Straw Machine Market Challenges in Cost-Efficiency and Regulatory Compliance

Overview of the Straw Machine Market

The global straw machine market is witnessing significant growth driven by increasing demand for efficient and automated straw production solutions across various industries, particularly in food and beverage, agriculture, and packaging. Straw machines are specialized equipment designed to manufacture straws from materials such as plastic, paper, biodegradable polymers, and metal.

With the rising global focus on sustainable packaging and single-use plastic alternatives, the demand for eco-friendly straw manufacturing machines has surged. Moreover, advancements in automation, precision engineering, and material flexibility are further enhancing the capabilities of straw machines, making them indispensable for manufacturers seeking high-volume production with consistent quality.

Market Dynamics

The straw machine market operates within a dynamic environment influenced by a mix of regulatory policies, shifting consumer preferences, and technological innovations. On the demand side, the growing foodservice industry, especially quick-service restaurants (QSRs), cafes, and beverage outlets, has been a critical driver for straw production. Simultaneously, environmental regulations restricting single-use plastics have pressured manufacturers to adapt by investing in straw machines capable of processing paper and biodegradable materials.

From a supply perspective, manufacturers are focusing on integrating smart automation systems to improve productivity and reduce human intervention. Competitive pricing, product diversification, and machine efficiency are major factors influencing purchasing decisions within the market. Additionally, the market is witnessing a notable shift towards fully automated production lines that can handle multiple straw dimensions, colors, and materials with minimal downtime, offering manufacturers operational flexibility.

Key Market Drivers

1. Rising Demand for Eco-Friendly and Biodegradable Straws

With global campaigns and regulations aimed at reducing plastic pollution, there is a growing demand for paper straws, PLA (polylactic acid) straws, and other biodegradable alternatives. This has significantly fueled investments in straw machines capable of handling alternative materials efficiently. Governments worldwide are imposing bans and restrictions on plastic straws, which has escalated the need for machines designed to manufacture eco-friendly variants.

2. Expanding Food and Beverage Sector

The growth of the global food and beverage industry, particularly the on-the-go beverage consumption trend, is a substantial driver. Cafes, fast-food chains, bubble tea outlets, and juice bars contribute to a steady demand for high-quality drinking straws, necessitating advanced straw production lines to meet large-scale requirements.

3. Automation and Production Efficiency

The need for operational efficiency and cost reduction is pushing manufacturers to adopt automated straw machines. Features such as automatic feeding, cutting, gluing, and packaging are now standard expectations, leading to faster production cycles and minimal manual labor.

4. Customization and Design Flexibility

The demand for customized straws—whether in terms of size, shape, color, or material—has encouraged machine manufacturers to develop flexible production systems. Machines that can be quickly adapted to produce a variety of straw types are in high demand, particularly among companies serving premium or niche markets.

Technological Advancements and Innovation

The straw machine market has witnessed several technological breakthroughs aimed at improving production efficiency, product quality, and environmental compliance. Modern straw machines are now equipped with advanced control systems, such as PLC (Programmable Logic Controller) and HMI (Human-Machine Interface) panels, enabling precise control over the production process and real-time monitoring.

Another key innovation is the development of machines that can seamlessly switch between plastic and paper straw production modes. Innovations in blade technology, ultrasonic sealing, and eco-friendly adhesive applications have also improved the quality and durability of paper straws, addressing one of the key concerns of both consumers and manufacturers.

Additionally, manufacturers are integrating IoT (Internet of Things) features for predictive maintenance and remote monitoring, which reduces downtime and enhances overall equipment efficiency (OEE). The integration of modular machine designs allows for easy upgrades and scalability, catering to both small-scale startups and large industrial units.

Market Segmentation (Description in Paragraph Form)

The straw machine market can be segmented based on machine type, material type, end-use industry, and region. In terms of machine type, the market includes paper straw machines, plastic straw machines, and multifunctional straw machines that support both materials. Paper straw machines are gaining significant traction due to sustainability initiatives.

Material type segmentation involves plastic (PP and PET), paper, PLA (biodegradable polymers), and metal straws, with paper and PLA segments witnessing exponential growth owing to environmental regulations. The end-use industry segmentation covers food and beverage, agriculture (for straw baling machines), packaging, and healthcare sectors. Among these, the food and beverage segment remains the dominant consumer, fueled by demand from QSRs and cafes.

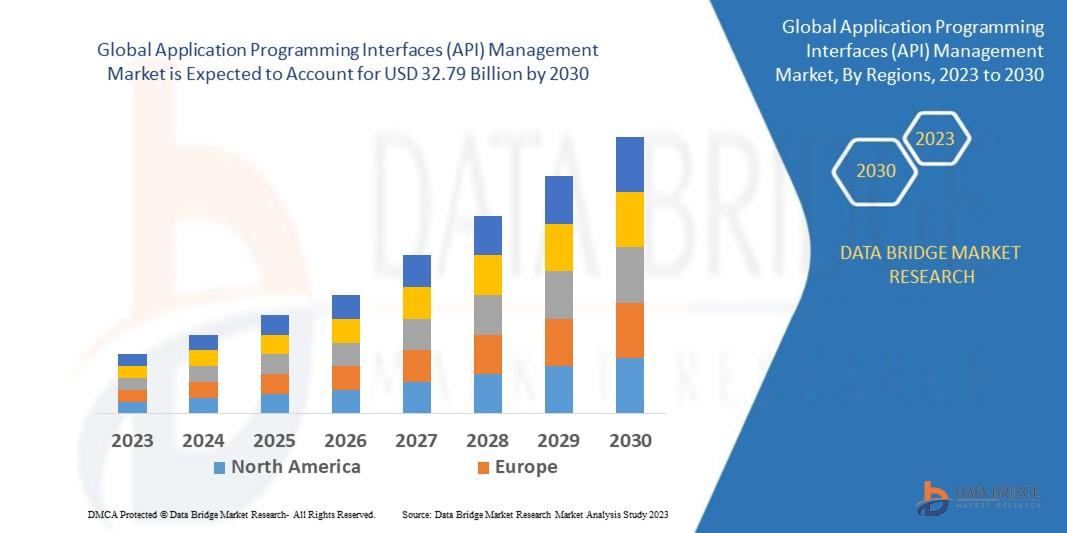

Geographically, the market is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific holds a major share due to the presence of large-scale manufacturers and rising demand from emerging economies. Europe and North America are also key regions driven by strict environmental policies.

Challenges and Market Constraints

Despite its growth prospects, the straw machine market faces several challenges. High initial investment costs for advanced automated machines can be a barrier for small and medium enterprises (SMEs). Additionally, the technical complexity of processing biodegradable materials poses manufacturing challenges, such as ensuring product durability and production speed.

Another constraint is the volatility in raw material availability and prices, particularly for paper and bioplastics. The durability concerns associated with paper straws, like sogginess after prolonged use, require continuous R&D investments, adding to operational costs.

Moreover, the fragmentation of regulations across different regions regarding acceptable materials and product standards complicates global operations for straw manufacturers. The market also faces competition from alternative solutions like reusable straws made of stainless steel or silicone, which can impact the demand for disposable straws and the associated machinery.

Future Outlook

The straw machine market is poised for continued growth, underpinned by the global shift towards sustainable packaging solutions. Over the next decade, manufacturers are expected to focus heavily on R&D for high-performance biodegradable straws and machine innovations that reduce production costs while enhancing efficiency. The integration of AI-powered quality control systems, further automation, and the development of energy-efficient machinery will be key trends shaping the market landscape.

Additionally, with growing consumer demand for customized products, straw machines offering flexibility in design, size, and branding options will witness higher adoption. The Asia-Pacific region, particularly countries like China and India, is likely to remain a manufacturing hub, while Europe and North America will continue to lead in eco-friendly straw consumption, driving the need for innovative machinery