Best Demat Accounts in India for Seamless Trading and Investment

In the modern financial landscape, having a reliable demat account is essential for every investor. A demat account not only allows safe and electronic storage of securities but also simplifies buying, selling, and managing investments. Choosing the best demat accounts in India ensures you can trade efficiently, monitor your portfolio, and access financial markets without any hassle.

A demat account serves as the backbone of trading in India, allowing investors to hold shares, bonds, mutual funds, and other securities in digital form. With the rise of technology and mobile trading, top demat accounts now offer robust mobile app access, enabling users to trade anytime and anywhere. Whether you are a beginner or an experienced trader, having the right demat account can significantly impact your investment journey.

What Is a Demat Account?

A demat account, short for “dematerialized account,” is an electronic account that holds your financial securities securely. Before demat accounts, investors had to manage physical share certificates, which were cumbersome and prone to risks such as loss or damage. With a demat account, all securities are stored digitally, ensuring transparency, safety, and seamless transfers.

Importance of Mobile App Access in Demat Accounts

Mobile app access has transformed the way investors manage their portfolios. The convenience and efficiency of trading through a mobile app provide several advantages:

-

Instant Trading: Execute buy or sell orders in real-time.

-

Portfolio Tracking: Monitor your holdings anytime, anywhere.

-

Market Alerts: Receive timely notifications about stock movements and corporate announcements.

-

Research and Analysis: Access charts, technical indicators, and expert insights directly from your smartphone.

-

Ease of Use: User-friendly interfaces make trading simple even for beginners.

With mobile app access, investors no longer need to depend on desktops or brokers to manage their investments. It allows for quicker decisions and improved market responsiveness.

Key Features to Look for in the Best Demat Accounts in India

When selecting a demat account, it is important to evaluate certain features to ensure a seamless trading experience.

User-Friendly Interface

The mobile app and web interface should be easy to navigate, allowing both beginners and seasoned traders to place orders, track portfolios, and access insights effortlessly.

Security

Strong security measures like two-factor authentication, encryption, and secure login are essential to protect your investments from unauthorized access.

Low Charges

Compare annual maintenance charges (AMC) and transaction fees. Some brokers offer low-cost plans with competitive brokerage rates, which can save significant money over time.

Research and Insights

Top brokers provide research reports, market analysis, and expert recommendations to help investors make informed decisions.

Customer Support

Efficient customer support ensures any issues or queries are resolved quickly, whether related to account management, trading, or app usage.

Popular Demat Accounts in India

Several brokers in India offer excellent demat accounts with mobile app access. The most popular options include:

Zerodha

Zerodha is one of India’s leading brokers, offering the Kite mobile app with an intuitive interface, advanced charts, and low brokerage. It is suitable for beginners and professional traders alike.

Upstox

Upstox provides a fast and simple app with real-time market data, technical analysis tools, and easy order placement. Its low-cost brokerage makes it ideal for budget-conscious investors.

Angel One

Angel One combines trading, investment insights, and educational resources in its mobile app, catering especially to beginners who need guidance.

Groww

Groww allows trading in stocks and mutual funds through its clean and simple mobile interface. It is ideal for new investors seeking convenience and easy navigation.

5Paisa

5Paisa offers a feature-rich app at a budget-friendly cost. It includes research tools, market news, and automated investment options, making it suitable for long-term investors.

Steps to Open a Demat Account

Opening a demat account has become simple with online platforms. Here’s a step-by-step guide:

-

Choose a Broker: Compare features, fees, and mobile app reviews.

-

Submit Online Form: Provide personal details and KYC documents.

-

Complete e-KYC: Verify identity using Aadhaar or PAN.

-

Sign Digital Agreement: Approve account opening documents electronically.

-

Activate App Access: Download the broker’s app and start trading.

Most best demat accounts in India are activated within 24 hours, providing a hassle-free onboarding experience.

Advantages of Using Demat Accounts

Using a demat account offers numerous benefits:

-

Safe and Secure: Eliminates risks associated with physical share certificates.

-

Quick Transactions: Buying and selling securities is fast and efficient.

-

Easy Portfolio Management: Track multiple investments in one place.

-

Paperless Process: No need for physical forms or documentation.

-

Access to IPOs: Apply for initial public offerings conveniently.

Tips for Choosing the Right Demat Account

-

Check app store reviews and ratings of the mobile trading app.

-

Compare brokerage and AMC charges across brokers.

-

Look for research tools and analytics features within the app.

-

Ensure the broker is SEBI-registered for safety and compliance.

-

Consider customer support availability and response times.

Common Mistakes to Avoid

-

Ignoring Security: Always enable two-factor authentication and use strong passwords.

-

Overtrading: Avoid frequent buying and selling, which can increase costs.

-

Relying Only on App Data: Cross-check information with other research sources.

-

Neglecting Updates: Keep the app updated to prevent technical issues.

-

Skipping Backup Options: Ensure access to web or desktop versions in case of app failure.

Mobile App Features That Enhance Trading

-

Live Market Data: Real-time stock prices help with timely decisions.

-

Interactive Charts: Perform technical analysis directly on the app.

-

Watchlists: Track selected stocks efficiently.

-

Fund Transfers: Add or withdraw funds quickly for smooth trading.

-

Portfolio Analytics: Detailed insights into gains, losses, and allocation.

Future of Demat Accounts

As technology evolves, demat accounts are becoming more advanced. Features like AI-based stock recommendations, voice-enabled trading, and automated alerts are becoming standard. Mobile app access is now a necessity for investors seeking speed, convenience, and better market insights.

Conclusion

Selecting the best demat accounts in India is essential for investors who want a seamless trading experience with security, convenience, and insightful tools. A reliable demat account enables efficient portfolio management and provides the flexibility to trade anytime through mobile apps.

For those looking to explore the stock market with minimal risk, combining a dependable demat account with the best penny stocks in India can be an effective strategy. By carefully selecting affordable, high-potential penny stocks, investors can begin their equity journey safely while laying the foundation for long-term wealth creation.

الأقسام

إقرأ المزيد

In the ever-evolving landscape of Artificial Intelligence, the race to secure top talent is heating up, with universities facing a significant "brain drain" as private companies lure away their best AI scientists and students. With AI skills in high demand, it’s no wonder that tech giants are offering enticing six-figure salaries that academic institutions simply cannot compete with....

Online cricket betting has quickly become popular in India. From casual fans to experienced bettors, many people want to place bets on exciting matches like the IPL, T20 World Cup, and domestic leagues. However, before you make your first bet, one important choice can affect your experience: choosing the Best online cricket ID. In this blog, we will discuss why the quality of your Online...

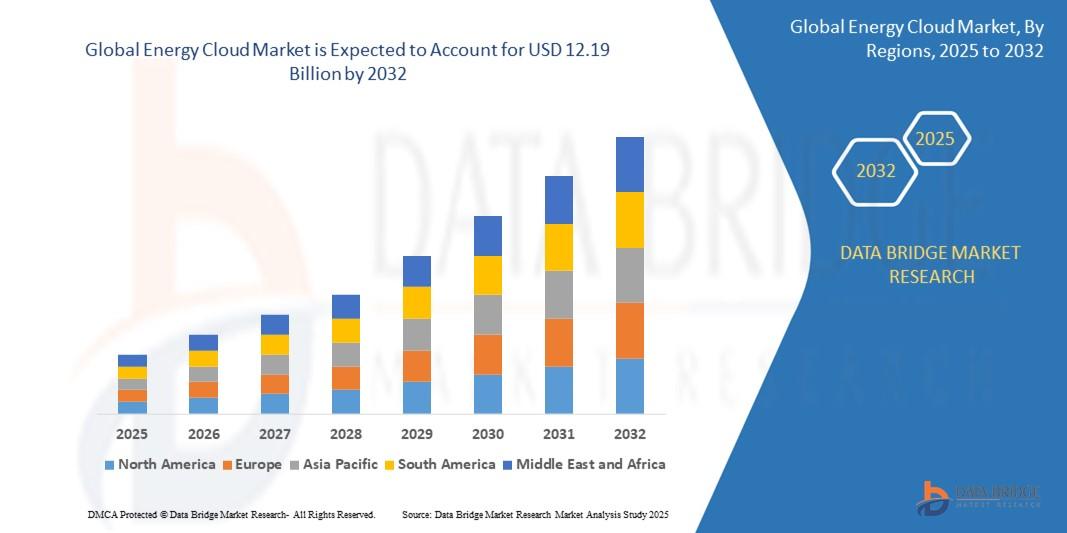

"Executive Summary Energy Cloud Market Research: Share and Size Intelligence The global energy cloud market size was valued at USD 2.69 billion in 2024 and is expected to reach USD 12.19 billion by 2032, at a CAGR of 20.80% during the forecast period. This growth is driven by factors such as the increasing adoption of smart grid technologies, the...

The Bolivia OTR Tire Market size was valued at around USD 45.10 million in 2024 and is projected to reach USD 68 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 7.21% during the forecast period, i.e., 2025-30. Bolivia OTR Tire Market...

Hello there! You want to get into the male escort in Patna in profession? You’re on the right page. This article breaks down all you want to know — what it is, what to expect — in Male escort in Nagpur, a simple respectful, and easy-to-understand Gigolo service in Patna way. Let’s start! 🤷♀️What Is a Male Escort? A male escort offers...