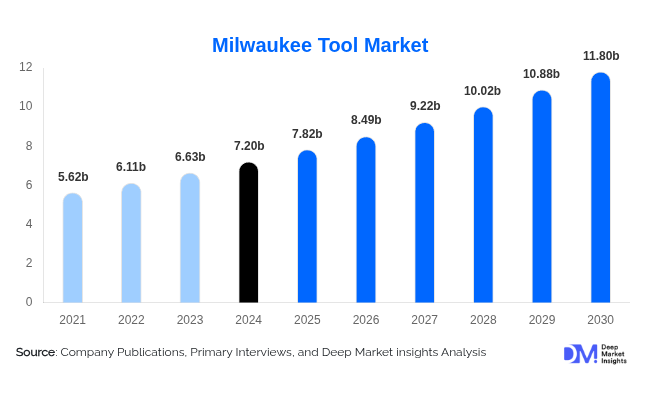

Milwaukee Tool Market to Reach USD 11.8 Billion by 2030, Driven by Cordless Innovation and Smart Jobsite Solutions

According to Deep Market Insights, " The global Milwaukee Tool market, valued at USD 7.2 billion in 2024, is projected to grow from USD 7.82 billion in 2025 to USD 11.8 billion by 2030, registering a compound annual growth rate (CAGR) of 8.6% during the forecast period (2025–2030)." Growth is underpinned by the increasing adoption of cordless power tools, jobsite digitalization, and sustainability-driven demand in construction and industrial sectors.

Market Overview

Milwaukee Tool, a subsidiary of Techtronic Industries (TTI), has strengthened its leadership in heavy-duty power tools through platforms such as M18 FUEL and MX FUEL, which feature brushless motors, extended battery performance, and smart integration. The ONE-KEY digital ecosystem has positioned the company at the forefront of connected jobsite solutions, enabling real-time tracking, diagnostics, and asset management.

In 2024, power tools accounted for 56.2% of total revenue, while the construction sector represented over 52% of end-use demand, confirming the brand’s primary revenue drivers. North America led the global market at USD 3.2 billion, supported by a mature construction ecosystem and strong brand loyalty.

Regional Insights

-

North America: Largest market, valued at USD 3.2 billion in 2024, expected to grow at a CAGR of 9.3% through 2030. Growth is supported by advanced infrastructure projects, contractor partnerships, and Milwaukee Tool’s expanding U.S.-based R&D and manufacturing facilities.

-

Europe: Demand is increasing due to stricter emission and noise regulations, with contractors shifting from gas-powered to cordless systems. Renovation projects tied to the European Green Deal continue to drive adoption.

-

Asia-Pacific: Fastest-growing region, supported by urbanization and infrastructure investments in India, Vietnam, and Indonesia. Local assembly hubs and distributor partnerships are improving competitiveness.

-

Latin America: Market recovery is driven by post-pandemic construction rebound in Brazil, Mexico, and Colombia. Demand centers on residential and commercial projects requiring portable, battery-powered tools.

-

Middle East & Africa: Growth opportunities tied to mega-projects such as Saudi Arabia’s Vision2030 and renewable energy expansions. Professional-grade tools are in demand for infrastructure and industrial diversification.

Market Trends

-

Smart tool integration: The ONE-KEY platform enables asset tracking, inventory management, and performance monitoring. In 2025, Milwaukee Tool expanded integration with Autodesk BIM 360 and Procore, enhancing digital compliance and productivity for contractors.

-

Sustainability focus: Initiatives include lithium-ion battery recycling, reduced packaging waste, and energy-efficient operations. These align with ESG-driven procurement standards in public and private infrastructure projects.

Growth Factors

-

Technological innovation: Features such as overload detection, auto-stop control, and torque optimization enhance safety and efficiency. The MX FUEL Cut-Off Saw, launched in 2024, reduced start-up times by 70% while eliminating emissions and noise compared to gas-powered tools.

-

Cordless adoption: High-capacity REDLITHIUM batteries and REDLINK overload protection drive preference for cordless systems, replacing corded, pneumatic, and gas-powered tools in professional environments.

Market Restraints

-

Premium pricing: Higher price points limit penetration in cost-sensitive regions such as Southeast Asia, Africa, and South America, where Makita, Bosch, and local brands capture greater DIY and mid-tier demand.

-

Supply chain disruption: Dependence on semiconductors and lithium cells has exposed vulnerabilities, particularly amid geopolitical tensions in Asia. Rising logistics and raw material costs remain challenges.

Opportunities

-

Expansion of ONE-KEY ecosystem: Growing integration into enterprise systems enhances compliance and reporting, positioning Milwaukee Tool as a preferred vendor for large infrastructure projects.

-

Emerging markets: Southeast Asia, Latin America, and Eastern Europe present strong growth prospects. Local assembly initiatives are expected to reduce pricing gaps and improve service responsiveness.

Competitive Landscape

The global market is moderately consolidated, led by Milwaukee Tool (TTI) and DeWalt (Stanley Black & Decker).

-

Milwaukee Tool: Holds ~19% share of the professional power tool segment. Strength lies in cordless innovation (M18, MX FUEL), digital ecosystem (ONE-KEY), and regional expansion. In May 2025, Milwaukee launched its Jobsite Systems Division to consolidate digital tools, energy storage, and connectivity.

-

DeWalt: Strong in North America retail and professional segments, leveraging its FlexVolt platform and Tool Connect™ ecosystem to compete with Milwaukee’s M18 line.

Other notable competitors include Bosch Power Tools, Makita Corporation, Hilti Group, Festool, Husqvarna, Snap-on, and Ryobi.

Product & End-Use Breakdown

-

By Product Type:

-

Power Tools (56.2% revenue, CAGR 10.4% through 2030)

-

Hand Tools

-

Accessories (batteries, blades, bits)

-

Outdoor Equipment

-

Storage & Safety Solutions

-

-

By End-Use Industry:

-

Construction (52% revenue share in 2024)

-

Manufacturing

-

Utility & Infrastructure

-

Others (DIY, Landscaping)

-

Recent Developments

-

March 2025: Milwaukee Tool expanded U.S. manufacturing and R&D capacity with new automation systems and warehouses to reduce lead times and support regional demand.

-

February 2025: ONE-KEY API capabilities expanded for integration with Procore, strengthening compliance and productivity tools for large contractors.