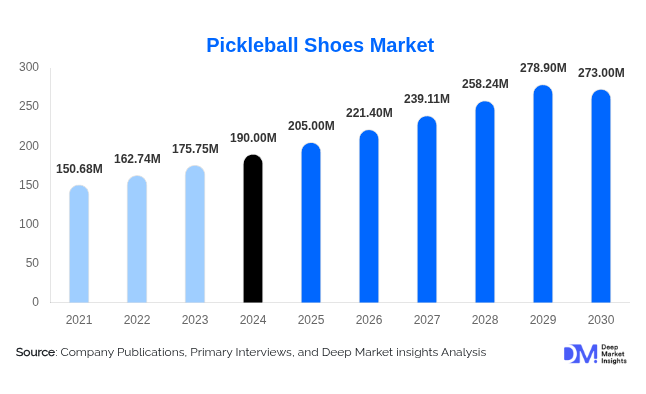

Pickleball Shoes Market Set to Reach USD 273 Million by 2030, Driven by Explosive Growth of the Sport

According to Deep Market Insights, "The global pickleball shoes market, valued at USD 190 million in 2024, is projected to grow steadily to USD 205 million in 2025 and reach USD 273 million by 2030, representing a CAGR of 8% over the forecast period." This growth reflects the meteoric rise of pickleball itself, now one of the fastest-growing sports worldwide, and the increasing demand for specialised footwear designed to enhance performance, comfort, and injury prevention.

Key Market Insights

Outdoor pickleball shoes dominate the segment, powered by the surge in public and community courts that require durable, weather-resistant footwear. Mesh materials lead the market as players seek lightweight breathability without sacrificing structural support. Standard fit remains the most widely purchased sizing option, offering universal compatibility and broad appeal.

Women’s shoes account for the largest share of sales, with the 30–65 age group showing rapid adoption. North America continues to hold the top regional position due to high participation levels, strong retail support, and brand sponsorships. Meanwhile, Asia-Pacific presents the fastest growth trajectory, with notable expansion in Japan, Australia, South Korea, and India.

Emerging Trends

Brand expansion has accelerated competition in the pickleball footwear market. Established sportswear giants are entering aggressively, leveraging their distribution networks and global recognition. This forces smaller brands to differentiate with eco-certified lines, smart-technology integration, and niche designs. In January 2025, Adidas launched its “Cloud White / Silver Metallic” pickleball shoe, a milestone that underscores the sport’s transition from niche to mainstream.

Specialised design is also shaping the category. Pickleball shoes differ from standard training or running footwear, as they must support quick lateral movements, directional changes, and hard-court traction. Players increasingly demand court-specific outsoles, enhanced ankle stability, and reinforced cushioning to withstand intense play.

Marketing and sponsorship are adding momentum. Leading brands like Skechers, Fila, and Babolat are dedicating resources to pickleball-specific lines, sponsoring tournaments such as the APP Tour and PPA, and partnering with federations worldwide. For example, in June 2025 Skechers became the official footwear sponsor of the Philippine Pickleball Federation during its first national championship.

Price point strategies are ensuring accessibility across demographics. Entry-level shoes at USD 50–80 target beginners, mid-range at USD 80–120 appeal to intermediates, and premium models above USD 120 cater to professionals seeking advanced technology. This tiered pricing strategy allows brands to reach diverse consumer groups and encourage upgrades as players progress.

Market Restraints

Despite robust growth, two challenges remain: price sensitivity and material cost fluctuations. Premium shoes above USD 120 can deter beginners and older players, particularly in emerging markets. Additionally, global supply chain instability and fluctuating prices for rubber, EVA foam, and synthetic materials create cost pressures. Some brands are addressing this with sustainable sourcing and local production, though these require significant investment.

Key Opportunities

Sustainability is an area of major opportunity. Consumer demand for eco-friendly products continues to rise, and pickleball players are increasingly conscious of material sourcing. Shoes made with recycled plastics, bio-based polymers, or organic textiles—certified by organisations like the Global Recycled Standard—are expected to capture strong loyalty and premium margins.

Another growth avenue is smart shoe technology. By embedding sensors and motion trackers, smart pickleball shoes can provide data on player movements, balance, and performance. This feature is particularly appealing to competitive athletes and coaches who wish to analyse play in real time. As production costs decrease, these innovations are expected to become mainstream.

Regional Outlook

North America remains the largest market, with the United States leading adoption. Europe is the fastest-growing region, where sustainability and performance-driven footwear resonate with consumers in the UK, Germany, and the Nordics. Asia-Pacific is gaining momentum in Japan, South Korea, India, and Australia, supported by strong community adoption. Latin America and the Middle East & Africa are in earlier stages of growth, but urban hubs and sports-driven cultures provide fertile ground for expansion.

Competitive Landscape

The pickleball shoes market is highly competitive, featuring established athletic giants alongside niche brands. ASICS, a leader in cushioning technology, commands the U.S. market with its GEL RENMA and GEL Game shoes, launched in March 2025. HEAD dominates Europe, supported by its Motion Pro series introduced in April 2025. Adidas, K-Swiss, Mizuno, New Balance, Nike, and Puma are intensifying their presence, while specialist brands like Babolat and Skechers are carving strong niches through sponsorship and targeted campaigns.

Conclusion

The pickleball shoes market is evolving rapidly, mirroring the sport’s transformation into a global phenomenon. With innovation in sustainable materials, smart technology integration, and increasing investment from leading sportswear brands, the market is positioned for sustained growth through 2030. Brands that can balance accessibility with high performance, while capturing emerging opportunities in sustainability and technology, are expected to lead the next phase of this dynamic market.