Japan Kombucha Market Analysis by Size, Trends, & Research Report, 2033| UnivDatos

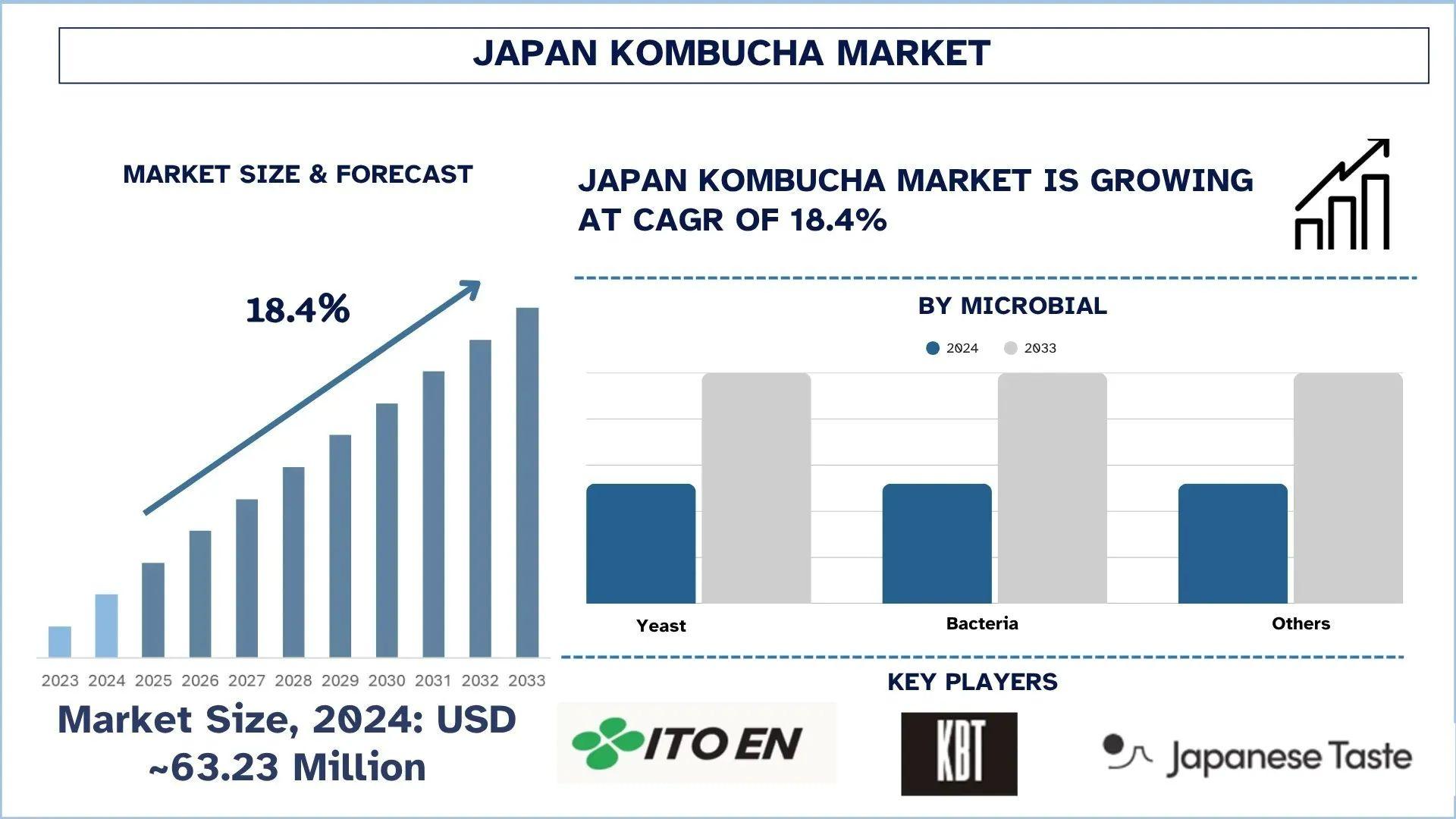

According to the UnivDatos, the rise in demand for probiotic and hard Kombuchas would fuel the demand for Japanese Kombucha. As per their “Japan Kombucha Market” report, the Japanese market was valued at USD 63.23 million in 2024, growing at a CAGR of about 18.4% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The Japanese kombucha market is experiencing a silent change with the increased health culture and the changing consumer inclination towards natural functional drinks. Japan is fighting against an aging population and paying more attention to preventive health, which is why the probiotic-filled profile of kombucha is becoming increasingly popular. Kombucha is still a relatively niche product, but it fits the current clean-label categories, the trend towards the healthiness of the gut, and, most recently, the sensation of immunity following COVID-19. The products being innovated, such as regional flavors adapted to different regions like yuzu and matcha, or the high-end and hard kombucha products, are carving out the terrain. The Tokyo urban areas, such as the Kanto region, are becoming the hotspots of the kombucha culture because of the demand from millennials and wellness trends.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/japan-kombucha-market?popup=report-enquiry

Rising Health‑Consciousness & Probiotic Demand:

· Japan has recorded considerable movement towards healthier living in the past few years as it is aging, healthcare awareness is on the rise, and there is a growing consumer demand towards preventive health. This cultural change is contributing to the increase in popularity of natural, functional beverages, especially the ones that promote gut health, immunity, and the overall well-being of the consumer. On its part, kombucha, a fermented tea, which is a source of probiotics and antioxidants, is also becoming popular.

· Japanese consumers are becoming more informed about the gut-brain axis and the importance of probiotics in the digestive and immune system. These needs are well suited to the naturally produced and living cultures of Kombucha, which provides an alternative and refreshing beverage, low in sugar, compared with traditional soft drinks. With the increasing issue over sugar consumption and artificial ingredients, kombucha is considered an additive-free, clean-label product with functional supplementation.

· The COVID-19 pandemic only increased the popularity of interest in immunity food and beverages. Marketed as a health potion, kombucha has been gaining presence in health shops in various offline and gourmet grocery stores. Still not a mainstream product, it has been placed into alignment with health-durable trends, which means it can prosper in a changing Japanese beverage market.

· With the growing health awareness, kombucha's natural probiotic profile makes it a great value to people and brands trying to innovate in the functional beverage category.

Latest Trends in the Japan Kombucha Market

Flavor Innovation & Premiumization:

Premiumization and flavor innovation are significant aspects that promote the development of the kombucha market in Japan. The companies are coming up with other newer flavors that suit local tastes better, like yuzu, ginger, and matcha. These are alternatives to make consumers take an interest and spread the product to a broader market than one consisting of pioneers.

Simultaneously, the compliance with a high level of quality of kombucha products increases. Numerous buyers seek products containing natural ingredients, few additives, and information about the product. In response, brands are offering small-batch or handmade kombucha, often alongside quality products and health benefits. Value is also being communicated, and higher prices are supported by high-quality packaging, like glass bottles, simple labels, etc. Such efforts will transform kombucha into a trustworthy and healthy functional beverage.

This concentration of rich, regional flavors and premium qualities encourages brands to fight off stringent consumer health shoppers and develop a greater market share.

Hard Kombucha & Low‑Alcohol Offerings:

The increase in low alcohol and alternative alcohol beverages is opening new possibilities for hard kombucha in Japan. The alcohol content in hard kombucha is usually 3-7%, and it is targeted at the health-conscious clientele seeking a lighter alcoholic drink compared to beer or spirits. It takes the perceived health properties of kombucha, including probiotic and natural character, and mixes it with the social factor of alcohol.

This mixture particularly applies to the younger adults in the range of decreasing their intake of alcoholic beverages, yet they are still determined to take part in social drinking. People with changing lifestyle habits were midway between hard and non-alcoholic, so hard kombucha falls in the middle.

Still a minor category in Japan, hard kombucha is receiving traction in lifestyle bars, health-oriented cafes, and premium stores. Increased growth in this region is possible once the producers add local preferences in terms of laces and meet the local regulations.

All in all, the hard kombucha concept is one that will allow the kombucha market to expand the purpose of consumption beyond the health and wellness sector into the non-medical context of recreational consumption.

Click here to view the Report Description & TOC https://univdatos.com/reports/japan-kombucha-market

Regional Market Growth

Kanto region, which hosts Tokyo and the most populous metropolitan area in Japan, is one of the major growth centers in the Kombucha market. There is an abundant health-savvy population and a vibrant cafe culture; therefore, there is a following of kombucha among the young and millennial generations. Specialty health stores, organic supermarkets, and urban cafes have started to carry both local and foreign bottled kombucha brands. The local manufacturers are employing the creation of new flavors, like yuzu, matcha, and shiso, to suit local tastes. There is also the emergence of trendy kombucha breweries and wellness places or pop-ups in Kanto that can be considered a sign of increasing interest in natural, probiotic drinks as a component of a healthy diet and lifestyle.

“Bridging Wellness and Lifestyle Through Fermented Beverages”:

Kombucha is strongly placed to transform itself in Japan, from a niche health drink to a mainstream lifestyle drink. The category has good growth potential, particularly in densely populated urban areas, with the expansion of old and mid-scale brands, continuous innovation, and the addition of new retail outlets. Future growth will be driven by brands that will localize the tastes, and consumers will be educated.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/