Personal Gadget Insurance Market Size, Share, Growth Drivers, Trends and Forecast 2025–2032

"Latest Insights on Executive Summary Personal Gadget Insurance Market Share and Size

CAGR Value

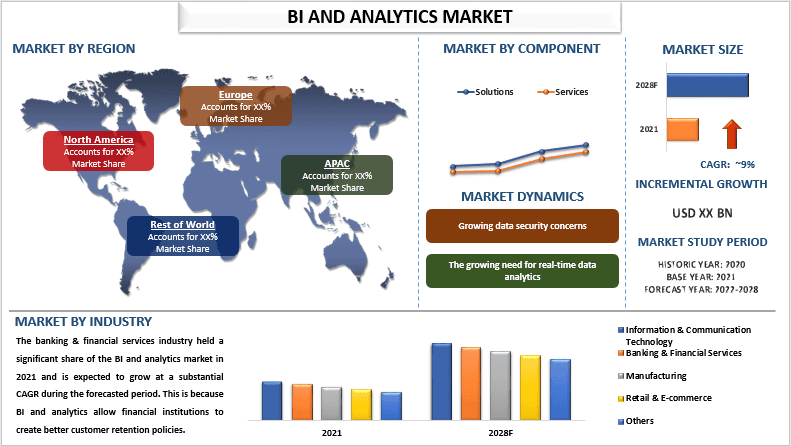

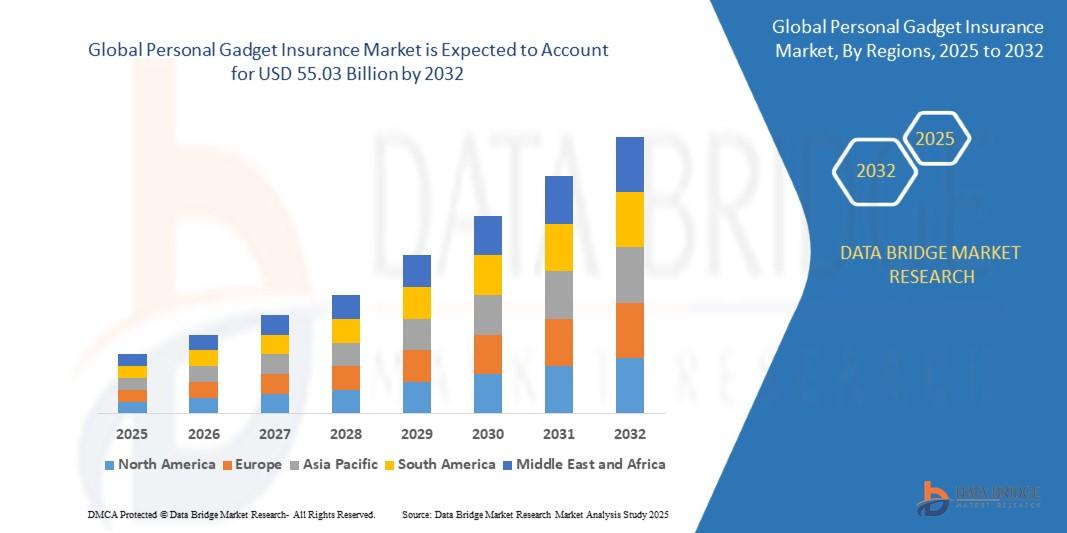

The global personal gadget insurance market size was valued at USD 25.30 billion in 2024 and is projected to reach USD 55.03 billion by 2032, with a CAGR of 10.20% during the forecast period of 2025 to 2032.

To produce the best market research report, a wide range of objectives is required to be kept in mind. The large scale Personal Gadget Insurance Market report is comprehensive and object-oriented which is structured with the grouping of an admirable industry experience, talent solutions, industry insight and most modern tools and technology. Here, market segmentation is performed in terms of markets covered, geographic scope, years considered for the study, currency and pricing, research methodology, primary interviews with key opinion leaders, DBMR market position grid, DBMR market challenge matrix, secondary sources, and assumptions.

Various parameters taken into consideration in Personal Gadget Insurance Market business report helps businesses for better decision making. This information and market insights help to increase or decrease the production of goods depending on the conditions of demand. It also simplifies management of marketing of goods and services successfully. With the meticulous competitor analysis detailed in this report, businesses can estimate or analyse the strengths and weak points of the competitors which helps create superior business strategies for their own product. A wide-ranging Personal Gadget Insurance Market research report is sure to help grow the business in several ways.

Dive into the future of the Personal Gadget Insurance Market with our comprehensive analysis. Download now:

https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market

Personal Gadget Insurance Business Outlook

**Segments**

- **Type:** The personal gadget insurance market can be segmented into mobile phones, laptops, tablets, and others. With the increasing dependency on these gadgets for both personal and professional use, the demand for insurance to protect them from damages and theft is also on the rise.

- **Distribution Channel:** The market can also be segmented based on the distribution channel, including online channels and offline channels. Online channels provide convenience and quick access to insurance, while offline channels offer a personal touch and assistance in understanding the insurance policies better.

- **End-User:** Another crucial segmentation factor is the end-user segment, which includes individuals and businesses. Individuals opt for gadget insurance to safeguard their personal devices, while businesses insure gadgets used by their employees for work purposes.

**Market Players**

- **Allianz Worldwide Partners**

- **American International Group, Inc.**

- **AmTrust Financial Services, Inc.**

- **Assurant, Inc.**

- **Asurion**

- **AT&T Inc.**

- **Trojan Insurance Services Ltd**

- **SquareTrade**

- **Nippon Life Insurance Company**

The global personal gadget insurance market is witnessing significant growth due to the increasing adoption of smartphones, laptops, and other electronic devices. As consumers become more reliant on these gadgets for communication, work, and entertainment, the need to protect them from potential risks such as accidental damage, theft, and breakdowns has become paramount. This growing awareness regarding the importance of gadget insurance is driving the market forward, with various players offering a range of insurance products tailored to meet the diverse needs of consumers.

The segmentation of the market based on type, distribution channel, and end-user provides insights into the specific preferences and requirements of different customer segments. For instance, mobile phones are one of the most commonly insured gadgets due to their high susceptibility to damage and theft. Online distribution channels are gaining popularity among tech-savvy consumers who prefer the convenience of purchasing insurance digitally. On the other hand, offline channels cater to customers who value face-to-face interactions and personalized service.

Market players such as Allianz Worldwide Partners, AIG, and Assurant are leading the charge in providing comprehensive gadget insurance solutions to meet the evolving needs of consumers. These companies offer a wide range of coverage options, quick claim processing, and responsive customer support to ensure a seamless experience for policyholders. With the rise of smart homes and IoT devices, the scope of personal gadget insurance is expected to expand further, offering opportunities for new entrants to tap into this burgeoning market.

The personal gadget insurance market is poised for continued growth as the demand for insurance coverage for smartphones, laptops, tablets, and other electronic devices escalates. Consumers are increasingly recognizing the need to protect their valuable gadgets against potential risks such as damage, theft, and malfunctions. This shift in consumer behavior is driving market players to innovate and offer tailored insurance products that cater to the specific needs of individuals and businesses. With the proliferation of smart devices in daily life, the market for personal gadget insurance is expected to expand even further in the coming years.

One key trend reshaping the personal gadget insurance market is the integration of digital technologies and online distribution channels. Consumers are increasingly turning to digital platforms to purchase insurance due to the convenience and accessibility they offer. Online channels enable quick and hassle-free policy purchases, making insurance more accessible to a wider audience. Market players that capitalize on this trend by enhancing their digital capabilities stand to gain a competitive edge in the market.

Moreover, the segmentation of the market based on end-user preferences and behaviors has become essential for market players to customize their offerings effectively. Understanding the specific needs of individual consumers versus businesses allows insurance providers to design policies that address the unique requirements of each segment. For instance, businesses may require group insurance policies to cover multiple devices used by employees, while individual consumers may seek comprehensive coverage for their personal gadgets.

In terms of market competition, established players such as Allianz Worldwide Partners, AIG, and Assurant continue to dominate the personal gadget insurance landscape with their extensive product offerings and strong brand presence. These companies have built a reputation for reliability, excellent customer service, and efficient claims processing, positioning them as preferred choices among consumers. However, with the evolving nature of the personal gadget insurance market, there is room for new entrants to disrupt the industry by introducing innovative insurance solutions and addressing emerging market needs.

Looking ahead, the personal gadget insurance market is expected to witness further growth driven by factors such as the increasing penetration of smart devices, rising digitalization, and the growing awareness of the importance of insurance protection. Market players that focus on consumer-centric innovation, seamless digital experiences, and personalized insurance solutions are likely to thrive in this dynamic market environment. As technology continues to advance and gadgets become more integrated into everyday life, the personal gadget insurance market presents lucrative opportunities for players to expand their market presence and cater to evolving consumer demands.The personal gadget insurance market is a rapidly growing sector that is driven by the increasing reliance on smartphones, laptops, tablets, and other electronic devices in both personal and professional settings. As consumers continue to recognize the importance of protecting their valuable gadgets from risks such as damage, theft, and malfunctions, the demand for insurance coverage is on the rise. This shifting consumer behavior has created opportunities for insurance providers to offer tailored products that cater to the specific needs of individuals and businesses alike.

One significant trend shaping the market is the integration of digital technologies and online distribution channels. With the convenience and accessibility of online platforms, consumers are increasingly opting for digital channels to purchase insurance policies. This shift towards online channels not only provides a seamless experience for customers but also enables insurance providers to reach a broader audience more effectively. Companies that leverage digital capabilities to enhance their customer experience and streamline policy purchasing processes are likely to gain a competitive advantage in the market.

Segmentation based on end-user preferences and behaviors plays a crucial role in enabling insurance providers to customize their offerings according to the unique requirements of different customer segments. Understanding the distinct needs of individual consumers versus businesses allows insurers to design policies that address specific concerns. For instance, businesses may require group insurance policies to cover multiple devices used by employees, while individual consumers may seek comprehensive coverage for their personal gadgets. By aligning their offerings with the preferences of each segment, insurers can effectively meet customer expectations and enhance their market positioning.

Established market players such as Allianz Worldwide Partners, AIG, and Assurant have solidified their presence in the personal gadget insurance landscape through their extensive product portfolios, strong brand reputation, and emphasis on customer service excellence. These companies have set industry standards for reliability, efficient claims processing, and responsive customer support, making them preferred choices among consumers. However, the evolving nature of the personal gadget insurance market also presents opportunities for new entrants to disrupt the industry by introducing innovative insurance solutions that cater to emerging market needs.

In conclusion, the personal gadget insurance market is expected to continue its growth trajectory driven by factors such as the increasing penetration of smart devices, digitalization trends, and heightened awareness of insurance protection benefits. Market players that prioritize consumer-centric innovation, seamless digital experiences, and personalized insurance solutions are well-positioned to thrive in the dynamic market landscape. By staying attuned to evolving consumer demands and technological advancements, insurers can capitalize on the expanding market opportunities and solidify their foothold in the personal gadget insurance sector.

Analyze detailed figures on the company’s market share

https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market/companies

Personal Gadget Insurance Market – Analyst-Ready Question Batches

- What is the Personal Gadget Insurance Market share of domestic vs international players?

- Which product innovations are most successful?

- What are the logistics challenges in this Personal Gadget Insurance Market industry?

- Which pricing models are most effective?

- What customer acquisition strategies work best?

- How has COVID-19 impacted the Personal Gadget Insurance Market?

- What are the main challenges faced by SMEs?

- Which countries are the biggest importers?

- What portion of the Personal Gadget Insurance Market is unorganized?

- How has consumer perception evolved recently?

- Which regions are considered saturated?

- What role does packaging play in consumer choice?

- What loyalty programs are used in this Personal Gadget Insurance Market?

- How is AI being applied in the Personal Gadget Insurance Market?

Browse More Reports:

Global Polyester Based Flexible Heater Market

Global Premenstrual Dysphoric Disorder Market

Global Real Estate Legal Services Market

Global Service Bureau Market

Global Smart Security Market

Global Speciality Tools Market

Global Surgical Imaging Market

Global Virtual Router Market

Global Weathering Steel Market

Global Wireless Intrusion Prevention System Market

Global Activated Carbon Filters Market

Global Amniotic Membrane Market

Global Artificial Intelligence as a Service Market

Global Beverage Enhancers Market

Global Ceric Ammonium Nitrate Market

Global Packaged Foods Testing Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"