How Drone Integration Is Changing Aircraft Insurance Dynamics

Opportunities and Innovations in the Aircraft Insurance Market

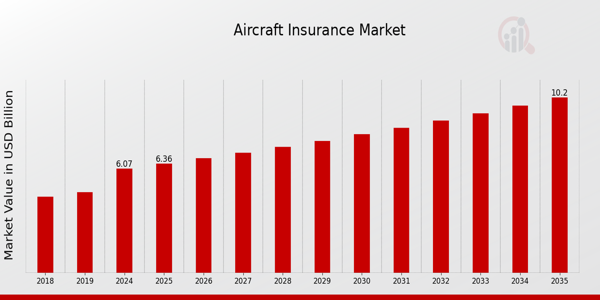

According to MRFR Analysis, the Aircraft Insurance Market was valued at USD 5.79 Billion in 2023 and is forecasted to reach USD 10.2 Billion by 2035. This growth is driven by rising demand for air travel and stringent regulatory compliance requirements. The market is experiencing notable advancements fueled by technological innovations and an increased emphasis on risk management, resulting in the development of innovative insurance solutions.

While challenges exist, the aircraft insurance market is also ripe with opportunities. One of the most exciting is the development of parametric insurance products. These policies use predefined parameters (like weather data or flight delays) to trigger payouts, reducing claims processing times and improving efficiency.

Blockchain technology is another innovation poised to transform the market. By offering greater transparency and security in data management, blockchain can streamline policy issuance, claims settlement, and compliance tracking. This technology is especially valuable in the aircraft insurance market, where documentation and audit trails are essential.

Telematics and real-time monitoring systems are also being adopted to assess pilot behavior and aircraft performance. These systems allow insurers to offer usage-based policies, rewarding safe practices with lower premiums. Such dynamic pricing models are gaining popularity among operators looking for cost-effective coverage options.

Moreover, there is growing demand for specialized insurance products catering to niche aviation sectors like private jets, helicopters, and even space tourism. As these markets expand, insurers have the opportunity to create tailored solutions that address unique operational risks and customer expectations.

Request Your Free Report Sample – A sneak peek into the strategic data and trends we provide.

Education and training also offer growth potential. Insurers who invest in educating clients about risk management and policy features tend to build stronger relationships and improve policyholder retention. This proactive approach can differentiate providers in a competitive marketplace.