Insurance Rating Platform Market Trends, Growth & Research Report to 2032 | UnivDatos

The rating of insurance platforms for the United States’ market is an active segment, which is a part of the insurance technology industry. This is a market where software is used to determine premiums for various insurance policies, with the use of AI and ML to improve on risk management as well as operations.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/insurance-rating-platform-market?popup=report-enquiry

Key Trends and Drivers: Certain factors are influencing the market of the insurance rating platform in the U.S:

· Technology: Incorporation of smart technologies such as AI and ML is helping insurers in making accurate ratings in the insurance industry and offering suitable policies to the client. This is especially the case in the U.S., where the insurers are increasingly relying on these technologies to help with underwriting and to improve the experiences of the policyholders.

· Regulatory Rules and Regulations: This means that one of the most important essential success factors is meeting the regulatory requirements of the insurance industry in the United States of America. Such platforms must make sure they comply with the changing policies, for instance, those concerning the protection and safety of user information.

· Customer Expectations: A policyholder in the United States of America expects to engage in business with an organization electronically and be served according to the individual’s unique needs. As such, insurance rating platforms must meet these expectations by having effective and convenient interfaces of both the insurers and the policyholders.

The future demand in the United States insurance rating platform market also has some challenges:

· Competition and Market Share: Competition on the market is intense and most of it is monopolized by a few companies and players, making it quite irreprehensible for the new entrants to come into the market and excel. This remains a competitive market that can only be efficiently operated by companies that bring out a unique selling proposition that provides newcomers with a new proposition and a reliable strategic partnership.

· AI, Data analytics, and big data: The insurers are required to deal with such a huge amount of data which may involve data privacy laws and at the same time may need data analytics to assess risks. Data security is something that is important for managing customers’ trust and meeting requirements of the regulations.

· The U.S. insurance market is saturated, and customers can switch easily from one insurer to another and as such; insurers have had to adapt and innovate. This is taxing on the competitors and presents an opening for companies that are flexible to adopt to new trends and technologies.

Click here to view the Report Description & TOC https://univdatos.com/reports/insurance-rating-platform-market

Conclusion

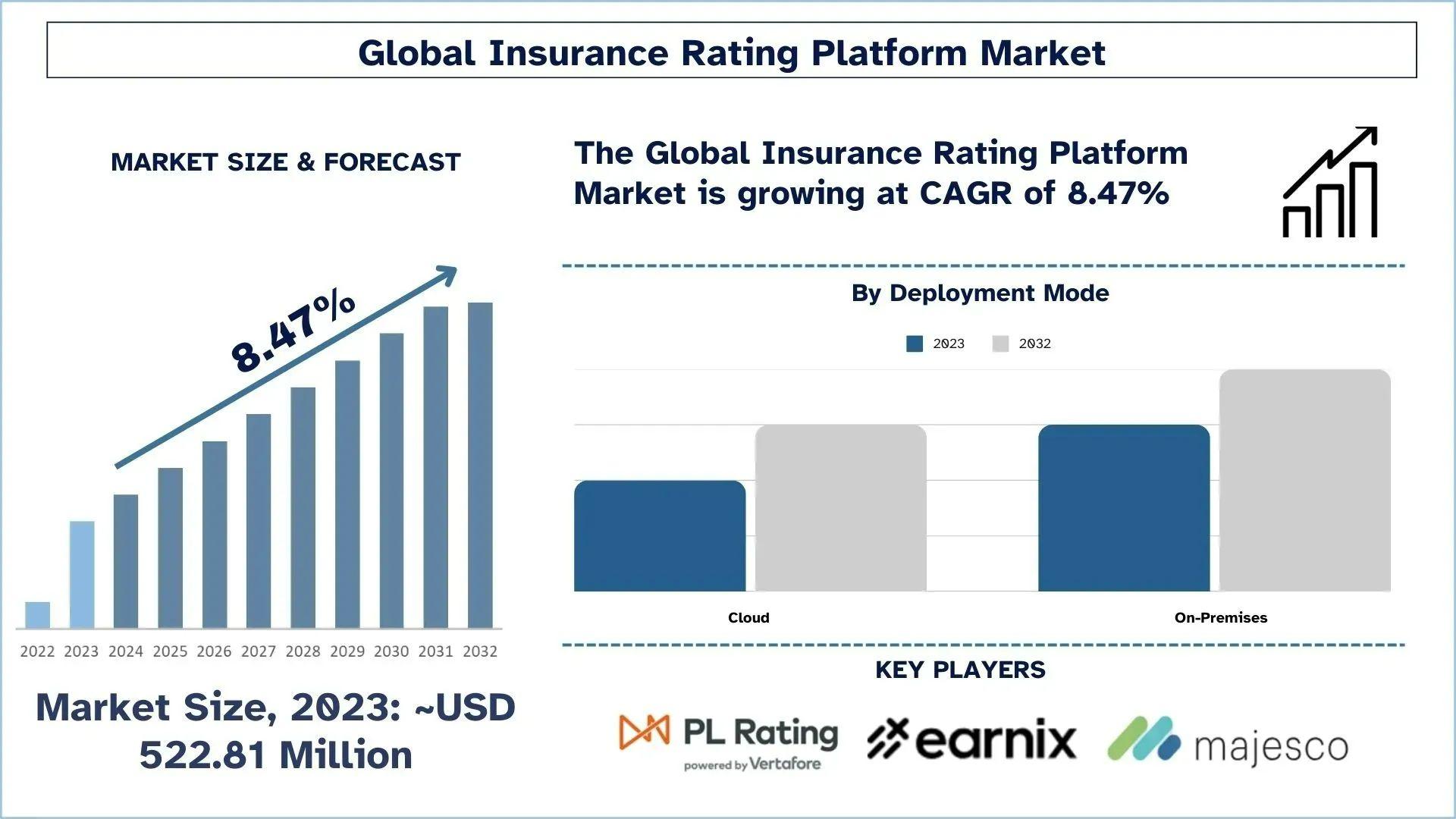

There is quite a high dependence of the U.S. insurance rating platform market on the use of technology and legislation. This means that in the future, there will be more competition and innovation of AI solutions and other forms of digital transformations among the insurers. For companies to maximize the growth potentials of cloud services, they will need to strike a good relationship between technology advancement in the field, customer services, and legal requirements in the market. The future of insurance rating platforms in the U.S. will be shaped by their ability to adapt to evolving customer needs and technological advancements.

Related Report

Private Health Insurance Market: Current Analysis and Forecast (2024-2032)

Cyber Insurance Market: Current Analysis and Forecast (2024-2032)

India Travel Insurance Market: Current Analysis and Forecast (2024-2032)

India Motor Insurance Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/