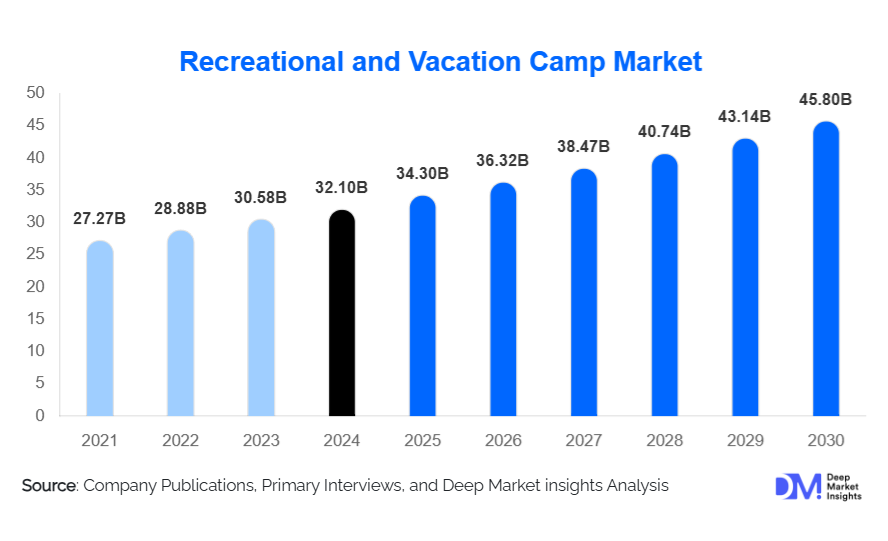

Global Recreational and Vacation Camp Market Set to Reach USD 45.8 Billion by 2030, Driven by Demand for Eco-Friendly and Tech-Enabled Stays

According to market insights, " The global recreational and vacation camp market, valued at USD 32.1 billion in 2024, is projected to expand from USD 34.3 billion in 2025 to USD 45.8 billion by 2030, registering a compound annual growth rate (CAGR) of 5.9%." Growth is fueled by increasing interest in outdoor leisure, wellness retreats, and digital detox experiences.

Market Overview

The recreational and vacation camp sector is undergoing transformation as travelers prioritize sustainable lodging, tech-enabled facilities, and flexible outdoor experiences. Demand for eco-conscious accommodations, wellness-integrated stays, and digital convenience is reshaping the industry. Online platforms have become the leading booking channel, while North America and Europe remain primary markets, with Asia-Pacific recording the fastest growth.

Emerging Trends

Premium Comfort and Culinary Experiences: Camping is shifting from basic lodging to luxury stays. According to Business Insider (March 2025), Gen Z campers now spend about USD 266 daily, embracing “glamping” with premium amenities. Operators such as KOA and Hipcamp are introducing Wi-Fi tents, air-conditioned cabins, spa pods, and gourmet dining options.

Community Conservation and Wild Camping: Purpose-driven camping models are gaining traction. In March 2025, UK platform CampWild partnered with Rewilding Britain to open sites in Cornwall, Scotland, Dorset, and Yorkshire. These stays combine low-cost camping with hands-on conservation activities like biodiversity monitoring, aligning travel with environmental stewardship.

Key Growth Factors

Tech-Enhanced RVs and Digital Campsites: Integration of solar panels, smart controls, and Wi-Fi boosters in RVs has expanded appeal to digital nomads and long-stay travelers. Campsites now offer app-based bookings, EV charging, and digital hubs, blending nature with connectivity.

Affordability and Tourism Impact: Camping continues to attract families, youth, and retirees as a cost-effective vacation option. The model also supports rural economies through spending on local services. Governments and tourism boards are promoting camp-based travel via infrastructure investment and marketing campaigns.

Restraints

Infrastructure Gaps and Zoning Restrictions: Many rural destinations lack broadband, reliable power, and sanitation, limiting the growth of tech-enabled campsites. Zoning hurdles and permitting delays, particularly in eco-sensitive areas, create barriers for new entrants. Smaller operators face difficulties upgrading facilities such as EV chargers and remote work zones.

Seasonal Demand Volatility: The sector remains heavily dependent on summer and holiday seasons. Off-peak utilization is low, creating financial strain for operators managing year-round facilities. Staff retention, inconsistent service levels, and weather variability also contribute to instability.

Opportunities

Design-Led, Eco-Aware Lodging: There is rising demand for accommodations like treehouses, glamping tents, and handcrafted cabins that integrate local materials, biophilic architecture, and renewable energy. These unique stays appeal to travelers seeking authenticity and aesthetic value.

Wellness-Oriented Nature Escapes: Campgrounds offering wellness elements—such as forest bathing areas, meditation spaces, and seasonal retreat programs—are positioned to capture experience-driven demand. Wellness integration enhances year-round market potential and supports premium pricing.

Market Insights by Segment

-

Accommodation Type: Demand is strongest for eco-conscious designs, followed by cabins, treehouses, campervan rentals, and pod-style lodging. Traditional tent camping maintains relevance but shows slower growth.

-

Distribution Channel: Online platforms dominate bookings, followed by direct website reservations and peer-to-peer mobile apps. High-quality visuals, social media integration, and user reviews make digital channels the most effective driver of demand.

Regional Insights

-

North America: The largest market, supported by wellness tourism, remote work culture, and a mature campground infrastructure.

-

Europe: Strong emphasis on sustainable camping, backed by regulatory frameworks and widespread campsite networks.

-

Asia-Pacific: Fastest growth, driven by a rising middle class, social media influence, and increasing road infrastructure.

-

Latin America: Emerging market supported by biodiversity tourism, backpacker demand, and localized camping services.

-

Middle East and Africa: Growth led by desert glamping, wildlife tourism, and luxury eco-conscious stays, though infrastructure gaps remain.

Competitive Landscape

The market remains fragmented, with contributions from RV manufacturers, outdoor gear companies, and specialized operators. Major players include Thor Industries, Winnebago Industries, The North Face, Patagonia, Yeti, Hipcamp, Tentrr, Under Canvas, Camplify, and Canopy & Stars.

Recent Developments

-

July 2025: Pebble launched the Pebble Flow EV Travel Trailer, featuring a 45-kWh battery, solar panels, and battery-assisted towing. Priced at USD 109,000–135,500, the model provides seven days of off-grid capability and luxury amenities.

-

July 2025: Camping World Holdings announced its Q2 financial results release for July 29, with a focus on sales performance, inventory updates, and digital initiatives.

Conclusion

The recreational and vacation camp market is expanding steadily, supported by eco-conscious lodging, wellness-driven demand, and digital convenience. However, infrastructure gaps and seasonal volatility remain challenges. With design-led stays and wellness integration emerging as key opportunities, operators and investors have significant scope to innovate and scale within this evolving sector.