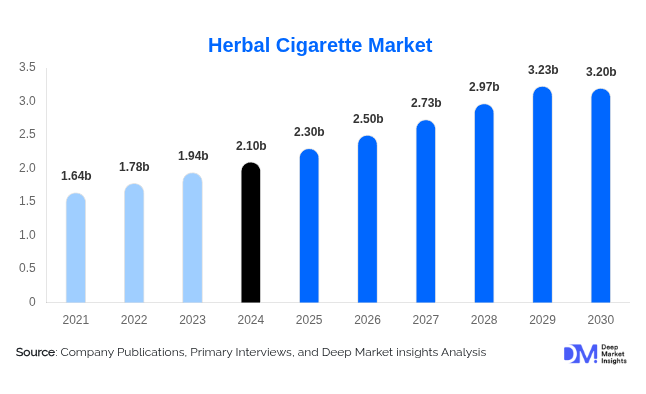

Global Herbal Cigarette Market to Reach USD 3.2 Billion by 2030 at 8.9% CAGR

According to Deep Market Insights, "The global herbal cigarette market, valued at USD 2.1 billion in 2024, is projected to grow to USD 2.3 billion in 2025 and reach USD 3.2 billion by 2030, expanding at a compound annual growth rate (CAGR) of 8.9% during the forecast period (2025–2030)."

The market is experiencing steady growth as consumers shift toward nicotine-free alternatives to conventional tobacco. Increasing health awareness, anti-smoking campaigns, and supportive tobacco control policies are key drivers. Herbal cigarettes, made from blends such as rose petals, mint, clove, corn silk, and lemongrass, are being adopted by consumers seeking to quit smoking or reduce nicotine dependency.

Key Market Insights

-

Flavoured herbal cigarettes remain the largest subsegment, especially popular among young adults and ex-smokers.

-

Honeyrose Products Ltd. recorded a 23% revenue increase in 2024, led by Germany and France.

-

Guangdong Yuxin Herbal reported 40% domestic sales growth in 2024, driven by Traditional Chinese Medicine (TCM)-based blends.

-

32% of adults enrolled in quit-smoking programs in Asia and Europe prefer herbal alternatives.

-

Adults aged 25–45 constitute the largest consumer group due to higher spending power and health awareness.

-

Online channels, including Amazon Wellness and iHerb, are the fastest-growing distribution platforms.

-

Herbal cigarettes are increasingly offered in wellness spas across Dubai and Abu Dhabi.

Market Trends

Nicotine-Free Lifestyle Movement

A leading trend in the market is the adoption of nicotine-free lifestyles. Younger consumers, particularly Millennials and Gen Z, are avoiding chemically additive products in favour of organic, clean-label alternatives. A recent survey showed over 47% of global consumers under age 35 avoid nicotine products. Herbal brands such as Honeyrose (UK) and Nirdosh (India) are capitalising on this trend with flavoured, nicotine-free blends featuring lavender, basil, and other natural ingredients.

Growing Smoking Cessation Efforts

The rise in smoking cessation programs is driving demand for herbal alternatives. Herbal cigarettes are increasingly recognised as step-down products that mimic the smoking experience without nicotine. The American Lung Association’s January 2025 report emphasised the role of non-nicotine tools in cessation, reinforcing herbal cigarettes as a transitional aid for the 36 million U.S. adults who still smoke.

Market Restraints

Despite their nicotine-free composition, herbal cigarettes face scrutiny over potential health risks. The American Cancer Society has noted that burning herbal cigarettes still produces harmful substances such as tar and carbon monoxide. Misleading claims around being “100% safe” have also attracted regulatory attention. Stricter compliance requirements and the need for transparent labelling increase operational costs, which may limit adoption among cautious consumers.

Market Opportunities

Emerging regions, particularly Asia-Pacific and Latin America, present significant opportunities. Rising disposable incomes, stronger anti-tobacco sentiment, and cultural acceptance of herbal medicine support growth. India’s Ministry of Commerce & AYUSH reported a 5.9% increase in herbal exports (April 2024–Feb 2025), valued at USD 621.6 million, highlighting global demand. E-commerce platforms such as iHerb and Alibaba Health are enabling cross-border accessibility, further opening markets.

Segment Analysis

-

By Type: Flavoured herbal cigarettes lead the segment due to consumer preference for mint, clove, rose, cinnamon, and fruity infusions. Honeyrose and Organic Smokes (India) have introduced exotic blends targeting wellness consumers in urban markets.

-

By Distribution Channel: Online retail is expanding fastest, supported by wellness-focused platforms that offer subscription models, personalised search filters, and organic certifications.

-

By End User: Adults aged 25–45 remain the largest user group, influenced by higher health literacy, cessation participation, and disposable income.

Regional Insights

-

Europe leads the market, supported by strict tobacco regulations and high demand for plant-based alternatives. Germany, France, and the UK are key markets, with Honeyrose reporting 23% year-over-year growth in 2024.

-

Asia-Pacific is the fastest-growing region, with strong adoption in India, China, and South Korea. Companies such as Nirdosh and Guangdong Yuxin Herbal are driving growth through Ayurveda and TCM-backed blends.

-

North America is growing steadily, with U.S. FDA guidelines in 2024 promoting research into non-nicotine smoking alternatives. Online retailers such as VitaCost and Amazon Wellness have expanded product visibility.

-

Latin America is emerging, supported by anti-tobacco campaigns and wellness tourism in Costa Rica, Mexico, and Brazil.

-

Middle East & Africa (MEA) shows modest but rising demand, particularly in UAE wellness spas and luxury detox programs.

Competitive Landscape

The herbal cigarette market is moderately fragmented. Leading companies compete through flavour innovation, eco-friendly packaging, ingredient transparency, and digital-first marketing strategies. Key players include:

-

Honeyrose Products Ltd.

-

Dreamy Herbal Cigarettes

-

Ecstacy Cigarettes Pvt. Ltd.

-

Nirdosh Herbal Products

-

Herbal King

-

Brown Bear Herbs

-

Bio-herbal Cigarettes Co.

-

Organic Smokes

-

Nirvana Herbal

-

Beyond Nicotine

-

DeCig Herbal

-

Red Dragon Organics

-

QuitGo

-

ZeroNic

-

Pure Herbal Smokes

Recent Development: In January 2025, Organic Smokes (Mea Ame Pvt. Ltd.) featured on Shark Tank India, presenting its AYUSH-approved herbal cigarettes made with tulsi and rose petals.