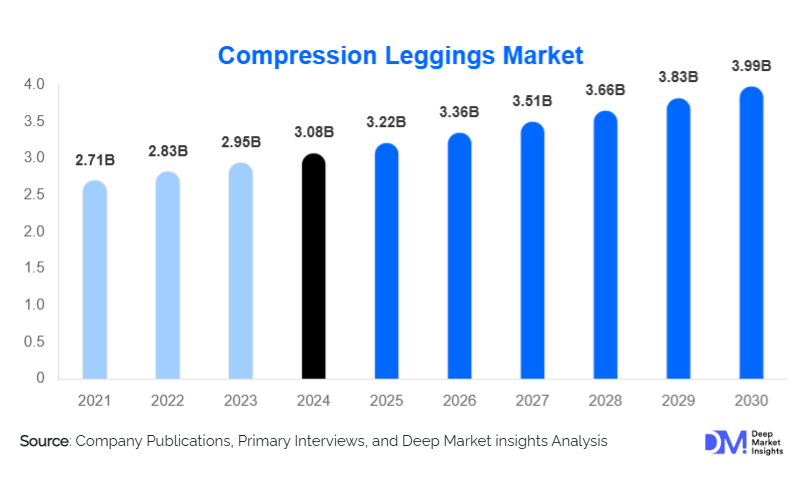

Global Compression Leggings Market to Reach USD 3.99 Billion by 2030

According to Deep Market Insights, "The global compression leggings market, valued at USD 3.08 billion in 2024, is projected to grow from USD 3.22 billion in 2025 to USD 3.99 billion by 2030, reflecting a CAGR of 4.4% during the forecast period (2025–2030)." Growth is supported by fabric technology innovations and rising adoption in sports and medical recovery.

Market Overview

-

Product Trends: Full-length compression leggings dominate the market, driven by their comfort, support, and performance benefits in both athletic and recovery applications.

-

Distribution: Online retail remains the leading channel, supported by features like AI-based size guidance, subscription models, and global reach.

-

Applications: Sports and fitness account for the largest application segment, with growing use among runners, gym-goers, and yoga practitioners.

-

Regional Leadership: North America leads the global market, backed by strong fitness culture and e-commerce infrastructure, followed by Europe where demand for sustainable and medical-grade compression is increasing.

Latest Trends

-

Sustainable Materials: Eco-friendly compression fabrics are reshaping the market. In 2025, Triarchy and Yulex introduced leggings using natural rubber-based fibres, reducing reliance on elastane and lowering microplastic waste. Brands like Under Armour and Lululemon are experimenting with recycled fabric blends.

-

Daily Wear Integration: Compression leggings are increasingly adopted beyond sports, becoming part of daily fashion. Athleisure brands such as Gymshark, Sweaty Betty, and Lorna Jane are designing leggings that merge performance with modern style, catering especially to millennial and Gen Z consumers.

Growth Drivers

-

Physiological Benefits Awareness: Compression leggings are recognised for supporting muscle alignment, reducing fatigue, and aiding post-exercise recovery. Nike’s 2025 innovations highlight enhanced oxygen delivery and temperature regulation.

-

Athleisure and Social Media: Social media platforms and influencer-driven marketing expand the adoption of compression leggings as fashion and performance gear, with brands like Alo Yoga and Lululemon leading campaigns.

Market Challenges

-

High Costs: Premium leggings with advanced fabric technologies remain expensive, limiting adoption in price-sensitive regions such as Asia and Africa.

-

Limited Awareness: Misconceptions about discomfort and limited understanding of functional benefits continue to hinder growth, particularly in rural or non-metro areas.

Opportunities

-

Medical Use: Innovations in post-surgical compression leggings are opening new avenues. In November 2024, The Marena Group and Clothing 2.0 introduced FDA-registered leggings infused with pain-relief agents.

-

Inclusivity and Custom Fit: Rising demand for plus-size, maternity, and adaptive compression wear is shaping the market. Brands are utilising 3D body scanning and advanced stretch fabrics to improve fit and accessibility.

Regional Insights

-

North America: Leads global demand due to premium product adoption, awareness of recovery apparel, and strong e-commerce penetration.

-

Europe: Growth is supported by sustainability-focused consumers and ageing populations seeking medical-grade compression.

-

Asia-Pacific: Expected to record the fastest growth, driven by rising fitness participation, digital retail adoption, and expanding middle-class incomes.

-

Latin America: Market growth is steady, with fitness awareness and athleisure culture gaining ground, despite pricing barriers.

-

Middle East & Africa: Urban fitness trends and luxury wellness culture drive adoption in regions such as UAE and South Africa, though affordability remains a restraint elsewhere.

Competitive Landscape

The compression leggings market is competitive, with key players leveraging performance innovation, branding, and sustainability strategies. Major companies include Nike Inc., Lululemon Athletica, Adidas AG, Under Armour Inc., Spanx Inc., Puma SE, 2XU Pty Ltd, Athleta (Gap Inc.), and Vuori.

-

Lululemon Athletica: Expanded its PowerSupport™ Legging range in April 2025, featuring zoned compression and seamless construction, targeting recovery and endurance athletes.

-

Under Armour Inc.: Introduced its Recovery Compression Series in October 2024, integrating mineral-infused fabrics to support blood flow and post-exercise recovery.

-

Recent Product Launches:

-

June 2025: Elastique Athletics launched L’Original lymphatic drainage leggings with embedded silicone beads.

-

February 2025: Calvin Klein entered the market with a shapewear line offering four levels of compression.

-

February 2025: Lululemon unveiled its Glow Up line of shapewear-inspired leggings blending compression with contouring design.

-

Conclusion

The compression leggings market is on track for steady growth, supported by sports adoption, recovery benefits, sustainability trends, and expanding lifestyle use. While high costs and limited awareness remain barriers, opportunities in medical applications, inclusivity, and eco-friendly fabrics are set to define the next phase of industry expansion.