Understanding the Basics of Wholesale Funding in Private Credit

The private credit space has evolved into a major avenue for wholesale investors seeking consistent returns and greater control over capital. At its core, wholesale funding allows sophisticated investors to participate in structured lending opportunities not available in public markets. With customised risk profiles and regular income potential, wholesale private credit has become a powerful tool in modern portfolio strategy.

This article explores how wholesale funding works, why it’s growing in relevance, and what investors need to know before getting involved.

Key Points About Wholesale Funding in Private Credit

-

Tailored Investment Structures

Wholesale funding arrangements are often structured around the specific needs of investors and borrowers. These deals typically include secured loans, senior debt, or mezzanine financing. Unlike public markets, terms such as loan-to-value (LTV), yield, and repayment schedules are customised to suit risk tolerance and expected returns. -

Access to Private Credit Markets

Wholesale investors gain entry to an otherwise restricted market—private credit. This includes lending to small to mid-sized enterprises (SMEs), property developers, or other non-bank borrowers who may not qualify for traditional bank loans. This access provides diversification and income streams that are uncorrelated with equities or fixed-income securities. -

Higher Yield Potential

One of the biggest attractions of wholesale private credit is its potential for enhanced returns. Since these investments are less liquid and more bespoke, investors are often compensated with yields significantly higher than those found in traditional fixed-income assets. Net returns can range from 8% to 14% per annum, depending on risk and structure. -

Enhanced Risk Controls

Despite the perception of higher risk, many private credit funds are secured against hard assets or receivables. Due diligence, borrower profiling, and ongoing portfolio monitoring help reduce default risk. Lenders often include covenants, step-ins, and first-ranking security as part of the loan agreement. -

Flexible Capital Deployment

Wholesale funding enables investors to be more agile with how and when their capital is deployed. Whether it’s participating in monthly income funds or locking into multi-year credit opportunities, investors can align their strategy with their financial goals. This flexibility is particularly useful for income-focused or retirement planning strategies. -

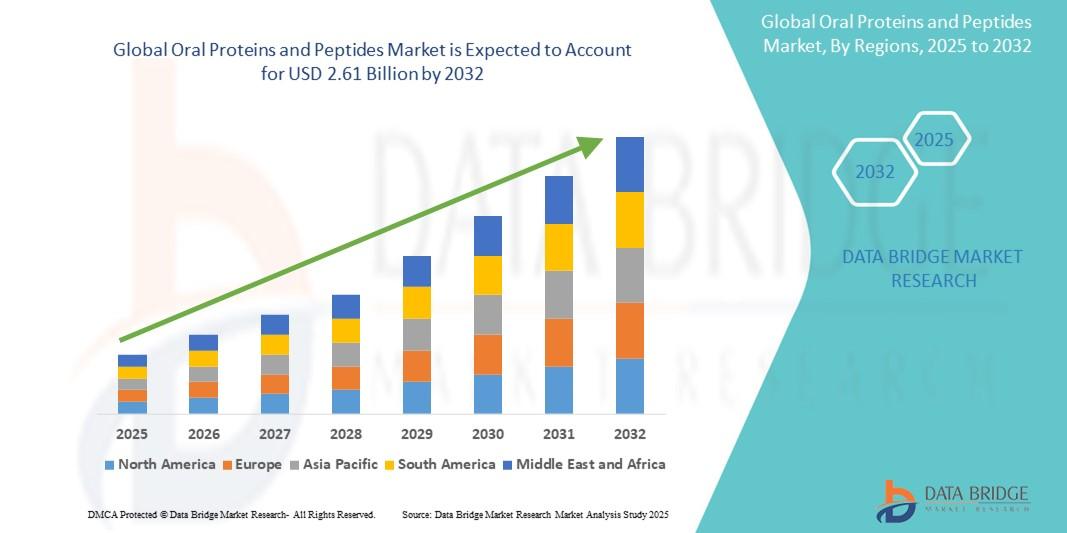

Growing Popularity Among Sophisticated Investors

The demand for wholesale private credit is surging, especially among family offices, high-net-worth individuals, and financial advisers. As traditional asset classes face increasing volatility, private credit presents an appealing alternative—offering both stability and strong income generation potential in a low-yield environment.

Structured private credit investments accessed through wholesale-funding models are reshaping the way experienced investors build income portfolios. Firms like Rixon Capital offer access to these solutions, combining tailored loan structures with real-world security—making them a compelling alternative to traditional financial products.