India Biomass Market Size, Share & Analysis Report, 2033 | UnivDatos

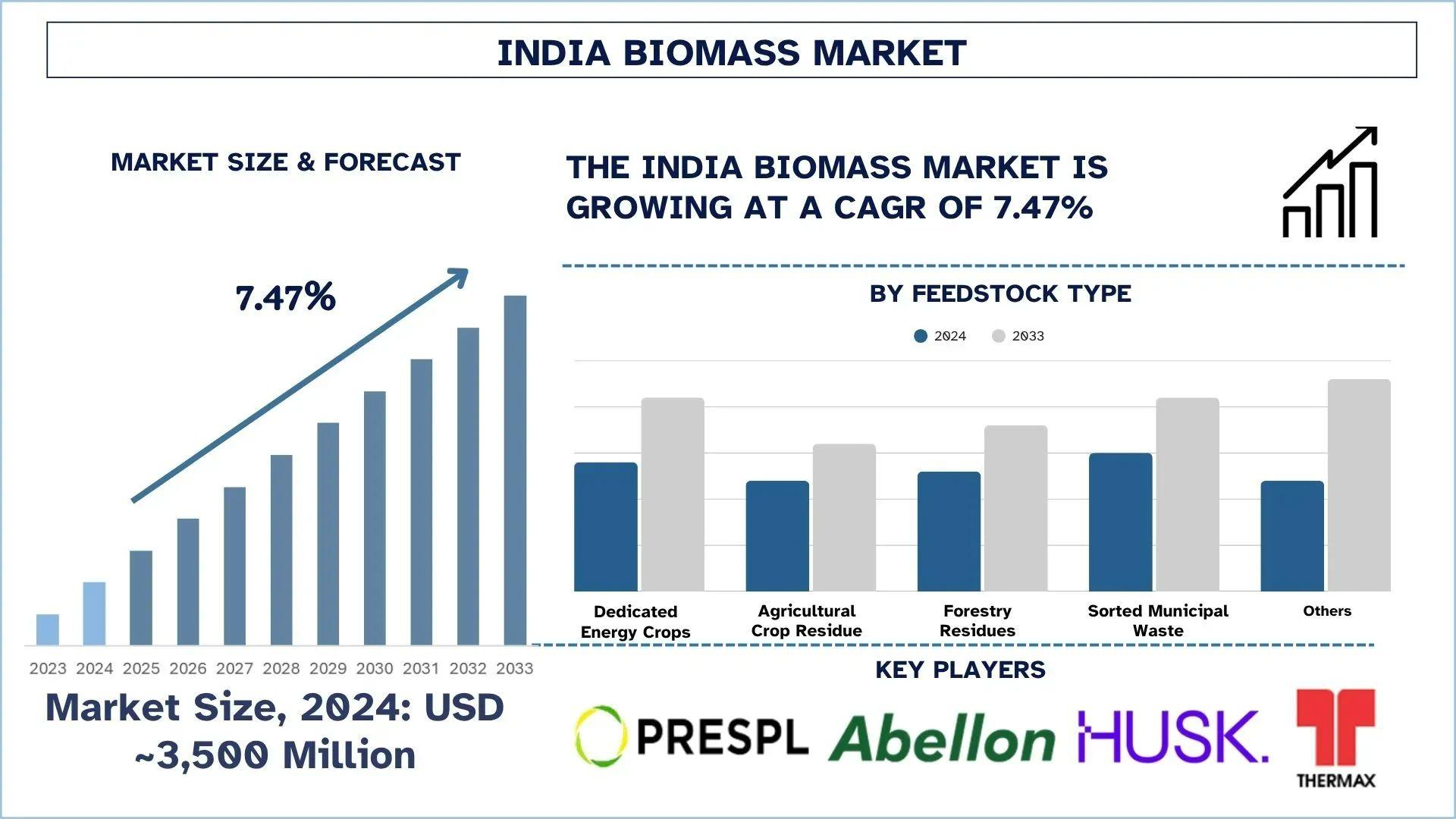

According to the UnivDatos, abundant agricultural and forestry waste availability, rising demand for clean and decentralized energy, supportive government policies and subsidies, increasing industrial adoption of biomass boilers, growing need for rural electrification, push for biofuels in transportation, and favorable carbon credit and REC markets are driving the India Biomass market. As per their “India Biomass Market” report, the Indian market was valued at USD ~3,500 million in 2024, growing at a CAGR of about 7.47% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The biomass energy potential has been gaining importance in India in its renewable energy move, particularly in the efforts of rural electrification, clean fuel production, and waste management. On the one hand, with huge volumes of crop residues produced through farming activities, and emerging policy steerage embracing national climate targets, the India biomass market finds itself in a crucial stage in terms of expanding and investing. Government support in the form of biomass programmes, as well as funding, is not only opening the sector but also attracting the private sector to sustainable energy infrastructure.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-biomass-market?popup=report-enquiry

Waste to Energy Programme:

- MNRE has been implementing a Programme on Energy from Urban, Industrial, Agricultural Wastes/ Residues and Municipal Solid Waste since 2018 for the recovery of energy in the form of Biogas/BioCNG/Power from urban, industrial, agricultural wastes and municipal solid waste.

- Under new guidelines of the programme for the period of 2021-22 to 2025-26, Central Financial Assistance shall be made available to projects for setting up of large Biogas, BioCNG and Power plants (excluding MSW to Power projects).

- There exists tremendous scope for generating bio-CNG (Compressed Biogas-CBG) in the Country for meeting various applications such as vehicles, industries for captive energy needs, cooking, etc., besides generating bio-fertilizers. India, through the SATAT (Sustainable Alternative Towards Affordable Transportation) scheme of the Ministry of Petroleum and Natural Gas on CBG, envisages targeting the production of 15 MMT of CBG from 5000 plants by 2023. Oil Marketing Companies have offered long-term pricing on CBG to make projects bankable and have agreed to execute long-term agreements on CBG. The BioCNG component of the programme supports the SATAT initiatives of MoPNG.

Investment and Policy by the Government

Biomass development in India has been established by the Ministry of New and Renewable Energy (MNRE) with several Polices and financial assistance schemes.

National Bioenergy Programme (2021–26)

As of 31 March 2025:

Cumulative installed capacity of Biomass power and cogeneration capacity: 9.82 GW (Bagasse & IPP) and 0.92 GW (Non-Bagasse).

Cumulative installed capacity of Waste to Energy capacity: 840.21 MWeq (309.34 MW grid-connected, 530.87 MWeq off-grid).

Under the Biomass Programme, Cumulative installed capacity: 11.583 GW.

Installed biogas plants: 51.04 lakh small and 361 medium, with a cumulative 11.5 MW off-grid power generation capacity.

Companies' Investment in the Biomass Market

On March 23, 2023, the Asian Development Bank (ADB) and SAEL Industries Limited signed loan agreements of up to 7.5 billion Indian rupees (around USD 91.14 million) to promote the generation of biomass energy using agricultural residue, helping diversify India’s energy mix and reduce carbon intensity.

On August 4, 2021, Mitsui & Co., Ltd. announced that it would invest INR 300 million (approximately USD 4.1 million) in Punjab Renewable Energy Systems Pvt. Ltd. ("PRESPL"), one of the leading biomass supply chain management companies in India.

Crop Residue

According to the International Journal of Research in Agronomy, India generates more than 500 million tons of agricultural waste each year, of which only about half is used successfully, particularly in northern states such as Punjab, Haryana, and Uttar Pradesh. This common practice is a major cause of seasonal air pollution and greenhouse gas emissions. Adding to this, agricultural wastes such as rice straw, wheat straw, sugarcane bagasse, cotton stalks, and maize cobs can be effectively utilized as raw materials to generate clean energy, promoting alternative energy sources instead of fossil fuel.

Such realization by the government has seen the state and central governments initiate crop residue management (CRM) programs. These are machinery assistance for collecting and baling, assistance for decentralized pellet units, subsidies, and technical training for farmers. This transition from burning to using biomass is making waste highly efficient and a form of energy that can perform transactions.

Click here to view the Report Description & TOC https://univdatos.com/reports/india-biomass-market

Path Forward for India’s Biomass Sector

To unlock the potential of the biomass sector in India, there is a need to focus more on feedstock logistics, quality control in biomass fuels, and the ease of doing business by small-scale developers. Additional investment in infrastructure, such as storage facilities, transportation, and outside-the-plants, will be essential. The collaboration of policy, technology, and civil movement provides a strong possibility of transforming the Indian albatross of agri-wastes into a scalable, need-based, and sustainable clean energy, turning it into a win-win solution.

To sum up, biomass is at the crossroads between the environmental, agricultural, and energy goals of India. A strong set of program guidelines and increasing confidence on the part of investors have placed the sphere in a good position to power the Indian green tomorrow.

Related Report:-

Biomass Briquette Fuel Market: Current Analysis and Forecast (2023-2030)

Global Biomass Boiler Market: Current Analysis and Forecast (2021-2027)

Bioenergy Market: Current Analysis and Forecast (2021-2027)

Bio-based Naphtha Market: Current Analysis and Forecast (2025-2033)

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/