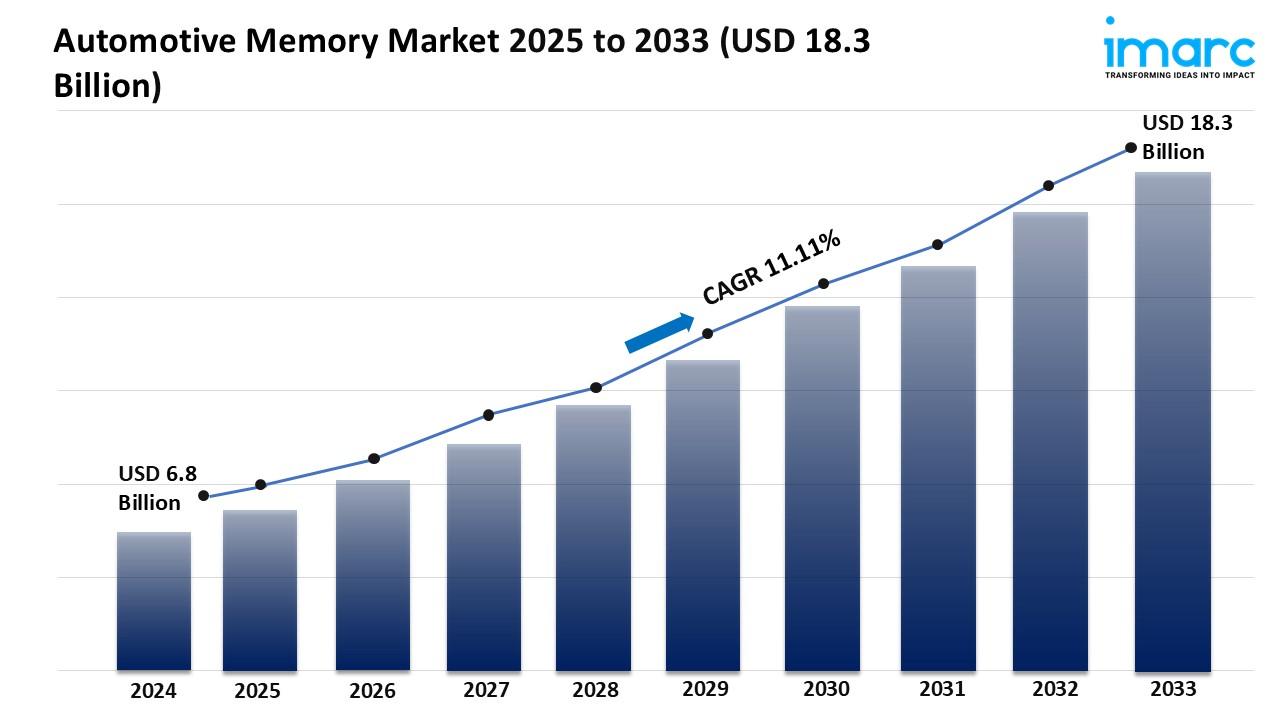

Automotive Memory Market Size, Growth, and Forecast 2025-2033

Market Overview:

The automotive memory market is experiencing rapid growth, driven by proliferation of advanced driver-assistance systems (ADAS), rise of in-vehicle infotainment and connectivity, and development towards autonomous driving. According to IMARC Group's latest research publication, "Automotive Memory Market Report by Product (DRAM, NAND, SRAM, NOR, and Others), Vehicle Type (Passenger Vehicles, Commercial Vehicles), Application (Infotainment and Connectivity, ADAS, and Others), and Region 2025-2033", the global automotive memory market size reached USD 6.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.3 Billion by 2033, exhibiting a growth rate (CAGR) of 11.11% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/automotive-memory-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Automotive Memory Market

- Proliferation of Advanced Driver-Assistance Systems (ADAS)

The widespread adoption of Advanced Driver-Assistance Systems (ADAS) is the impetus for the rapidly expanding automotive memory market. ADAS represents a complete class of systems that generally feature things like adaptive cruise control, lane-keeping assist, automatic emergency braking and parking assist. Each ADAS function needs quite a bit of processing power, and in turn memory. The key to each ADAS function is that each system relies on continuous streams of sensor data -- from cameras, radar, lidar and ultrasonic sensors -- that must be captured, processed and stored in real-time before making decisions by the vehicle's electronic control units (ECUs). The continuous stream of data requires high-bandwidth / low-latency memory like LPDDR4X or LPDDR5 DRAM, and high-capacity high reliability flash memory like UFS or eMMC, to store algorithms, maps and environmental data captured by the sensors. As the complexity of ADAS systems increases as well as the number of ADAS features in mid-tier vehicles, the memory needed to support these systems will only continue to grow to ensure safe and reliable operation.

- Rise of In-Vehicle Infotainment and Connectivity

Modern vehicles are increasingly transforming into connected digital hubs, driven by the expanding capabilities of in-vehicle infotainment (IVI) and connectivity systems. These systems now offer a rich array of features, including high-resolution displays, navigation with real-time traffic updates, voice assistants, streaming media, smartphone integration (e.g., Apple CarPlay, Android Auto), and over-the-air (OTA) software updates. All these functionalities require substantial memory resources. High-definition graphics rendering for dashboards and infotainment screens, the processing of complex navigation algorithms, and the storage of large media libraries and application data necessitate significant DRAM and flash memory. Furthermore, the constant exchange of data between the vehicle and external networks for cloud-based services and OTA updates puts additional strain on memory requirements, demanding solutions that can handle intensive read/write cycles and ensure data integrity over the vehicle’s lifespan. This evolution is reshaping the memory architecture of vehicles, pushing for greater capacity and performance.

- Development Towards Autonomous Driving

The long-term vision of fully autonomous vehicles is the ultimate demand driver for automotive memory. Although we still consider the way to mass consumer deployment in the early days, the development of Level 3, 4, and 5 autonomous driving systems are generating, collecting, and processing unprecedented levels of data. Autonomous vehicles must consume vast amounts of sensor data - compress this data, process this data, and then act on this data to continuously provide and update a complete view of their environment. Autonomous vehicles must be able to classify objects, predict movement and plan trajectories in real-time in milliseconds. This is incredibly computational and the memory required is vast - high-speed memory is needed for temporary storage of data, for running AI models and making real-time decisions about where to go - when and how to act. Often, this data needs specialized memory such as HBM (High Bandwidth Memory) or large sizes of LPDDR5X. The amount of memory required for autonomous operations is substantial and memory makers will regard it as a must-have component for the in-vehicle equipment on this progression to self-driving cars. Ensuring the right reliability and longevity of memory is vital for the safe operations of autonomous vehicles.

Key Trends in the Automotive Memory Market

- Increasing Demand for High-Bandwidth Memory (HBM and LPDDR5/5X)

The automotive industry's push towards more sophisticated ADAS and autonomous driving capabilities is unequivocally driving an escalating demand for high-bandwidth memory (HBM) and the latest generations of LPDDR (Low Power Double Data Rate) DRAM, specifically LPDDR5 and LPDDR5X. These advanced memory technologies are crucial for handling the immense volumes of data generated by multiple sensors (cameras, radar, lidar) and for accelerating complex AI and machine learning algorithms required for real-time perception, decision-making, and path planning in autonomous systems. HBM, with its stacked die architecture, offers significantly higher bandwidth compared to traditional DRAM, making it ideal for high-performance computing units in autonomous driving platforms. Similarly, LPDDR5 and LPDDR5X provide improved speed, efficiency, and lower power consumption, which are vital for automotive applications where power optimization and thermal management are critical considerations. The integration of these advanced memory types is a clear trend, reflecting the need for superior data throughput to enable next-generation automotive functionalities.

- Focus on Enhanced Reliability and Endurance

Automotive applications differ greatly compared to consumer electronics. Automotive applications are subjected to harsh environments, such as wide temperature variations, extreme vibrations, and operating hours that extend over several years. Reliability and longevity are paramount. In fact, increasing levels of reliability and longevity are a trend in the automotive memory market. Manufacturers are producing and qualifying memory devices that would pass the extreme automotive-grade testing methodologies (e.g. AEC-Q100 qualification for integrated circuits (IC)). Manufacturers are developing recommended memory with robust error correction code (ECC) capabilities, advanced wear-leveling algorithms for flash memories to extend useful life, and stable performance throughout wide-operating temperatures. Memory reliability affects the safety and performance of critical vehicle systems, such as engine control to ADAS systems. The durability and data integrity of memory in automotive applications is not optional; increasing reliability and longevity of memory in automotive applications is leading to more specialized, higher-dependability memory devices.

- Integration of Memory with Processing Units (Domain Controllers/SoCs)

One of the major trends that's currently happening in automotive architecture is the shift to tight integration of computation platforms in a centralized computing environment, sometimes referred to as domain controllers or System-on-Chips ("SoCs"). These domain controllers and SoCs consolidate all of the functions of previously independent individual ECUs that were discrete and that also required individual wiring and individual physical housing. The movement towards centralized computing platforms or SoCs is tied to the memory market, which continually pushes boundaries for tight integration with computing units. Memory packaging could be situated on-chip with these ECUs, or more commonly with tight physical proximity, to reduce latency and maximize data transfer speed to/from the SoC. The reason proximity to an SoC is important is due to the amount of real-time processing in ADAS systems and fueled autonomous driving. 'Proximity:', here could involve chip-on-chip packaging, System-in-Package (SiP) designs or on-die (some caches) memory. The shift to centralized computing platforms and/or domain controllers simplifies vehicle harnesses and weight, while improving collective performance and efficiency of the system. The memory maker is required to work collaboratively together with the SoC developer(s) to build high performance, thermally effective memory for the System, with an eye to improving performance memory performance capability.

Leading Companies Operating in the Global Automotive Memory Industry:

- Infineon Technologies AG

- Integrated Silicon Solution Inc.

- Macronix International Co. Ltd.

- Micron Technology Inc.

- Nanya Technology Corporation

- Renesas Electronics Corporation

- Samsung Electronics Co. Ltd.

- SK hynix Inc.

- Texas Instruments Incorporated

- Western Digital Corporation

- Winbond Electronics Corporation

Automotive Memory Market Report Segmentation:

By Product:

- DRAM

- NAND

- SRAM

- NOR

- Others

DRAM dominates the market due to its critical role in quick read/write access for computing and data processing, especially in automotive applications like ADAS and infotainment systems.

By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

Passenger vehicles represent the largest segment as they outnumber commercial vehicles and are increasingly equipped with advanced technologies requiring substantial memory capabilities.

By Application:

- Infotainment and Connectivity

- ADAS

- Others

Infotainment and connectivity centralized systems in vehicles that rely on robust memory solutions for entertainment, navigation, and communications, managing tasks like real-time data processing and multimedia streaming.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia pacific exhibits clear dominance in the automotive memory market, accounting for the largest share among regions analyzed, including North America, Europe, Latin America, and the Middle East and Africa.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145