Lightweight Materials Driving the Future of Sustainable Automotive Aluminum Market Outlook 2025-2033

Market Overview

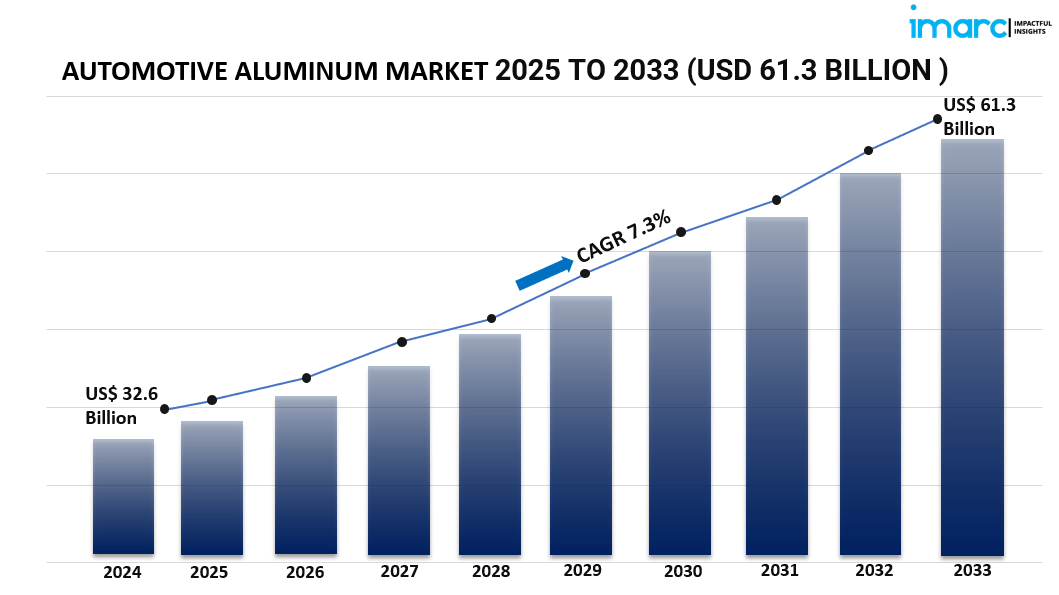

The global automotive aluminum market is experiencing strong growth, propelled by the increasing adoption of lightweight and fuel-efficient vehicles. In 2024, the market reached a value of USD 32.6 billion and is expected to grow to USD 61.3 billion by 2033, reflecting a CAGR of 7.3% during 2025-2033. This growth is driven by rising demand for lightweight luxury vehicles, stricter environmental regulations, and strong collaborations between OEMs and aluminum suppliers.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

Automotive Aluminum Market Key Takeaways

- Market Size & Growth: Valued at USD 32.6 billion in 2024, projected to reach USD 61.3 billion by 2033, growing at a CAGR of 7.3% (2025-2033).

- Dominant Product Form: Cast aluminum leads the market due to its excellent strength-to-weight ratio and versatility in complex designs.

- Leading Vehicle Type: Passenger cars hold the largest share, driven by demand for improved fuel efficiency and reduced emissions.

- Primary Application: Powertrain components dominate as aluminum offers superior thermal efficiency and lightweight properties.

- Regional Leader: Asia Pacific is the leading region, supported by strong EV sales, manufacturing capabilities, and R&D initiatives.

- Key Growth Drivers: Emission standards, increasing EV adoption, and advancements in aluminum processing technologies.

Request for a sample copy of this report: https://www.imarcgroup.com/automotive-aluminium-market/requestsample

Market Growth Factors

Shift Toward Lightweight and Fuel-Efficient Vehicles

Aluminum helps automakers achieve fuel efficiency goals and lower greenhouse gas emissions. Its usage supports environmental targets while meeting consumer demand for sustainable vehicles.

Technological Advancements in Aluminum Processing

Innovations such as advanced casting and extrusion methods enable production of complex, high-strength components, allowing aluminum to replace heavier materials without compromising performance or safety.

Rapid Growth of Electric Vehicles (EVs)

The rise of EVs increases aluminum use in battery enclosures, body frames, and structural components, helping balance battery weight, improve efficiency, and extend driving range.

Market Segmentation

Breakup by Product Form

- Cast Aluminum

- Die Casting: Used for complex shapes like engine casings through high-pressure molding.

- Permanent Mold Casting: Applied to high-strength parts such as wheels.

- Sand Casting: Suitable for larger components like engine blocks, providing design flexibility.

- Rolled Aluminum

- Aluminum Plate: Thick sheets for strength-intensive applications.

- Aluminum Sheet: Thin sheets for body panels and exterior surfaces.

- Aluminum Foil: Ultra-thin sheets for insulation and heat exchangers.

- Extruded Aluminum

- Produced by forcing aluminum through a die to create frames, supports, and cross-sectional profiles.

Breakup by Vehicle Type

- Passenger Cars: Aluminum is used in body panels, frames, and engines for enhanced performance and fuel efficiency.

- Light Commercial Vehicles (LCV): Structural aluminum improves payload capacity and efficiency.

- Heavy Commercial Vehicles (HCV): Aluminum wheels, tanks, and components enhance load-carrying capacity.

Breakup by Application

Powertrain

- Pistons: Reduce engine inertia and improve performance.

- Engine Blocks: Lower overall weight for better fuel efficiency.

- Fuel Systems: Corrosion-resistant for longer lifespan.

- Heat Shields: Provide thermal protection for critical components.

- Heat Exchangers: Maintain optimal engine temperatures.

Chassis and Suspension

- Suspension Parts: Reduce unsprung mass for improved ride handling.

- Wheels: Lightweight and strong, enhancing fuel economy.

- Steering Systems: Improve steering precision.

- Brake Systems: Aluminum enhances heat dissipation for safer braking.

Car Body

- Body Structure: Reduces weight while maintaining strength.

- Roof and Trim: Improves vehicle aerodynamics and aesthetics.

- Car Interiors: Offers a premium finish while reducing mass.

- Hang-On Parts: Lightweight doors, hoods, and trunks improve vehicle balance and efficiency.

Breakup by Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

Asia Pacific leads the global automotive aluminum market. Strong EV adoption, extensive aluminum production capabilities, and advanced R&D initiatives contribute to its market dominance. Countries such as China, Japan, and India are driving integration of aluminum in vehicle designs to achieve efficiency and sustainability goals.

Recent Developments & News

- Automation and robotics, including collaborative robots and machine vision, are improving production precision and efficiency.

- Automakers are increasingly shifting from steel to aluminum to manufacture lighter, eco-friendly vehicles that meet environmental commitments and consumer demand for high-performance automobiles.

Key Players

- Alcoa Inc.

- Novelis

- Rio Tinto Alcan

- Constellium

- BHP

- AMG Advanced Metallurgical

- UACJ Corporation

- Norsk Hydro ASA

- Dana Holding Corporation

- Progress-Werk Oberkirch AG

- Jindal Aluminium

- Kaiser Aluminum

- Lorin Industries

- Tenneco Inc.

- ElringKlinger AG

- ThermoTec Automotive

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=2105&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302