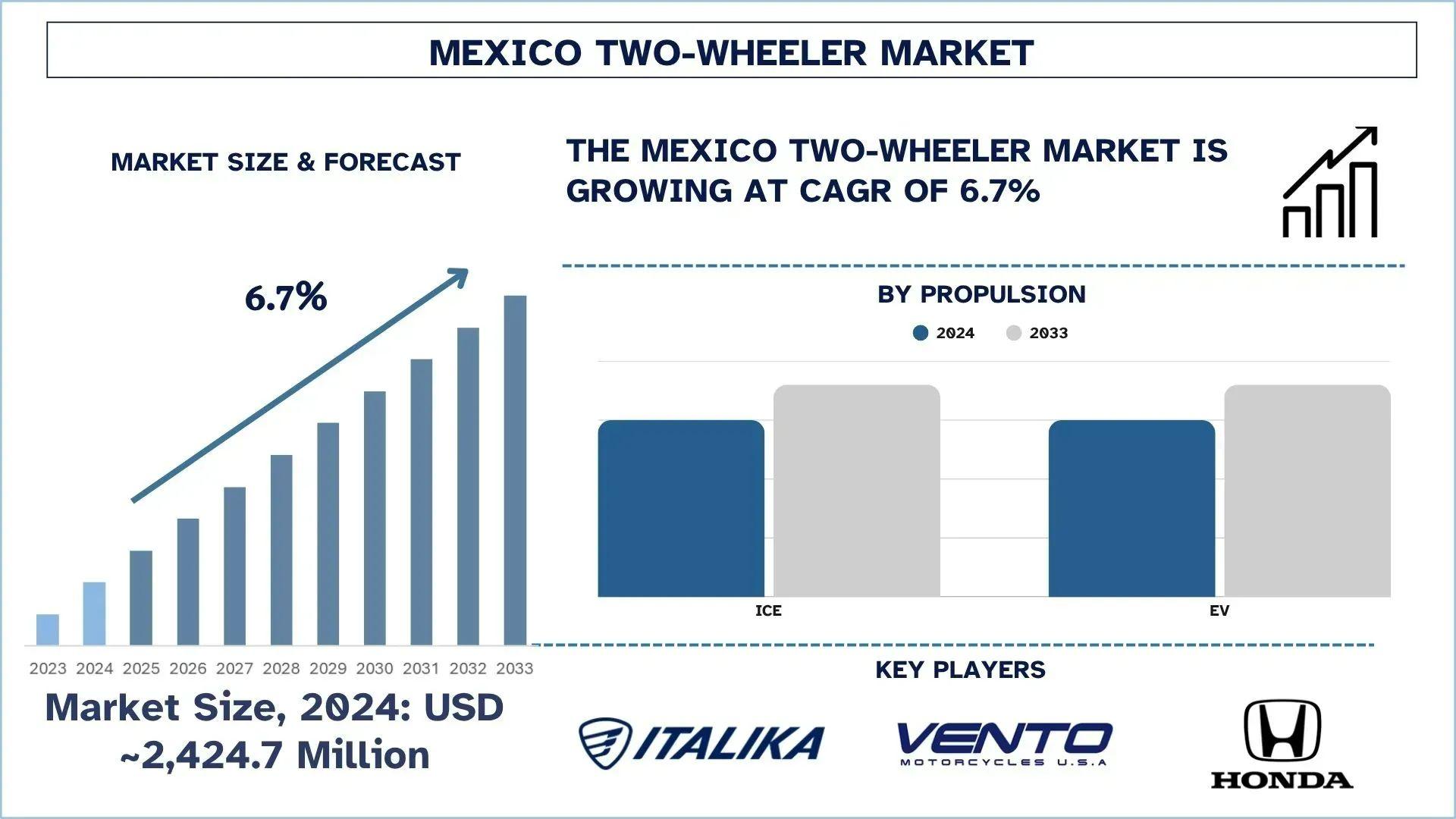

Mexico Two-Wheeler Market Analysis by Size, Trends, & Research Report, 2033| UnivDatos

According to the UnivDatos , rising urban congestion, growth in last-mile delivery services, and increasing demand for affordable personal mobility, would drive the Mexico Two-Wheeler market. As per their “Mexico Two-Wheeler Market” report, the market was valued at USD 2,424.7 Million in 2024, growing at a CAGR of about 6.7% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

The Mexican two-wheeler market consists of internal combustion engine (ICE) motorcycles, scooters, and electric pathways; 2024 has been quite overwhelming to the market, where about 1.9 million units were sold. Increasing urban traffic, inadequate capacity of the available transport systems, and the soaring need to afford yearning modes of personal transport are the driving factors in the market. The scooters and motor-bicycles are less expensive to maintain and can be navigated through traffic faster, making them ideal for inner-city commuting and delivering items. The volume segment is controlled by local manufacturers such as Italika, whereas electric variants are experiencing a market penetration with the support of government policies and awareness of environmental issues.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/mexico-two-wheeler-market?popup=report-enquiry

The Growing Demand for Mexico Two-Wheeler

These two economic and infrastructural factors, combined with social factors, are boosting the demand for two-wheelers in Mexico. As more people make urban settlements their home and traffic congestion continues to pile up in such central urban areas as Mexico City, Guadalajara, and Monterrey, motorcycles and scooters have turned out to be a viable and time-saving option to cars and buses. Quite cheap to buy with comparatively low fuel consumption and maintenance costs, the two-wheelers are particularly appealing to low-income earners and middle-income consumers. In addition, the burgeoning digital commerce and the on-demand delivery system have greatly augmented the use of motorcycles in last-mile deliveries. The availability of flexible funding facilities, an increase in fuel prices, and the government promotion of electric mobility is also creating a prolonged upward surge in the adoption of two-wheelers in the country.

Latest Trends in the Mexico Two-Wheeler Market

The Mexico Two-Wheeler market is witnessing several emerging trends. Here are some of the key trends shaping the market:

Dominance of Low-Displacement ICE Motorcycles

Despite the increased EV usage, internal combustion engine (ICE) type motorcycles and especially those with engine capacities less than 250cc remain dominant in the Mexican market. These bikes with small engines are known to be cheap, economical, and easy to go through congested city traffic. It is the choice in rural and semi-urban locations where there is restricted EV infrastructure and supply of parts and services to traditional vehicles.

Tech & Connectivity Integration

Advanced technology is fast emerging as a feature of mid-range and premium quality two-wheeler products of Mexico. More and more frequent features include GPS navigation, Bluetooth connectivity, digital dashboards, ABS, and smartphone connectivity. Such improvements are not only to enhance the riders' experience and safety, but have a more youthful, technologically adept customer who wants only the most modern and connected cars to ride in.

Battery Swapping Models Emerging

Electric two-wheeler manufacturers are acknowledging battery-swapping technology as an approach that curbs range anxiety and limits charging offline time. This system will enable people to interchange exhausted batteries with refilled ones at select points with much ease. However, one of the current models under review is this model because it presents a possibility of achieving bulk purchases, especially in commercial fleets and delivery services within cities and towns.

Fleet & Delivery Electrification

In order to satisfy the demand related to seamless and affordable transportation that emerged as a result of e-commerce and on-demand food delivery solutions that gained popularity in Mexico has transformed logistics enterprises have transformed to use electric two-wheelers because of their low operating expenses and government promotion. This is one of the high-growth trends driving the EV segment in big cities such as Mexico City, Guadalajara, and Monterrey.

Eco & Sustainability Focus

Environmental sustainability is becoming a major issue to consumers and decision-makers alike. Rising concern over car emission standards and the quality of air in cities is challenging both individual users and company fleets to consider greener and efficient options in transportation. This change of attitude is also leading to an increase in the adoption of electric two-wheelers and pushing manufacturers towards investing in environmentally friendly technologies and models.

Rural & Semi-Urban Expansion

Urban centre still holds the market as the leader in selling two-wheelers, though it is gaining momentum in rural and semi-urban areas. The motor cycles and scooters in these places are very practical and affordable for transport, especially where there is no much or no form of transport. This has been an opportunity that manufacturers have taken up by increasing dealer networks and accessing funding for low-income and unbanked groups.

The biggest Two-Wheeler Company in Mexico

With more than 70 percent market share in the motorcycle market, Italika, which is dominant in Mexico, has sold the highest number of motorcycles in the last decade, amounting to 1.3 million. This is the 20th year in a row that this company is expanding, making it the most popular brand in the country and one of the largest manufacturers in the world.

Ø The firm has also added a new assembly plant recently in Guadalajara, which has added 500,000 units to the capacity annually.

Ø Italika has also initiated assembly of the international marques such as Hero and Benelli as part of its own brand.

Click here to view the Report Description & TOC https://univdatos.com/reports/mexico-two-wheeler-market

"Riding Ahead: Mexico’s Two-Wheeler Revolution"

The Mexican two-wheeler market is emerging rapidly due to the interaction of the peculiarities in mobile transport needs, the level of technology, and the e-mobility policy. Though motorcycles are the most popular owing to lower prices and general utility, the electrical industry is positioning itself as a growing niche, particularly in urban areas as well as in fleet service. The market can expand further both in the long- and the short-term because of a mix of factors: the increase of the infrastructure, the orientation to the environmentally-friendly and intelligent way of the kind of mobility, as well as the new preference of the customers. With its notable government support, upsurge in individual investment, and proliferation into the region of Latin America, Mexico is catching pace to emerge as one of the big two-wheeler centers in the region.

Related Report:-

India EV Market: Current Analysis and Forecast (2025-2033)

Automotive Ethernet Market: Current Analysis and Forecast (2024-2032)

Automotive Green Tires Market: Current Analysis and Forecast (2024-2032)

Automotive Fuel Pump Market: Current Analysis and Forecast (2023-2030)

Automotive Brake System Market: Current Analysis and Forecast (2022-2030)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/