Brazil Digital Payments Market Size, Share, Growth & Research Report, 2033 | UnivDatos

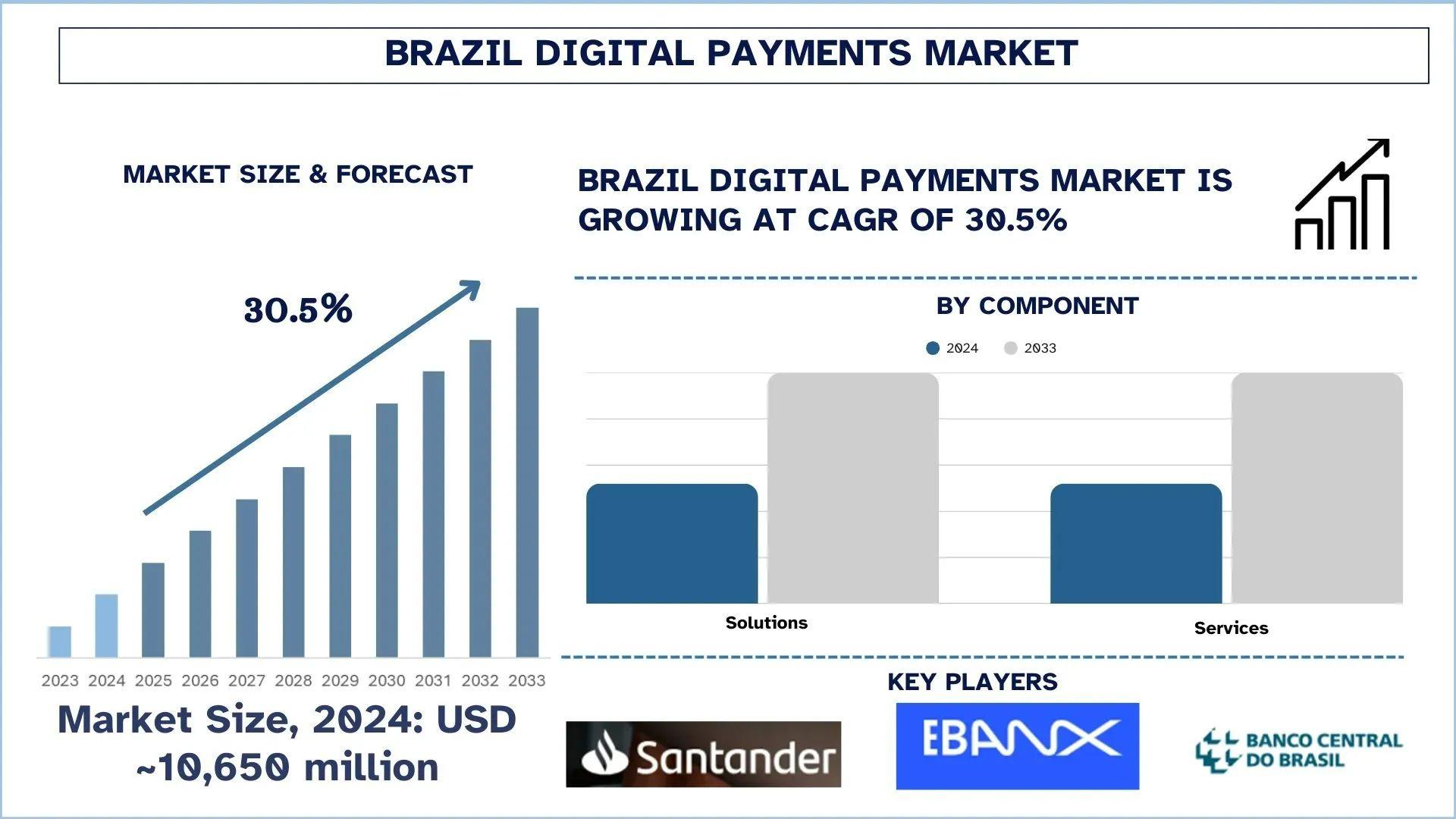

According to the UnivDatos , the robust government policies along with the extensive investments in digital payment and digital technologies would increase the demand for Digital Payments. As per their “Brazil Digital Payments Market” report, the Brazil market was valued at USD 10,650 million in 2024, growing at a CAGR of about 30.5% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The digital payments market in Brazil is experiencing an impressive shift that is driven by the speed of technological adoption, new regulations, and changing consumer behavior. The mobile-based transactions have positioned Brazil as a global leader in mobile phone and digital wallet transactions. Pix, which was developed by the Central Bank, has increased the speed of delivering instant payments and has drawn serious investments inside and outside of the country. International partnerships are also enhancing the position of Brazil in terms of global payment connectivity, and regional centers such as São Paulo and Rio de Janeiro are leading the pack. All these forces are defining the digital economy in Brazil and creating new business, fintech, and consumer opportunities in a fast-expanding market.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/brazil-digital-payments-market?popup=report-enquiry

Smartphone & Digital Wallet Proliferation:

With the adoption of digital wallets and contactless payments rapidly within Brazil, this has been highly exploited by the mass usage of smartphones. Since over 80 percent of the population will have a smartphone, consumers will be moving towards mobile-based transactions to save on convenience, costs, and time. Apple Pay, Google Pay, and various local fintech digital wallets are all experiencing a notable rise, with the usage of PIN codes and contactless cards. This shift can be attributed to the shifting consumer behavior, as well as the capabilities to send and receive payments instantly, seamlessly, and without cash have become the new standard. In the case of merchants, it presents them with an opportunity to increase online offerings, enhance checkout procedures, and address tech-sophisticated customers. Because digital wallets combine loyalty programs, payment options, and international payment solutions, they are not just a utilitarian application in the digital economy of Brazil and, in this regard, must be treated as a cornerstone in the digital economy transformation process.

Latest Trends in the Brazil Digital Payments Market

Cross‑border digital payments collaboration:

Brazil's digital payments industry is extending its reach beyond its borders: As it harnesses the potential of fintech and digital currencies, one trend is emerging as a game-changer: the rise of cross-border collaboration in the digital payments landscape. Globally, the trend of such efforts can be seen in the recently announced dialogue between Brazil and India on integration and interoperability of payment systems, as well as in other initiatives that revolve around similar subject matter. Such alliances allow for easier remittance transfers, smoother cross-border trade transactions, and less need for expensive third-party intermediaries. By establishing interconnectivity between payment infrastructures, Brazil will be able to play a leading role in promoting financial connectivity between emerging markets. Not only will this have greater efficiencies, but it is likely to also drive inclusion for migrant workers and small businesses involved in trade across borders. Further, it would also bring new opportunities for innovation in the fintech space since service providers would build products characterized by a cross-border focus.

Key Investment Trends:

The Brazil digital payments market is witnessing a rapid shift in terms of investments by the public as well as the private players. With the massive focus on digital payments and offering customers a hassle-free and comprehensive banking and payments experience, a large number of companies are entering industry. This is mainly attributed to the decision of Brazil’s central bank to launch the PIX payment system in 2020, which provided instant payments. Recently, significant investments have been made in digital payment companies in Brazil. In 2024, PayPal’s venture arm announced to invest USD 15 million in Ume, a Brazilian Payment service provider. This investment excludes the separate investment received by the company from debt financing from Verde, Itaú, which is USD 20 million.

Click here to view the Report Description & TOC https://univdatos.com/reports/brazil-digital-payments-market

Regional Market Growth

São Paulo and Rio de Janeiro are all in southeast Brazil, leading the digital payment revolution in the country. Being the most urbanized and economically active area, it has already become a test-ground for the new payment technologies, including digital wallets or the use of QR-code-based transactions. Companies, including big stores and street vendors, use more and more instant payments such as Pix to satisfy various customer requirements. The high level of fintech and innovative adoption is being fueled by the tech-savvy population in the region. To a great extent, Southeast Brazil is also indicative of how digital payments are transforming everyday life and business in the country.

“Brazil’s Digital Future: Powered by Payments”

The digital payment market in Brazil is witnessing a massive shift due to factors as financial inclusion, rise in digitalization, as well as unified actions taken by the government to launch a new payment system.

Related Report:-

Vietnam Loan Market: Current Analysis and Forecast (2025-2033)

Japan Car Insurance Market: Current Analysis and Forecast (2025-2033)

India Buy Now Pay Later Market: Current Analysis and Forecast (2025-2033)

Invoice Factoring Market: Current Analysis and Forecast (2024-2032)

Financial Data APIs Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/