10 smart and safe ways to put money into silver

Why Precious Metals Still Matter in 2025: Introduction

Investors are always looking for assets that hold their value in today's unstable market. Silver is still a popular choice among these because it is cheap and useful in technology and industry. Learning about the several ways to invest in silver can help you find both stability and development. At the same time, people who want to diversify can also acquire certified gold coins, which is a tried-and-true way to keep their money safe. This article goes into detail about both tactics and how they might help in real life.

Physical Silver: The Old-Fashioned Way for Newbies

Buying real silver is still one of the easiest ways to invest in silver. Physical silver, whether it's in bars, coins, or rounds, is real, valuable to everyone, and easy to store. Investors like that it lets them own something directly and that it can be a safe asset in times of trouble. Storage and insurance are something to think about, but the long-term benefits usually outweigh the logistical issues. Many people who want to diversify even further also acquire certified gold coins along with their silver coins.

Silver ETFs: Easy to Get and Tradeable on the Market

People who are looking for strategies to invest in silver also like exchange-traded funds (ETFs). You can get exposure to silver prices without actually owning the metal by using ETFs. You may trade these funds just like stocks, and they are great for investors who want a paper asset that is easy to sell. A well-balanced portfolio generally has both ETFs and the choice to buy certified gold coins. This gives you the most flexibility and keeps the most value.

Mining stocks are a risky but potentially profitable choice.

There are various methods to invest in silver, but buying silver mining stocks is one that could be rewarding even though it's not a direct investment. In bull markets, these stocks generally do better than actual silver. But they also have dangers that are unique to each company and depend a lot on how well they run their business and how much demand there is around the world. Smart investors frequently balance this with safer options and buy certified gold coins to protect themselves against market drops.

For more experienced investors: Silver Futures and Options

Traders who have been doing this for a long time usually employ silver futures and options. These contracts let investors guess what the price of silver will be in the future or protect other investments. Futures are one of the more complicated ways to invest in silver. They need a lot of money, education, and timing. People that use them are not weak, and many of them also buy certified gold coins to add a more stable asset to their portfolios.

Junk Silver: Old Coins That Are Worth More Than You Think

"Junk silver" is a term for antique U.S. coins that are 90% silver but aren't worth much as collectibles. These are dimes, quarters, and half-dollars that were made before 1965. Junk silver is one of the less well-known ways to invest in silver. It's a cheap way to get started and has been a good investment in the past. People who are very worried about hyperinflation or currency devaluation typically buy certified gold coins together with this method to safeguard themselves even more.

Digital Silver: Where Technology Meets Tradition

Digital platforms now make it easier to invest in silver without having to store it physically. You can buy fractional shares of silver backed by real reserves through these services. The ease of use is unrivaled, especially for young people and tech-savvy investors. Digital silver is becoming more popular, but many people still prefer to buy certified gold coins because of their historical value and the fact that the government backs them up.

Long-Term Plan: Silver in Retirement Accounts

You may now add silver to your self-directed IRAs, which gives people who want to invest in silver for retirement more options. This strategy could help you save money on taxes and build your money over time. Investors who are worried about their retirement portfolios also choose to buy certified gold coins. This helps them have a mix of safe assets that will grow in value over time.

Collecting Silver: More Than Just the Metal

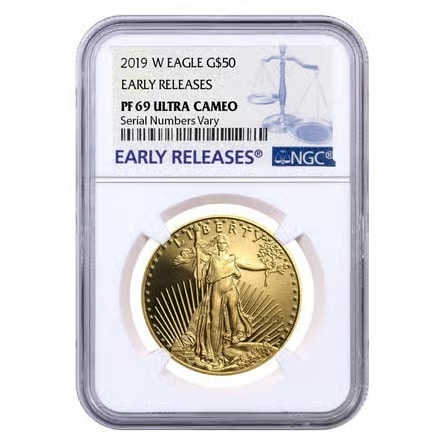

Numismatic silver coins are worth more than just their silver content; they are also rare, well-designed, and have historical significance. These are niche ways to invest in silver that collectors and others who want to hang onto their silver for a long time like. Numismatic coins can go up in value faster than bullion since they have two values. Many collectors also buy certified gold coins that are identical to each other to make their portfolios more interesting and valuable.

Why Silver Is Still in the News: Global Demand

The need for silver around the world is still high because of its application in industry, solar technology, and making electronics. These changes are making it easier to find new and relevant methods to invest in silver. Smart investors who pay attention to macroeconomic developments typically acquire certified gold coins as well. This makes sure that their investments are in line with both market demand and historical strength.

Things to Keep in Mind When Buying Silver

There are a lot of ways to invest in silver, but you need to be careful. Stay away from large premiums, make sure the dealer is real, and constantly check the purity of what you buy. When you acquire certified gold coins, the same rules apply: authentication, trust, and openness should govern every investing decision.

Conclusion: The best way to stay safe is to diversify

There are many ways to invest in silver that fit different risk levels and financial goals, from real bars to ETFs and collectibles. Adding the option to buy certified gold coins to these techniques makes a strong, balanced portfolio that does well in times of economic uncertainty. Many investors look to US Precious Metals for reliable help with both silver and gold investments because they know they can trust them.