Global Bridal Wear Market to Reach USD 96.5 Billion by 2030, Driven by Cultural Traditions, Digital Adoption, and Sustainability Shifts

According to Deep Market Insights, "The global bridal wear market, valued at USD 69.2 billion in 2024, is projected to expand steadily, reaching USD 96.5 billion by 2030. The market is set to grow from USD 74.9 billion in 2025, reflecting a compound annual growth rate (CAGR) of 5.7% during the forecast period (2025–2030)." Growth is being shaped by a balance of cultural traditions, consumer demand for individuality, and the adoption of digital and sustainable practices.

Key Market Highlights

-

Gowns and dresses accounted for 52.1% of the market in 2024, reflecting strong Western traditions and luxury brand demand.

-

Offline retail led with 68.9% of global sales in 2024, supported by personalized fittings and boutique experiences.

-

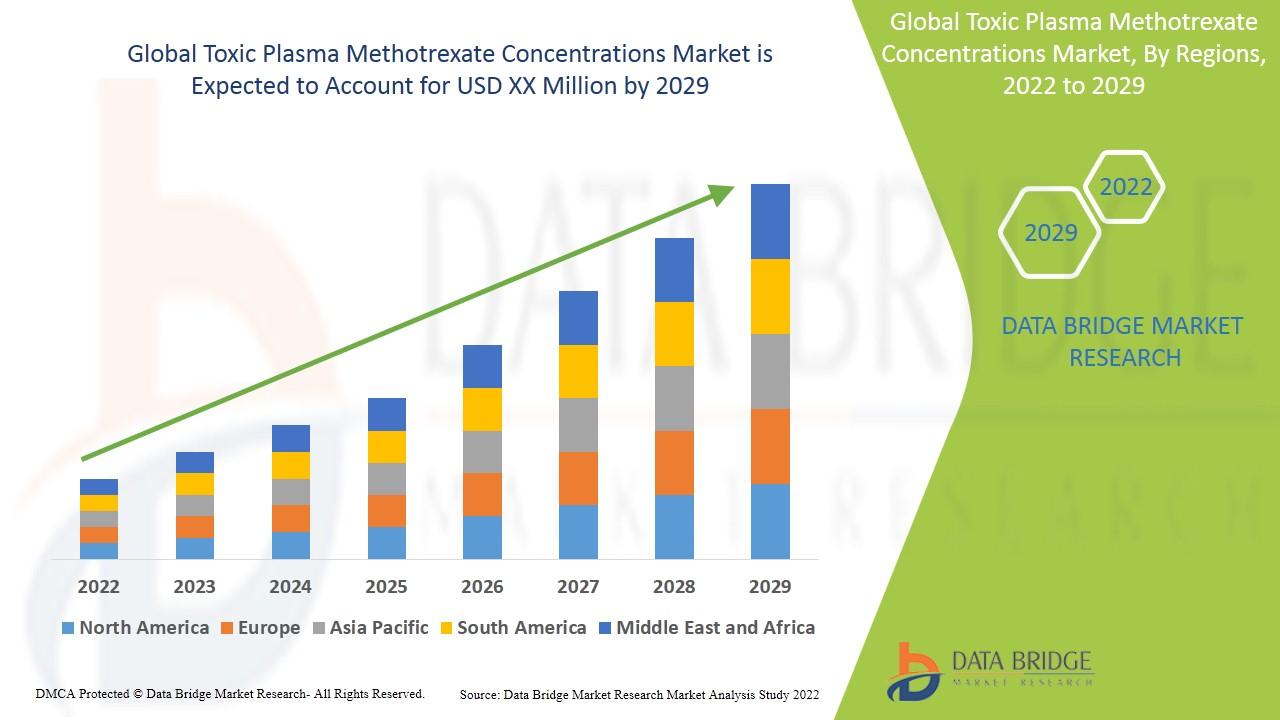

Regional market sizes in 2024: North America at USD 18.3 billion, Europe at USD 16.7 billion, Asia-Pacific at USD 22.9 billion, Latin America at USD 6.1 billion, and the Middle East & Africa at USD 5.2 billion.

Regional Performance

Asia-Pacific remained the largest market, led by elaborate cultural weddings in India and China, alongside strong local designer influence. North America showed high spending per wedding, supported by established bridal brands and digital adoption. Europe benefited from heritage fashion houses and sustainable bridal trends. Latin America and the Middle East & Africa presented emerging opportunities, with rising middle-class populations, cultural diversity, and growing luxury retail infrastructure.

Emerging Market Trends

Fusion and hybrid cultural styles are increasingly popular, particularly among multicultural weddings. Designers such as Anita Dongre and Rahul Mishra have introduced collections blending traditional embroidery with modern silhouettes, while Vera Wang and other Western designers are incorporating regional influences. Rising disposable income in emerging economies, particularly in India, Brazil, and Indonesia, is also driving higher spending on bridal fashion, jewellery, and accessories.

Minimalist and non-traditional bridal wear continues to gain traction, with younger generations seeking sleek silhouettes, jumpsuits, and understated gowns. Collections by Jenny Yoo and Reformation reflect this shift, appealing to Gen Z and millennial consumers. At the same time, e-commerce penetration is reshaping purchasing patterns. Roughly 40% of bridal purchases are now researched or completed online, supported by innovations such as AI-based style curators, try-at-home kits, and virtual fitting rooms.

Market Drivers and Restraints

The market is being supported by evolving consumer expectations that prioritise both tradition and personalisation. Destination weddings, increased digital adoption, and global exposure through social media are further influencing purchase decisions. However, the high cost of premium bridal wear continues to limit accessibility for mid-income consumers, particularly in regions with high import tariffs.

Sustainability concerns present another challenge. Increasing scrutiny on textile waste and environmental impact is pushing the market toward alternatives such as pre-owned bridal wear, rental options, and eco-friendly fabrics. Consumers in Europe and North America, in particular, are responding positively to brands offering sustainable solutions.

Opportunities Ahead

The rise of bridal rental and resale platforms offers new growth opportunities. Companies such as Rent the Runway, Borrowing Magnolia, and My Wardrobe HQ are addressing affordability and sustainability concerns. Additionally, regional startups in India and the Middle East are offering culturally tailored bridal outfits for rent.

AI-driven personalisation tools are also expanding the market. Platforms like Etsy’s AI-curated bridal boutique and Zozotown’s smart measurement technology enable virtual trials and customised fittings, reducing dependence on physical showrooms while broadening access to designer offerings.

Product and Channel Insights

-

Product Type: Gowns and dresses remain dominant, supported by cultural symbolism and luxury demand. Accessories, footwear, and groom wear contribute to market diversity, while lingerie and headpieces form a smaller but steady segment.

-

Distribution Channels: Offline retail continues to dominate due to the importance of fittings and in-store consultations. Bridal boutiques and flagship stores in global hubs remain significant. At the same time, online retail is gaining share, driven by tech-enabled experiences and consumer demand for convenience.

-

Fabric Preferences: Satin remains a preferred fabric due to its sheen and structure, popular in North America and Europe. Designers are incorporating satin blends for comfort and movement, while lace, tulle, and organza maintain significant shares in traditional and contemporary designs.

Competitive Landscape

The market is highly fragmented, comprising global couture labels, regional designers, and digital-first brands. Heritage players focus on premium, custom-made gowns, while emerging brands emphasise affordability and virtual experiences. Pronovias Group continues to hold significant market share in Europe and North America, supported by sustainability initiatives such as its “Second Life” alteration and conversion program. David’s Bridal is expanding digital engagement through tools like its AI-powered 3D gown customizer launched in March 2025.

Key Companies

-

Pronovias Group

-

David’s Bridal

-

Maggie Sottero Designs

-

Justin Alexander

-

Monique Lhuillier

-

BHLDN (Anthropologie)

-

Zuhair Murad

-

Sabyasachi (India)

-

Lela Rose

-

Marchesa

Conclusion

The bridal wear market is evolving through a mix of tradition, modern consumer expectations, and sustainability imperatives. While premium pricing and environmental challenges remain, opportunities in digital personalisation, rentals, and hybrid cultural styles are expected to drive significant growth through 2030.