Global Tax Management Market Set to Expand with Rising Digitalization of Tax Processes by 2032

"Executive Summary Tax Management Market :

CAGR Value

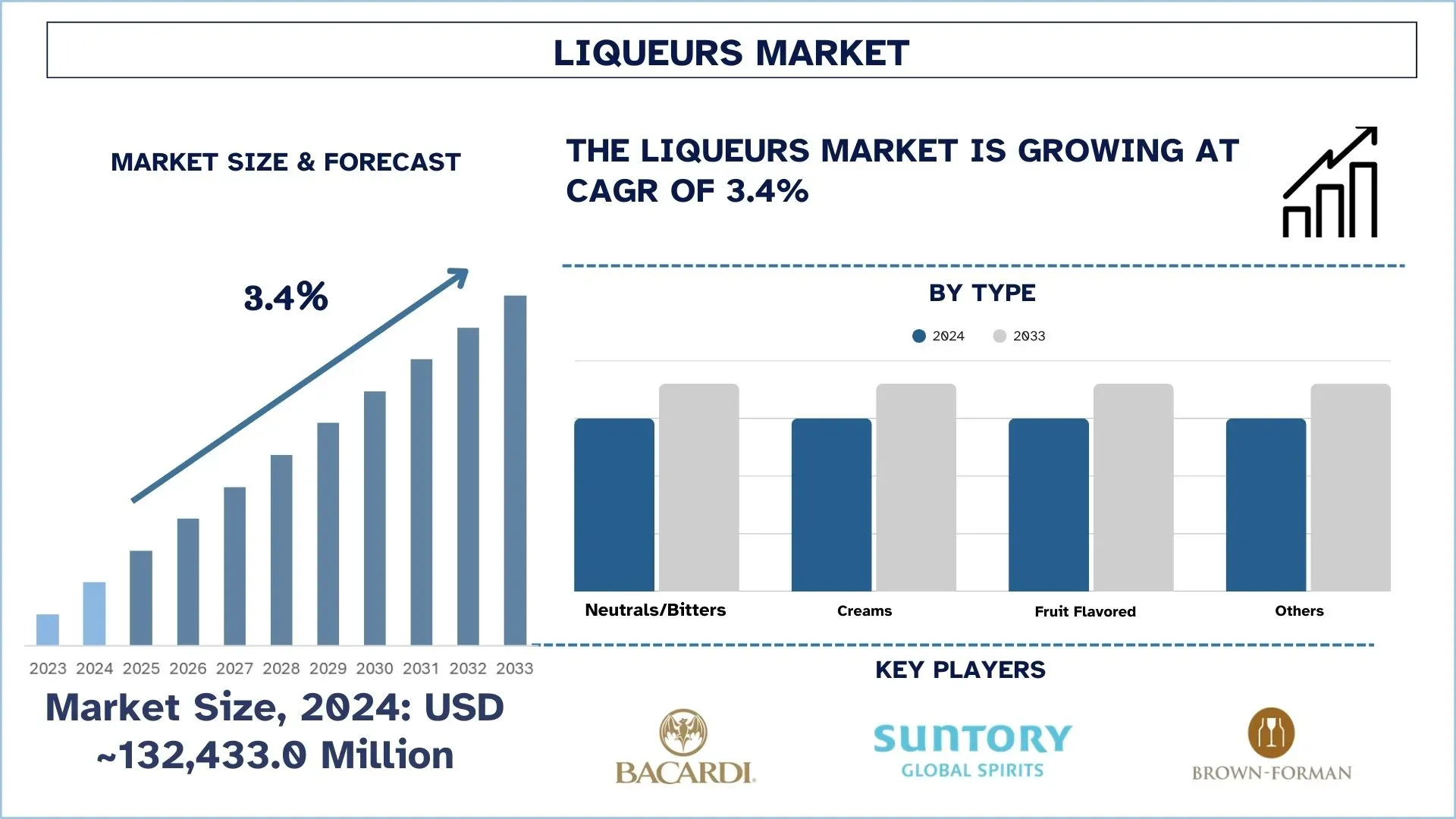

The tax management market is expected to witness market growth at a rate of 11.20% in the forecast period of 2021 to 2028.

This Tax Management Market report makes available an outline about the global industry perspective, comprehensive analysis, size, share, growth, segment, trends and forecast for the year 2018 – 2025. Tax Management Market analysis examines various segments that are relied upon to witness the quickest growth amid the approximate forecast frame. The Tax Management Market research study offers research data which makes the document a handy resource for managers, analysts, industry experts, and other key people get ready-to-access and self-analyzed study along with TOC, graphs, charts, and tables to help understand the market size, share, trends, growth drivers and market opportunities and challenges.

Various trustworthy sources such as journals, websites, and annual reports of the companies, white papers, and mergers have been used for assembling data and information mentioned in this Tax Management Market business report. With particular base year and historic year, definite estimations and calculations are carried out in this industry document. This market study also assesses the market status, growth rate, future trends, market drivers, opportunities, challenges, risks, entry barriers, sales channels, distributors and Porter's Five Forces Analysis. The Tax Management Market report is the best option to acquire a professional in-depth study on the up to date state for the market.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Tax Management Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-tax-management-market

Tax Management Market Overview

**Segments**

- Based on component, the global tax management market can be segmented into software and services. The software segment is expected to dominate the market as tax management software solutions help organizations automate and streamline their tax processes, ensuring compliance and accuracy. The services segment is also witnessing significant growth as businesses seek expert advice and support to navigate complex tax regulations and optimize their tax strategies.

- On the basis of tax type, the market can be categorized into direct taxes and indirect taxes. Direct taxes include income tax, corporate tax, and property tax, among others. Indirect taxes comprise value-added tax (VAT), goods and services tax (GST), and customs duties. With governments worldwide constantly updating tax laws and regulations, the demand for efficient tax management solutions that can handle both direct and indirect taxes is on the rise.

- By organization size, the market can be divided into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting tax management solutions to enhance compliance, reduce tax risks, and improve overall operational efficiency. Large enterprises, on the other hand, are implementing advanced tax management software to handle complex tax structures and ensure transparency in their tax reporting processes.

**Market Players**

- Thomson Reuters

- Wolters Kluwer

- Avalara, Inc.

- Vertex, Inc.

- ADP, LLC

- Intuit Inc.

- SAP SE

- H&R Block

- TaxSlayer LLC

- Sage Group

- Blucora, Inc.

These key market players are actively involved in product launches, partnerships, and acquisitions to expand their market presence and offer innovative tax management solutions to a diverse range of industries and clients. With the increasing focus on tax compliance and transparency, these companies are continuously enhancing their software and service offerings to meet the evolving needs of businesses in the global tax landscape.

The global tax management market is expected to witness significant growth in the coming years as businesses across various industries strive to navigate complex tax regulations and ensure compliance with evolving tax laws. One emerging trend in the market is the increasing demand for cloud-based tax management solutions that offer scalability, flexibility, and cost-effectiveness. Cloud-based software allows organizations to access their tax data remotely, collaborate with team members in real time, and receive automatic updates to ensure compliance with the latest regulations. Additionally, the integration of advanced technologies such as artificial intelligence and machine learning is shaping the future of tax management by enabling predictive analytics, automated tax reporting, and proactive tax planning.

Another key factor driving the market is the rising adoption of digital tax platforms that centralize tax processes, streamline workflows, and provide real-time insights into tax liabilities and exposures. These platforms empower organizations to make data-driven decisions, mitigate risks, and optimize their tax strategies for enhanced financial performance. Moreover, the increasing focus on sustainability and corporate social responsibility is prompting companies to incorporate tax planning as part of their overall ESG (Environmental, Social, and Governance) initiatives. By aligning tax management practices with sustainable business practices, organizations can enhance transparency, accountability, and stakeholder trust in their operations.

Furthermore, the convergence of tax and technology is reshaping the competitive landscape of the market, with new entrants and disruptive innovators revolutionizing traditional tax management practices. These players leverage digital tools, data analytics, and automation to offer agile and customer-centric tax solutions that cater to the evolving needs of modern businesses. Collaborations between tax service providers and technology companies are also on the rise, leading to the development of integrated tax platforms that combine tax expertise with cutting-edge technology capabilities. This fusion of tax and tech enables organizations to achieve operational efficiencies, minimize compliance risks, and drive strategic value across their tax functions.

In conclusion, the global tax management market is undergoing a paradigm shift driven by technological advancements, regulatory changes, and shifting business priorities. As organizations navigate the complexities of the global tax landscape, investing in advanced tax management solutions and partnering with innovative market players will be crucial to ensuring long-term success, compliance, and competitive advantage. By embracing digital transformation, leveraging data-driven insights, and embracing sustainable tax practices, businesses can position themselves for growth and resilience in an increasingly dynamic and challenging tax environment.The global tax management market is witnessing notable transformations and advancements driven by the integration of cloud-based solutions, artificial intelligence, and machine learning technologies. The shift towards cloud-based tax management software is enabling organizations to access real-time tax data, enhance collaboration, and ensure compliance with the latest regulations. The scalability, flexibility, and cost-effectiveness of cloud-based platforms are propelling their adoption across various industries as businesses strive to streamline tax processes efficiently.

Moreover, the incorporation of advanced technologies such as artificial intelligence and machine learning is revolutionizing tax management practices by enabling predictive analytics, automated reporting, and proactive tax planning. These technological integrations empower organizations to make data-driven decisions, optimize tax strategies, and mitigate risks effectively. The application of AI in tax management is enhancing accuracy, reducing manual errors, and driving operational efficiencies in compliance and reporting tasks.

Another significant trend shaping the market is the rising demand for digital tax platforms that centralize tax processes, streamline workflows, and provide real-time insights into tax liabilities and exposures. These platforms are enabling businesses to enhance decision-making processes, improve financial performance, and ensure regulatory compliance. By leveraging data analytics and automation capabilities, organizations can optimize tax planning strategies, identify opportunities for tax savings, and minimize compliance risks effectively.

Furthermore, the increasing focus on sustainability and corporate social responsibility is influencing companies to integrate tax planning into their ESG initiatives. By aligning tax management practices with sustainable business strategies, organizations can enhance transparency, accountability, and stakeholder trust. The adoption of sustainable tax practices not only contributes to ethical business conduct but also fosters long-term relationships with customers, investors, and regulatory authorities.

In conclusion, the global tax management market is evolving rapidly with the convergence of technology, regulatory changes, and shifting business priorities. The adoption of cloud-based solutions, artificial intelligence, and digital tax platforms is empowering organizations to navigate complex tax landscapes, ensure compliance, and drive strategic value across their tax functions. Embracing digital transformation, leveraging data-driven insights, and embracing sustainable tax practices are imperative for businesses to achieve long-term success, resilience, and competitiveness in a dynamic and challenging tax environment. Market players need to stay abreast of emerging trends, innovate continually, and collaborate with technology providers to meet the evolving needs of modern businesses in the global tax management landscape.

The Tax Management Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-tax-management-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Benefits of the Report:

- This study presents the analytical depiction of the global Tax Management Marketindustry along with the current trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the global Tax Management Market share.

- The current market is quantitatively analyzed from to highlight the Global Tax Management Market growth scenario.

- Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

The report provides a detailed global Tax Management Market analysis based on competitive intensity and how the competition will take shape in coming years

Browse More Reports:

Global Infectious Disease Testing Products Market

Global Rehabilitation Therapy Services Market

Global Battery Free Radio Frequency Identification (RFID) Sensor Market

Global Music Market

Asia-Pacific Sports Medicine Market

Global Medical Automation Market

Europe Mammography Devices Market

Global Bioplastics Packaging Market

Global Liquid Dietary Supplements Market

Global Distilled Water Market

North America Rolling Stock Market

Asia-Pacific Spandex Market

Global Soft Magnetic Material Market

Global Ceramic Textile Market

Global Cytochrome Inhibitors Market

Global Black Cumin Seed Oil Market

North America Alternative Proteins Market

Global Premium Alcoholic Beverages Market

Global Colon Polyps and Cancer Treatment Market

Global People Counting System Market

Spain Commercial Dishwashers Market

Global Methylene Diphenyl Di-Isocyanate (MDI) Market

North America Mammography Devices Market

Global Brewing Enzymes Market

Global Damask Rose Water Market

Asia-Pacific Commercial Dishwashers Market

Asia-Pacific Rice Based Infant Formula Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"