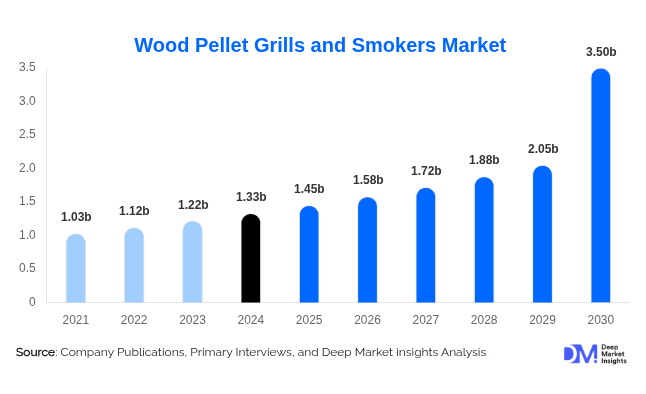

Global Wood Pellet Grills and Smokers Market Projected to Reach USD 2.23 Billion by 2030 at 9% CAGR

According to Deep Market Insights, "The global wood pellet grills and smokers market, valued at USD 1.33 billion in 2024, is projected to expand from USD 1.45 billion in 2025 to USD 2.23 billion by 2030, registering a compound annual growth rate (CAGR) of 9% during the forecast period (2025–2030)."

Market Overview

Wood pellet grills and smokers are gaining significant traction worldwide due to their versatility, advanced features, and ability to deliver a wood-fired cooking experience. These products appeal to both residential users and commercial establishments, offering functionalities such as grilling, smoking, roasting, baking, and searing. The integration of automated pellet feeders, digital temperature controls, and smart connectivity features has further boosted adoption.

Key Market Insights

-

Product Demand: Wood pellet grills remain the dominant product type, driven by their multifunctionality and popularity among both novice and experienced consumers.

-

Fuel Preference: Premium hardwood pellets lead the market owing to clean combustion, low ash residue, and sustainability advantages.

-

Primary Application: Residential use represents the largest segment, with homeowners increasingly investing in backyard cooking and outdoor living solutions.

-

Regional Leadership: North America remains the largest market, supported by a strong barbecue culture and broad product availability. Europe is seeing steady adoption, while Asia-Pacific represents a high-growth region led by Australia, Japan, South Korea, China, and India.

Market Drivers

-

Enhanced Flavor and Versatility

Pellet grills are preferred for their ability to infuse food with wood-fired flavors not achievable with gas or electric grills. Their multi-capability enables consumers to cook a wide range of dishes using a single appliance. -

Hospitality and Recreational Expansion

Restaurants, resorts, and outdoor venues are adopting pellet grills for efficient large-scale cooking, ensuring consistent quality with reduced monitoring requirements.

Market Restraints

-

High Cost: The upfront investment for pellet grills is higher than gas grills, and ongoing pellet supply adds to ownership costs. Limited pellet availability in some regions further restricts adoption.

-

Supply Chain Challenges: Availability of raw materials, environmental regulations, and logistics issues can disrupt pellet supply, leading some consumers to prefer alternative fuels.

Market Opportunities

-

Sustainable Fuel: Wood pellets, produced from compressed sawdust, offer a low-emission, renewable energy source. This aligns with global sustainability trends and appeals to environmentally conscious consumers.

-

Technological Advancements: WIFI connectivity, Bluetooth control, automated feeding systems, and programmable cooking cycles are enhancing user convenience, making grills accessible for beginners while offering precision for professionals.

Product Type Insights

-

Wood Pellet Grills: The largest segment, known for versatility and consistency.

-

Smokers and Combination Units: Popular among professional and hobbyist users seeking specialized cooking.

-

Portable Grills: Emerging niche for outdoor events and travel.

Fuel Type Insights

-

Premium Hardwood Pellets: The most widely adopted, valued for performance and environmental benefits.

-

Flavored and Low-Ash Pellets: Gaining traction for specific cooking preferences.

Application Insights

-

Residential: Dominant application, driven by backyard cooking and long-term investment in outdoor living.

-

Commercial and Events: Growing adoption in restaurants, food festivals, and hospitality sectors.

Regional Insights

-

North America: Largest market, led by the U.S. and Canada, with strong cultural affinity for barbecuing.

-

Europe: Growth driven by environmental awareness and demand for premium outdoor kitchens.

-

Asia-Pacific: Fastest-growing region, led by Australia’s barbecue culture and rising disposable incomes in Japan, South Korea, China, and India.

-

Middle East & Africa: Emerging market, with adoption concentrated in urban centers such as the UAE, Saudi Arabia, and South Africa.

-

Latin America: Expanding market, supported by grilling traditions in Brazil, Argentina, and Mexico.

Competitive Landscape

The market is competitive, with several global players focusing on innovation and advanced features. Companies are expanding product portfolios with smart technology integration, energy efficiency, and user-friendly designs.

-

Traeger Grills: Known for WiFIRE® technology and D2® Direct Drive. In January 2025, the company launched the Woodridge Series, expanding accessibility with enhanced smoke control and simplified cleaning.

-

Weber-Stephen Products LLC: Offers the SmokeFire series and new models such as the Sear wood and Smoque pellet grills, launched in April 2025.

-

Pit Boss Grills: Introduced the Pro Series v4 in January 2025, featuring a redesigned touchscreen controller and larger pellet capacity.

-

Memphis Wood Fire Grills: Expanded its high-end lineup in April 2025, with grills offering up to 700°F, direct flame inserts, and Wi-Fi-enabled LCD controls.

Other key players include Green Mountain Grills, Camp Chef, REC TEC Grills, Z Grills, Louisiana Grills, Yoder Smokers, Cookshack Inc., MAK Grills, Smokin Brothers, Grilla Grills, Char-Broil, Dyna-Glo, and Masterbuilt.

Outlook

With strong demand for sustainable, versatile, and technology-driven cooking solutions, the global wood pellet grills and smokers market is set for steady expansion. Rising disposable incomes, the shift toward outdoor living, and increasing awareness of renewable fuel options will further support long-term growth across residential and commercial applications.