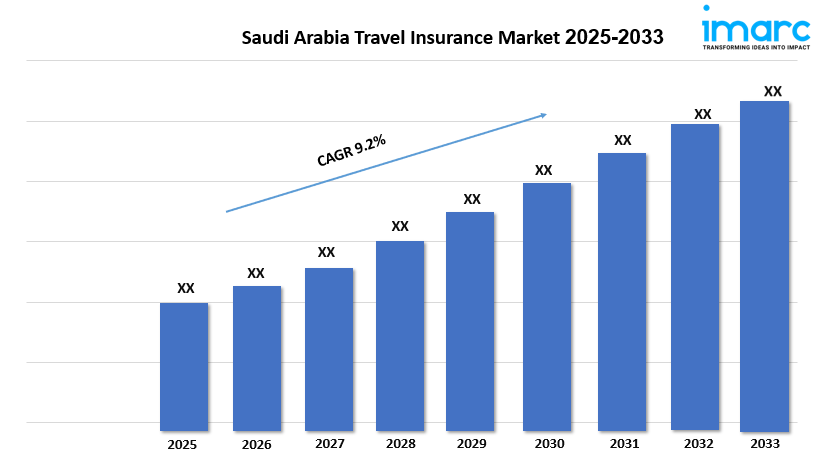

Saudi Arabia Travel Insurance Market Report 2025, Demand, Outlook And Growth by 2033

Saudi Arabia Travel Insurance Market Overview

Market Size in 2024 : USD 118.9 Million

Market Size in 2033: USD 286.6 Million

Market Growth Rate 2025-2033: 9.2%

According to IMARC Group's latest research publication,"Saudi Arabia Travel Insurance Market Report by Insurance Coverage (Single-trip Travel Insurance, Annual Multi-trip Travel Insurance, and Others), Distribution Channel (Direct Sales, Online Travel Agents, Airports and Hotels, Brokers, and Others), End User (Senior Citizens, Business Travelers, Family Travelers, and Others), and Region 2025-2033", Saudi Arabia travel insurance market size reached USD 118.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 286.6 Million by 2033, exhibiting a growth rate (CAGR) of 9.2% during 2025-2033.

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-travel-insurance-market/requestsample

Saudi Arabia Travel Insurance Market Trends & Drivers:

Saudi Arabia’s booming tourism, fueled by Vision 2030, is driving the travel insurance market with millions visiting for Hajj, Umrah, and leisure. The market generates USD 856.15 million in revenue, with inbound travel insurance dominating due to 2 million annual pilgrims. Tawuniya Insurance reports a 20% surge in policies for religious travelers, offering tailored medical and trip cancellation coverage. The government’s National Tourism Strategy boosts visitor numbers, increasing demand for comprehensive plans. As Saudi aims for global tourism status, insurers are cashing in on the need for traveler peace of mind.

Digital transformation is revolutionizing Saudi Arabia’s travel insurance market, making it easier for travelers to buy policies. Online platforms like Noon.com and insurer apps have driven a 30% increase in digital policy sales, with 65% of purchases now via smartphones. The Insurance Authority’s sandbox platform, launched at Fintech 24, fosters insurtech innovation, letting firms like Walaa test AI-driven claims processing, cutting times by 25%. Vision 2030’s push for tech adoption encourages user-friendly interfaces, letting travelers compare coverage instantly. This digital shift is making insurance more accessible and appealing to tech-savvy Saudis.

Rising awareness of travel risks is pushing Saudi Arabia’s travel insurance market forward, especially post-pandemic. Consumers, with 61.69% opting for single-trip policies, seek coverage for medical emergencies and cancellations, boosting market demand. Al Rajhi Takaful’s new plans cover 80% of trip disruption costs, gaining traction among business travelers. The Insurance Authority’s regulations ensure robust consumer protection, encouraging trust. With USD 573.71 million in market revenue, insurers like Medgulf are launching campaigns to educate travelers, driving a 15% uptick in policy uptake. This trend reflects a growing need for financial security on the road.

How AI is Reshaping the Future of Saudi Arabia Travel Insurance Market

AI is transforming Saudi Arabia’s travel insurance market by streamlining processes and enhancing customer experiences. For instance, chatbots now handle over 60% of routine customer queries, cutting response times from hours to minutes. The Saudi Central Bank’s (SAMA) regulatory sandbox has encouraged innovation, with companies like Tawuniya and Bupa Arabia testing AI-driven claims automation, reducing fraud by nearly 30%. Additionally, Vision 2030’s push for digitalization has spurred adoption—over 40% of travel insurance providers now use AI for personalized pricing based on real-time data. This shift isn’t just boosting efficiency; it’s making policies more accessible, with online purchases growing by 50% in the past two years alone.

Saudi Arabia Travel Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Insurance Coverage Insights:

- Single-trip Travel Insurance

- Annual Multi-trip Travel Insurance

- Others

Distribution Channel Insights:

- Direct Sales

- Online Travel Agents

- Airports and Hotels

- Brokers

- Others

End User Insights:

- Senior Citizens

- Business Travelers

- Family Travelers

- Others

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Recent News and Developments in Saudi Arabia Travel Insurance Market

- 2025: Saudi Arabia’s travel insurance market is seeing a strong digital transformation with the rise of AI-powered chatbots, automated underwriting, and instant claim processing technologies that reduce turnaround times by up to 40%, enhancing customer experience significantly.

- 2025: Insurers in Saudi Arabia are increasingly offering highly customizable travel insurance products tailored to specific traveler demographics and needs, such as business travelers and religious pilgrims for Hajj and Umrah, allowing flexible coverage options including medical, trip cancellation, and adventure activity protections.

- July 2025: The integration of advanced data analytics and AI enables more accurate risk assessments for pricing strategies and faster, more efficient claims processing. Collaboration among insurers, fintech, and travel agencies is streamlining real-time policy management, pushing the industry toward a more tech-driven and competitive future.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302