India Identity Verification Market Analysis by Size, Growth, & Research Report, 2033| UnivDatos

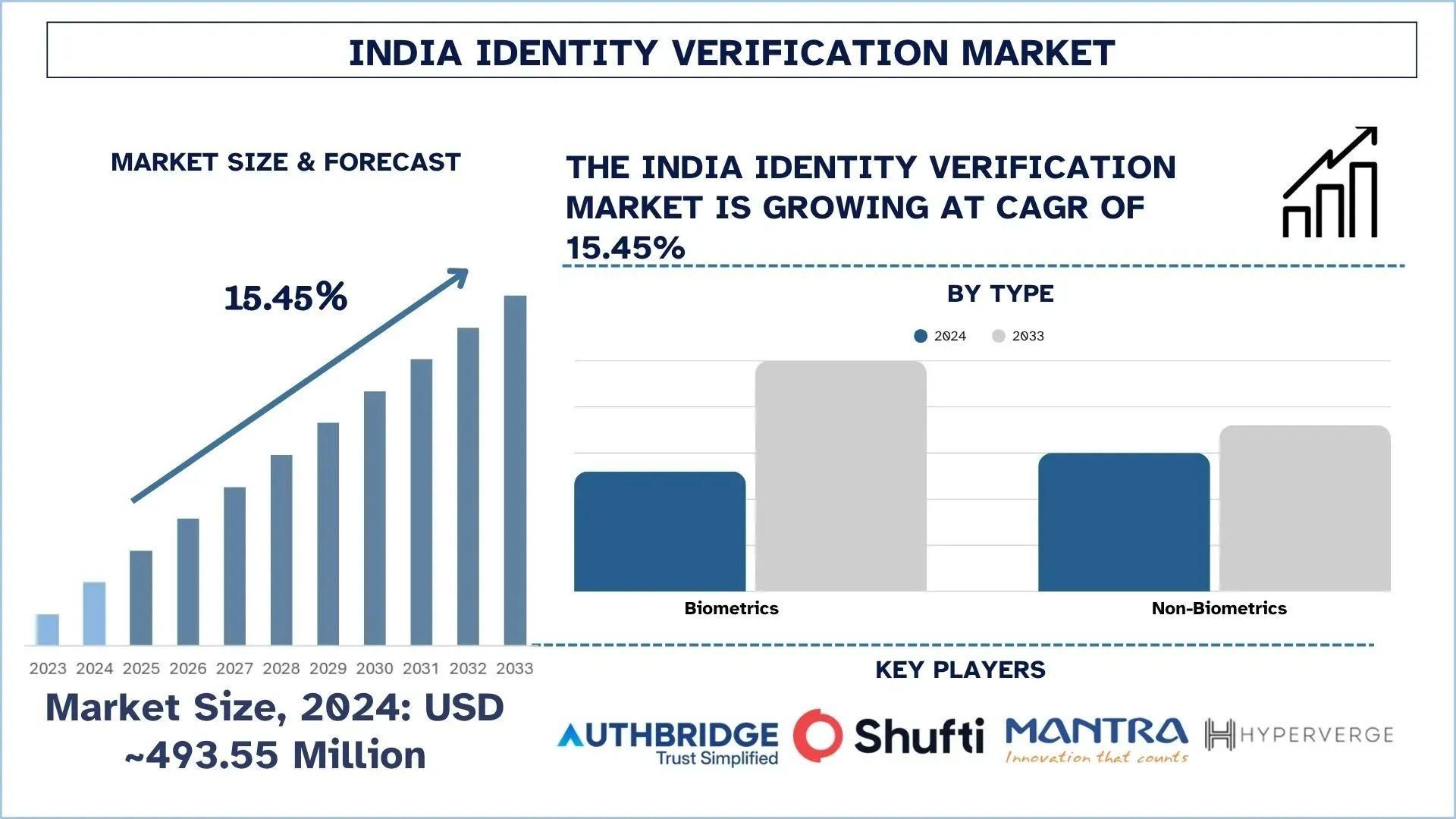

According to the UnivDatos, rising digital payments adoption, government initiatives like Aadhaar, expanding e-governance, increased cybersecurity threats, growth of remote work culture, and growing fintech and neo-banking sectors are driving the India Identity Verification market. As per their “India Identity Verification Market” report, the Indian market was valued at USD ~493.55 million in 2024, growing at a CAGR of about 15.45% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The fast-paced digitalization in India has extended its outreach into the businesses, government, and citizen interaction, trust, and security have become the backbones in this ecosystem. The very core of this transformation is the Identity Verification market that guarantees safe transactions, regulatory compliance, and fraud prevention across industries. With the increased digital economy in India, not only is identity verification facilitating growth, but it is also gaining huge investment from the government and private sectors.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-identity-verification-market?popup=report-enquiry

Digital Identity and Government Investment Infrastructures

The Government of India, with its flagship initiatives such as Aadhaar, DigiLocker, Jan Dhan Yojana, and other e-Governance processes, is building a strong digital identity backbone. With more than 1.3 billion citizens covered, Aadhaar has transformed identity verification biometrically and digitally by building it into the delivery of public services, the delivery of financial inclusion, and welfare programs. The government has spent heavily on the establishment and security of this infrastructure and has facilitated the development of eKYC, digital signature, and electronic authentication-type services. Besides, regulatory structures like the Digital Personal Data Protection (DPDP) Act, 2023, are pushing firms to implement identity verification tools that resonate with the requirements of privacy and consent, a factor that is boosting market dynamics.

· For instance, on June 26, 2025, The Department of Financial Services, Ministry of Finance, issued a notification published in the Gazette of India vide S.O.837 (pg.1614-15/c), authorising the Institute of Banking Personnel Selection (IBPS) to use Aadhaar authentication using Yes/ No or/ and e-KYC authentication facilitates, on voluntary basis, for verifying the identity of candidates during examinations and recruitment processes conducted by it.

· On May 5, 2025, The Unique Identification Authority of India (UIDAI) successfully conducted a Proof of Concept (PoC) on the use of face authentication during the National Eligibility cum Entrance Test (NEET UG) 2025 in New Delhi. This initiative was carried out in collaboration with the National Informatics Centre (NIC) and the National Testing Agency (NTA), marking a significant step towards enhancing exam security and candidate verification processes using advanced biometric technology

Rising Corporate Adaptation and Private Investments

The importance of identity verification to safeguard onboarding, prevent fraud, and meet the ever-changing legislative requirements is growing across banks, fintech, insurance, telecom, e-commerce, and more. The biggest players are investing in biometric tools with the power of AI, video KYC, and cloud-native platforms to seamlessly offer customers high security and facilitation of the process. Even startups and medium-sized companies are increasing their spending, especially focusing on AI-based and privacy-oriented verification systems. This corporate uptake is boosted by the increased interest of venture capital and private equity firms interested in funding scalable and modern technologies of ID verification. There is active venture funding in startups focused on the field of blockchain-based digital IDs, liveness detection, and anti-deepfake solutions, which underlines high investor confidence in the industry.

For example, on June 30, 2025, Meta made it mandatory for advertisers running securities and investment advertisements (ads) on its platforms in India (including global campaigns) to get verified by the Securities and Exchange Board of India (SEBI) or, if exempt from such registration, opt for identity or business verification..

New Trends Changing the Future

The major trends that are likely to shape the future of the Indian identity verification market are the emergence of the blockchain component to a decentralized identity system, AI/ML to address fraudulent charges, and a greater focus on privacy-first solutions when it comes to keeping data access at a minimum. Targeted to fuel growth and cut costs, the spread of cloud-based verification services is enabling businesses to grow rapidly, and collaborations between identity tech firms and banks or fintechs are providing new, fully integrated solutions that make compliance easier. Notably, such threats as deepfakes or AI-generated fraud increase, and businesses invest more in high-level anti-spoofing technologies to defend themselves and their customers alike.

Click here to view the Report Description & TOC https://univdatos.com/reports/india-identity-verification-market

The Market that is Poised to Investigate Strategically

The identity verification market in India is a good opportunity that businesses and investors can tap to facilitate and enjoy the digital development in India. Government investments have made the enabling foundation, but success will depend on innovation by the business sector within scalable, secure, and compliant solutions. To investors, now is the time to invest in technologies that combine security, privacy, and user experience, which are essential in establishing and cultivating trust in the Indian digital economy.

Related Report:-

Identity Verification Market: Current Analysis and Forecast (2021-2027)

Currency Exchange Bureau Software Market: Current Analysis and Forecast (2024-2032)

Authentication and Brand Protection Market: Current Analysis and Forecast (2022-2028)

FIDO Authentication Market: Current Analysis and Forecast (2022-2028)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/