Risks in Revenue Cycle Management in Healthcare

Revenue Cycle Management (RCM) is the financial backbone of every healthcare organization. It begins with patient registration and extends through coding, claims submission, payment posting, and collections.

While RCM ensures hospitals and clinics are compensated for the services they provide, it also comes with significant risks. From regulatory compliance challenges to coding mistakes and technological vulnerabilities, risks in RCM can result in revenue leakage, claim denials, and compliance penalties.

Understanding these risks is crucial for healthcare providers seeking long-term financial stability and operational efficiency.

The Growing Complexity of RCM in Healthcare

Healthcare systems today are more complex than ever. Providers must navigate new payment models, manage compliance with evolving regulations, and handle a growing volume of claims. Each step in the revenue cycle requires accuracy and attention to detail, and even a small mistake can ripple through the entire system. While revenue cycle management services streamline processes, the reality is that financial and operational risks continue to threaten the system’s reliability.

Coding Errors and Their Financial Impact

Accurate medical coding is the foundation of effective RCM. Yet coding errors remain one of the most common causes of revenue loss in healthcare. Improper documentation, use of outdated codes, or failure to meet payer requirements can lead to claim denials and audits. A trusted medical billing and coding company plays a vital role in reducing such risks by ensuring coding practices are up to date and compliant with payer policies.

Even minor inaccuracies can trigger claim rejections or underpayments. With value-based care models placing greater emphasis on accuracy, the risk of coding errors directly impacts both reimbursement levels and compliance with payer requirements.

Compliance Risks in RCM

The healthcare sector is one of the most heavily regulated industries, and non-compliance can bring severe consequences. Revenue cycle management teams must adhere to regulations such as HIPAA, the Affordable Care Act, and various state laws. Failure to comply can result in fines, reputational damage, and even loss of licensure.

Audits by government agencies and private payers continue to increase, creating additional pressure on providers to maintain strict compliance standards. One overlooked detail in patient data privacy or claim submission can expose healthcare organizations to significant legal and financial risks.

Denied and Delayed Claims

Claim denials are a persistent risk in RCM. Denials may stem from missing patient information, lack of medical necessity documentation, or technical errors in claim submission. Denied claims lead to lost revenue and add administrative burden as staff must resubmit or appeal claims.

Delayed payments are another concern, as they create cash flow issues for healthcare providers. When claims are stuck in review due to errors or insufficient documentation, hospitals and clinics may face serious operational strain. Proactive claim monitoring, supported by professional revenue cycle management services, can reduce these risks significantly.

Patient Payment Challenges

With the rise of high-deductible health plans, patients are now responsible for a greater portion of their healthcare costs. Collecting payments from patients can be one of the most difficult aspects of RCM.

If patients are not educated about their financial responsibilities upfront, it increases the risk of delayed or missed payments. This not only affects revenue but also strains patient-provider relationships. Healthcare organizations need strong communication strategies and payment solutions to minimize patient-related revenue risks.

Technological Risks in RCM

Modern RCM depends heavily on technology, including Electronic Health Records (EHRs), billing software, and claim processing systems. While these technologies improve efficiency, they also present risks such as system downtime, cybersecurity threats, and integration failures.

Data breaches are particularly concerning in healthcare, as sensitive patient information must remain secure under HIPAA regulations. A single breach can lead to reputational damage, regulatory fines, and loss of patient trust. Robust IT infrastructure, routine audits, and cybersecurity measures are essential for minimizing technological risks in RCM.

Staffing and Training Gaps

Revenue cycle processes require highly skilled staff who are trained in both medical and financial aspects of healthcare. However, staffing shortages and inadequate training are common risks. Inexperienced staff may make errors in coding, billing, or claim submissions, leading to lost revenue and compliance issues.

Healthcare organizations must invest in ongoing training and skill development to ensure their teams can keep pace with changes in coding systems, payer rules, and technology. Failure to do so creates gaps that directly affect RCM performance.

Financial Risks and Revenue Leakage

Revenue leakage happens when healthcare organizations lose revenue due to inefficiencies or errors in the RCM process. It may occur through unbilled services, underpayments, or missed follow-ups on denied claims. While these may seem like small amounts individually, the cumulative impact can be devastating to a provider’s financial health.

Regular audits, reconciliations, and the use of advanced analytics are critical to identifying and addressing revenue leakage. Without proactive measures, healthcare providers risk long-term financial instability.

Future Outlook: Managing Risks in RCM

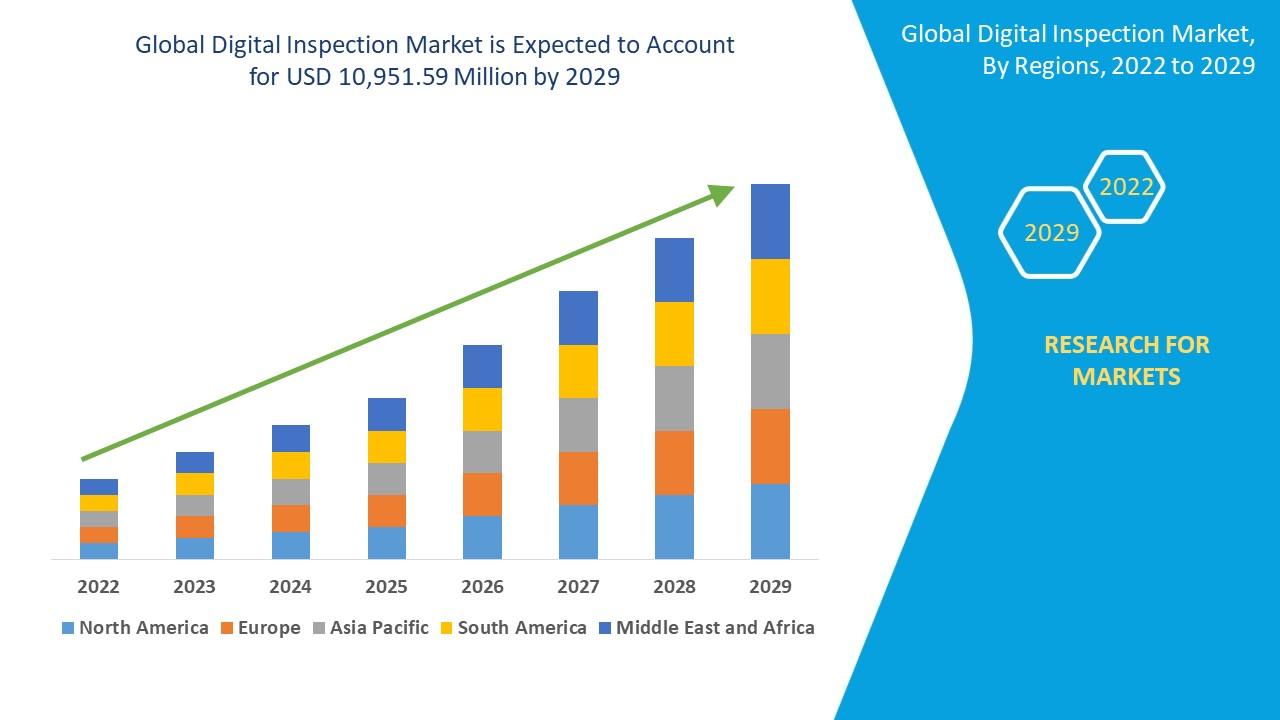

The future of RCM will be shaped by advancements in artificial intelligence, automation, and data-driven decision-making. These technologies promise to reduce human error, streamline workflows, and strengthen compliance. However, they also introduce new risks, such as dependency on automation and data security vulnerabilities.

Healthcare organizations must strike a balance between leveraging technology for efficiency and maintaining human oversight to safeguard compliance and accuracy. Building resilient revenue cycle systems will require both innovation and adaptability.

Why Understanding RCM Risks Matters

Healthcare is not just about delivering patient care—it is also about sustaining financial health to ensure that care remains accessible. Providers who overlook the risks in RCM jeopardize their ability to serve patients effectively. By identifying potential threats and implementing strong preventive measures, healthcare organizations can improve financial outcomes, reduce compliance risks, and enhance patient trust.

FAQs

What are the most common risks in revenue cycle management?

Common risks include coding errors, compliance failures, denied claims, patient payment challenges, and technological vulnerabilities. Each of these can lead to revenue loss and legal complications.

How do coding errors impact RCM?

Coding errors often result in claim denials or underpayments. They can delay reimbursements, increase administrative costs, and trigger audits.

Why are compliance risks critical in healthcare RCM?

Healthcare is highly regulated, and non-compliance with HIPAA, payer guidelines, or state laws can lead to financial penalties, reputational damage, and even loss of licensure.

Can technology reduce RCM risks?

Yes, technology such as automation and analytics can minimize errors and improve efficiency. However, it also introduces risks like cybersecurity threats and reliance on system accuracy.

How can providers reduce claim denials?

Providers can reduce denials by ensuring accurate documentation, training staff regularly, and using proactive claim monitoring through reliable revenue cycle management systems.

Conclusion

Risks in revenue cycle management are inevitable, but they can be effectively managed with the right strategies. Healthcare providers must recognize the vulnerabilities in coding, compliance, claims, patient payments, and technology to prevent revenue leakage and maintain compliance. By combining skilled staff, modern tools, and effective oversight, providers can build a resilient RCM process that safeguards both financial performance and patient care.