Electric Vehicle Finance Market Size, Share & Analysis Report, 2033 | UnivDatos

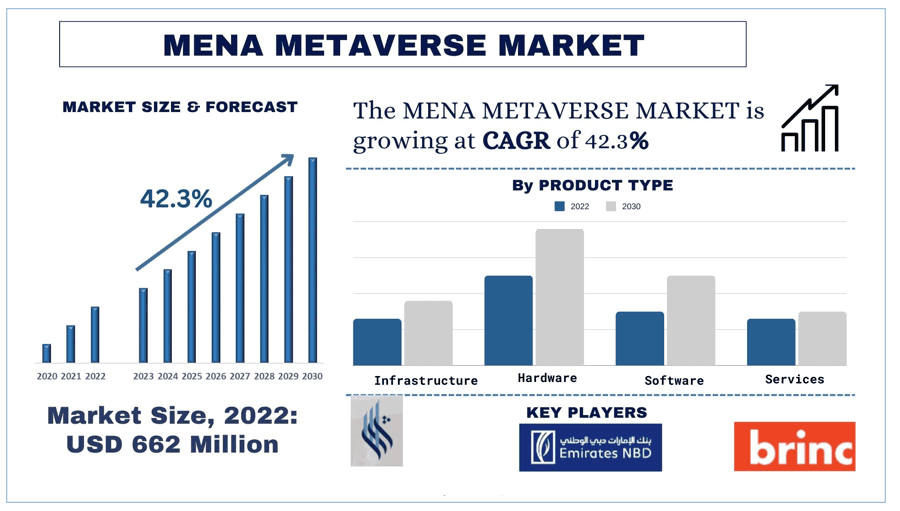

According to the UnivDatos analysis, rising EV adoption, increasing government incentives and subsidies that reduce ownership costs, and growing participation from banks, NBFCs, and OEMs offering flexible and innovative financing solutions to support EV affordability and accessibility are the major factors driving the growth of the Electric Vehicle Finance market worldwide. As per their “Electric Vehicle Finance Market” report, the global market was valued at USD 55,026 million in 2024, growing at a CAGR of about 29.84% during the forecast period from 2025 - 2033 to reach USD million by 2033.

An electric vehicle (EV) finance is a financial product and service offered to enhance the sale, lease, or ownership of electric cars/vehicles. It encompasses vehicle loans, leasing, insurance packages, and government incentives that are offered exclusively on EVs. The EV financing also reduces initial cost burdens through flexible payment plans, subsidies, and reduced interest rates. These solutions are available in banks and non-banking financial companies (NBFCs), automakers, and fintech companies to encourage EV use.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/electric-vehicle-finance-market?popup=report-enquiry

Increased NBFC and Fintech Participation: The Latest Trends in the Electric Vehicle Finance Market

Increased participation of NBFCs and fintech firms is becoming an important emerging trend in the electric vehicle (EV) finance market. NBFCs are also spreading to reach out to the underserved and rural groups with the help of flexible and easy-to-access loan features, which would further develop wider EV use. Additionally, fintechs are transforming EV financing through digital platforms and artificial intelligence-based credit evaluation. Together, NBFCs and fintechs are filling the gaps in the EV ecosystem, reducing financial barriers, improving customer experience, and making financing more scalable and capable of adapting to the rapidly changing consumer demands. An increasing number of start-ups providing EV financing services are supporting the global EV finance market. For instance, Vidyuttech is a start-up established in Bengaluru, India, in 2021. This company offers the ownership of the battery and allows fleet operators to lease their vehicles at effective interest rates of approximately 7 percent through the OEMs, such as Mahindra and Euler Motors.

Green Bonds: Powering the Shift to Sustainable Commercial Mobility

Electric vehicles are a crucial step towards a cleaner, more sustainable future. Commercial electric vehicles are revolutionizing the logistics, transportation, and e-commerce industries. However, the shift to commercial EVs is still highly problematic with its reliance on considerable funds for companies interested in going into cleaner, more efficient options. Green bonds and environmental, social, and governance criteria are being embraced and integrated into the financing of commercial EVs as part of a means of combating these problems and presenting investment and lending opportunities for market players.

Green bonds are a very strong financing tool for funding projects that have positive environmental impacts, including commercial electric vehicles and charging infrastructure. EV financing companies issue capital targeted at financing the adoption of commercial EVs through green bonds. This allows the company to access long-term, low-cost funding that is only directed toward electric auto finance loans through issuing green bonds. In this way, electric delivery trucks, e-bikes, and other EVs will be bought by companies at fairly competitive interest rates and favourable terms.

For instance, Green bond issuances in India have been on an upward trend in the past decade. Issuances have increased from US$1.2 billion (Rs. 1,000 crore) in 2013 to US$21.0 billion (around Rs 1.7 lakh crore) in 2023. These issuances have been supported by favourable government policies and the emphasis on moving to a sustainable economy. Indian companies, especially in sectors such as renewable energy, transportation, and infrastructure, have increasingly turned to green bonds and sustainable investments to raise capital for environmentally friendly projects.

Click here to view the Report Description & TOC https://univdatos.com/reports/electric-vehicle-finance-market

The Rise of EV Financing: Market Expansion Driven by Green Policies and Fintech Disruption

The electric vehicle finance market is significantly growing. It is expected to continue to grow in the the future, owing to various aspects, such as increasing adoption of EVs, growing government initiatives to go green, shifting of commercial vehicles from traditional to electric and growing participation of fintech firms in providing loans and financial services to purchase the EVs. Additionally, ongoing investments to support sustainability by launching green bonds, along with increased fintech start-ups, are further driving the growth of the global electric vehicle finance market. These factors are making a major contribution to high consumer demand for efficient financial services for purchasing EVs.

Related Report:-

India Personal Loan Market: Current Analysis and Forecast (2025-2033)

Private Pension Insurance Market: Current Analysis and Forecast (2025-2033)

Mexico Private Equity Market: Current Analysis and Forecast (2025-2033)

India Buy Now Pay Later Market: Current Analysis and Forecast (2025-2033)

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/