Rapid Diagnostic Kits Market: Outlook, Trends and Opportunities (2021–2031)

In recent years, the rapid diagnostic kits market has drawn intense attention from healthcare stakeholders, driven by the urgent need for faster disease detection, decentralization of testing, and consumer demand for at‑home diagnostics. Over the 2021–2031 period, this market is expected to undergo robust evolution, shaped by innovations in assay technologies, shifting application settings, and divergent growth trajectories across world regions.

Market Overview & Growth Trajectory

Between 2021 and 2031, the rapid diagnostic kits sector is expected to expand at a compound annual growth rate in the high single‐digits (commonly estimated in recent forecasts as ~8–9 % per year). For instance, a report notes a projected CAGR of 8.8 % for the period 2025–2031. The Insight Partners This aligns with broader industry projections placing the market in the tens of billions of US dollars by the early 2030s. (While public sources vary on absolute values, these growth rates reflect consensus on strong expansion.)

The growth is underpinned by multiple drivers:

-

The push to decentralize diagnostics, shifting from centralized labs to point-of-care (POC) or near-patient settings

-

Rising incidence of chronic and infectious diseases globally

-

Consumer preference for home and self-testing modalities

-

Technological advances that improve sensitivity, multiplexing, miniaturization, and connectivity

-

Supportive healthcare policy and reimbursement incentives for early detection

Simultaneously, challenges persist: regulatory harmonization for self‑use diagnostics, ensuring quality and reliability, supply chain constraints for critical reagents and materials, and affordability in lower‑income settings.

Technology Segment Dynamics

Within rapid diagnostic kits, several assay formats compete and coexist, each with strengths and trade‑offs. The key technologies are:

-

Flow‑Through assays

-

Solid phase assays

-

Lateral flow assays (LFA)

-

Agglutination assays

Of these, lateral flow assays dominate current market share and are forecasted to lead. For example, one study reported that lateral flow held ~32.45 % of revenues in 2022 and would grow at ~9.11 % CAGR. Grand View Research Another source placed the 2024 share of lateral flow at ~46.9 %, with continued strong growth through 2030. GlobeNewswire The appeal lies in their low cost, ease of use, rapid output (often within minutes), minimal instrumentation, and broad applicability to infectious disease and home tests.

However, competing formats gain traction in certain niches:

-

Agglutination assays remain relevant for simpler antigen/antibody detection applications where aggregation leads to visible readouts.

-

Solid phase immunoassays (e.g. ELISA‑style formats adapted to rapid kits) offer improved sensitivity or multiplexing in clinical settings.

-

Flow-through assays can facilitate more rapid reagent contact and washing steps, positioning them for some high-throughput POC contexts.

Going forward, hybrid and enhanced formats (e.g. lateral flow with reader devices, smartphone sensors, nanoparticle amplification, multiplexed membranes) will intensify competition. (For example, AI-enhanced interpretation of LFA images on smartphones has been explored to improve accuracy and usability.) arXiv

Application / End‑User Trends

Rapid diagnostics deploy across three broad application settings:

-

Hospitals and clinical settings

-

Home / self-testing settings

-

Veterinary settings

Historically, hospitals and clinics have been dominant end users—owing to the volume of patients and need for immediate decisions. Verified market data suggests that hospitals/clinical use accounted for ~45–50 % of the market in recent years. Verified Market Reports+1 However, the home / consumer diagnostics segment is poised for the fastest growth, supported by rising health awareness, telemedicine, and improved usability of kits. (One report forecasts home care kits growing at ~8.93 % CAGR to 2030. Mordor Intelligence)

Veterinary diagnostics also form part of the landscape, though representing a smaller share. The demand in veterinary settings is driven by livestock health monitoring, zoonotic disease surveillance, and companion animal diagnostics, particularly in regions where lab infrastructure is limited.

In applications by disease type, infectious disease testing commands a large share—driven further by the COVID-19 pandemic’s legacy and continuing need for rapid pathogen detection. One source places infectious disease as ~35–36 % of revenue in recent years. GlobeNewswire+1 Meanwhile, segments such as blood glucose monitoring, fertility and pregnancy tests, oncology markers, and cardiac markers are gaining importance. For instance, the blood glucose segment shows forecasts of high growth (due to diabetes prevalence) and is often cited among fastest expanding sub‑categories. Grand View Research+1 Oncology marker rapid kits are also expected to record elevated growth rates, though from smaller bases. Mordor Intelligence

Regional Outlook & Share Patterns

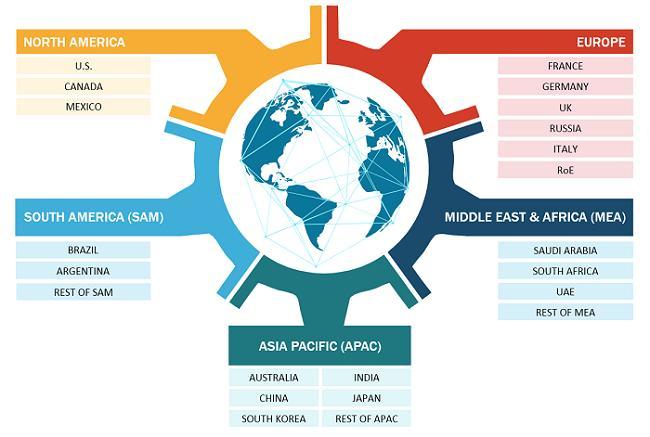

Geographically, the rapid diagnostics market is stratified by maturity, healthcare infrastructure, disease burden, and regulatory environments. Four major regions—North America, Europe, Asia Pacific, and Latin America (i.e. South & Central America)—shape the global distribution.

-

North America consistently holds a leading share, often in the 30–40 % range, driven by high healthcare spending, favorable reimbursement regimes, advanced diagnostics adoption, and consumer readiness. GlobeNewswire+3Grand View Research+3Mordor Intelligence+3

-

Europe maintains a strong position, underpinned by robust public health systems, preventive care emphasis, and cross‑border regulatory harmonization.

-

Asia Pacific is typically projected as the fastest growing region (CAGR often above 10 %) thanks to expanding healthcare infrastructure, rising incomes, urbanization, increasing disease incidence, and supportive government programs aiming to localize diagnostics manufacturing. Verified Market Reports+3Mordor Intelligence+3Grand View Research+3

-

Latin America / South & Central America is a smaller share, but with potential for growth in emerging economies via public health initiatives, private investments, and telehealth adoption.

For example, according to a Mordor Intelligence forecast, North America held ~38.17 % share in 2024 in the rapid diagnostics space, while Asia Pacific was poised for the highest growth at ~11.15 % CAGR to 2030. Mordor Intelligence Another source states that, in 2023, North America had ~40 % share, Europe ~30 %, Asia Pacific ~20 %, and Latin America / MEA the remainder. Verified Market Reports+1

Thus, while North America and Europe will remain important hubs for innovation, regulation, and premium markets, Asia Pacific and Latin America are core growth theaters.

Trends, Opportunities & Strategic Imperatives

Several trends are reshaping the competitive and innovation landscape in the rapid diagnostic kits market:

-

Multiplexing and syndromic panels

Kits that detect multiple pathogens or biomarkers in one test reduce cost, sample volume, and time. These are particularly attractive in respiratory and gastrointestinal syndromic diagnostics. -

Integration with digital/AI assistance

Use of smartphone readers, AI image processing, machine learning algorithms to interpret faint lines, reduce user error, and sync with electronic health records is accelerating. arXiv -

Miniaturization & microfluidics / lab-on-chip hybrids

Design innovations combining microchannels, smaller reagent volumes, and more precise fluid control enable more sophisticated tests in compact formats. -

Better labels and signal amplification

Nanoparticle-based signal enhancements (e.g. gold, fluorescence, plasmonics) help improve sensitivity, pushing lateral flow closer to lab-level performance. arXiv -

Regulatory evolution & self‑use approvals

Harmonizing regulatory pathways for consumer diagnostics (e.g. CLIA waivers in the US) will be critical. -

Local manufacturing & supply chain resilience

Regions are increasingly aiming for domestic kit production to reduce import reliance, especially for infectious disease tests (e.g. a Nigerian company plans local HIV/malaria kit manufacturing after aid reductions). Reuters -

Partnerships & convergence with telehealth

Rapid test providers are partnering with telemedicine platforms and health systems to integrate test ordering, result sharing, and remote consults.

Given these trends, strategic priorities for companies and stakeholders include:

-

Focusing on emerging markets with scalable, affordable kits

-

Investing in R&D for multiplex, highly sensitive, miniaturized assays

-

Building digital infrastructure and reader ecosystems

-

Navigating regulatory clearances for home and point-of-care use

-

Ensuring supply chain robustness and localization

Challenges & Risks

-

Quality, accuracy & false results: Ensuring consistent sensitivity/specificity in decentralized settings is critical to maintain trust.

-

Regulatory barriers: Diverse certification regimes across geographies slow rollouts.

-

Cost constraints: In low-income markets, even low-cost kits must compete with subsidized diagnostics or basic lab tests.

-

Reagent scarcity / supply chain bottlenecks: Especially for antibodies, enzymes, membranes.

-

User adoption & compliance: Even simple kits may suffer misuse or misinterpretation without good design and instructions.

Conclusion

Over the decade from 2021 to 2031, the rapid diagnostic kits market is projected to grow robustly, driven by innovation, decentralization, and evolving healthcare models. Lateral flow assays will continue to anchor much of the market, while hybrid formats, multiplexing, and digital integration will carve new niches and competitive advantages. Hospitals and clinical settings will remain foundational, but home testing and veterinary diagnostics will increasingly contribute to growth. Regionally, North America and Europe will sustain leadership in advanced segments, while Asia Pacific and Latin America will be the engines of volume growth.