Saudi Arabia Automotive Spare Parts Market Size, Share, Trends & Research Report, 2033 | UnivDatos

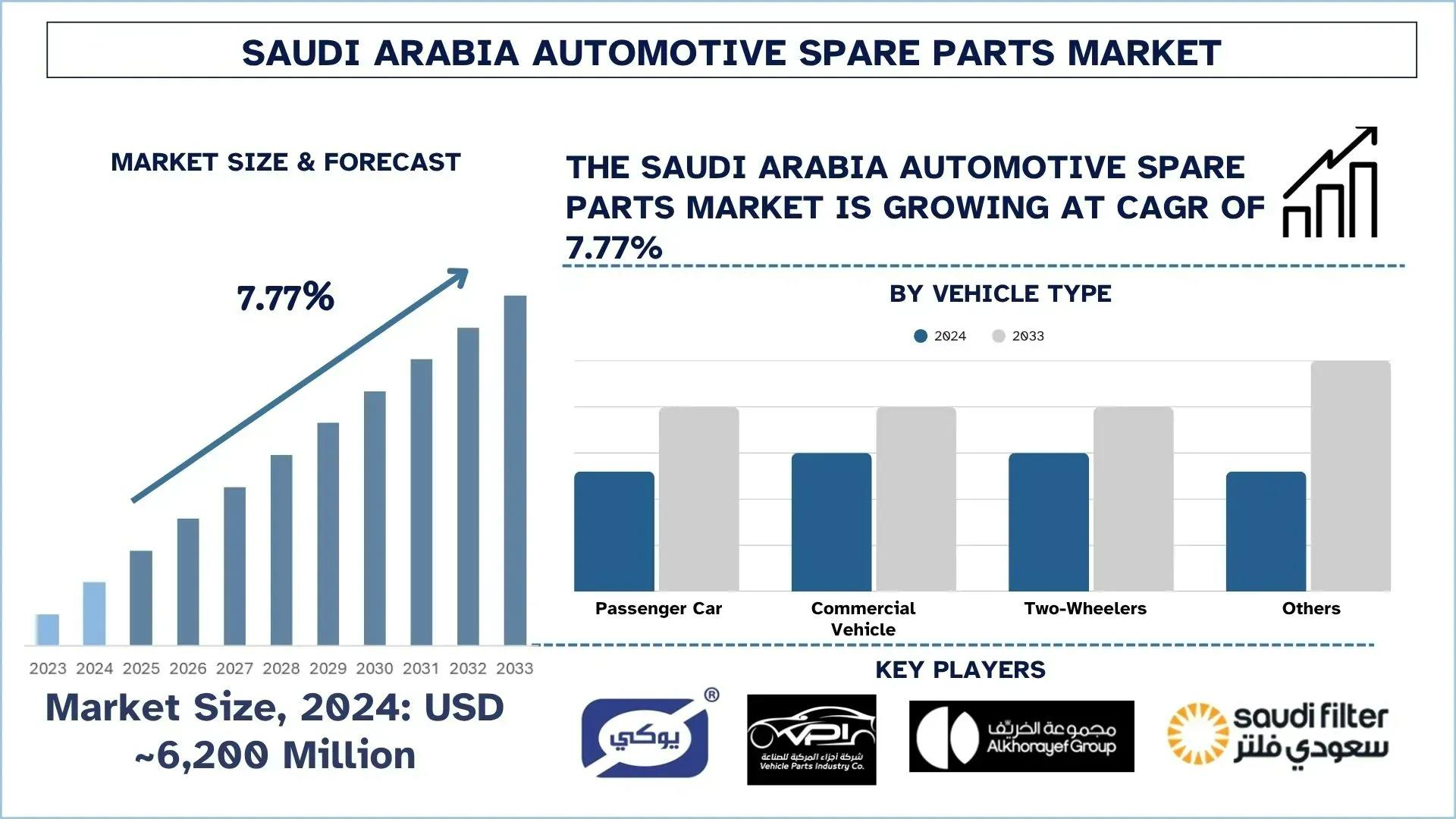

According to UnivDatos, the rising vehicle parc and aging fleet, growth in used car sales, Expansion of ride-hailing and logistics services, government support for local manufacturing (Vision 2030), and a Surge in e-commerce and digital platforms drive the Saudi Arabia Automotive Spare Parts market. As per their “Saudi Arabia Automotive Spare Parts Market” report, the market was valued at USD 6,200.00 Million in 2024, growing at a CAGR of about 7.77% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

The automotive spare parts market in Saudi Arabia is primarily focused on keeping cars on the road, but it is also an emerging industry driven by innovation, online adaptation, and financial commitment. Being one of the largest vehicle markets in the region, the Kingdom is experiencing a boom in demand for quality spare parts due to an emerging vehicle parc, vehicle age, and escalating consumer expectations. The industry is entering its new era of development as the change towards locally manufactured components and the emergence of digital distribution networks are influencing the industry.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/saudi-arabia-automotive-spare-parts-market?popup=report-enquiry

Innovation and Digital Acceleration

The automotive spare parts segment in Saudi Arabia is experiencing a dramatic change due to online platforms that ease the process of acquiring the products, price quotations, and deliveries. Also, companies are changing the model of the market, which entails splintered relations with vendors to centralized, digital marketplaces. These sites unite hundreds of suppliers, which means garages and consumers can compare parts, schedules, and prices, accelerating speed and increasing transparency. Meanwhile, major distributors are implementing AI to manage inventory and make more intelligent demand forecasts, thus decreasing time to delivery and stock windows.

On June 24, 2025, STV, the largest independent tech venture capital fund in the MENA region, announced a new investment in Morni, a leading Saudi platform offering tech-enabled automotive services. The investment comes from STV’s newly launched USD 100 million NICE Fund, reflecting strong confidence in Morni’s expanding vision.

As a roadside assistance provider, Morni is now transforming into a full-scale automotive ecosystem. Its services now include:

· Roadside assistance

· Vehicle auctions

· Insurance third-party administration

· A growing nationwide network of garages and spare parts dismantling centers

This expansion is powered by Morni’s in-house tech capabilities and a dedicated tech hub, helping the company deliver smart, seamless solutions across the entire vehicle ownership journey — benefiting drivers, insurers, and partners alike.

The market is also tilting towards telematics, collaboration, and partnership with distributors. The more vehicles connected, the more onboard diagnostic data will facilitate automated service notifications, posing a demand for smart tools in the realm of maintenance. This is particularly encouraging to fleet operators and ride-hailing companies, as part replacement that relies on predictive computation would improve the amount of time a company remains offline due to any of its parts. The increase will follow this in subscription-based maintenance models.

On February 29, 2024, Neweast joined forces with Isuzu Motors, unveiling their strategic partnership by opening a state-of-the-art dealership in the Kingdom of Saudi Arabia (KSA). This collaboration, symbolized by a February 23, 2024, signing ceremony, sets a new standard for innovation and leadership in automotive excellence. Neweast General Trading has been at the forefront of the automotive industry, catering to the increasing demand for high-quality and reliable aftermarket automotive spare parts.

Funding and Investment Guide

The automotive parts ecosystem is experiencing a surge in investments. Local manufacturing has been given priority through Vision 2030, and the government is encouraging local abilities through the National Industrial Development Center (NIDC). Clean Mobility Saudi Arabia announced plans to target an EV fleet penetration rate of 30% in its capital city of Riyadh by 2030. This forms part of the government’s recent pledge to reach net-zero emissions by 2060. The goal to boost EVs in Riyadh comes as more countries attempt to reduce or phase out internal combustion engines that run on gasoline and petrol. Saudi nationals have shown a strong appetite for owning EVs. Some of the companies that are increasing their local production prints include Alkhorayef Group and Vehicle Parts Industry Company (VPI).

This sector is also the target of private equity and venture capital companies. For example, companies raised funding to expand their B2B and B2C parts distribution networks. Logistics startups are also being supported in addressing the last-mile issue in parts supply, particularly in Tier 2 and Tier 3 cities, where availability has always been a blocker. On June 7, 2023, Autobia, a pioneering business-to-business (B2B) platform specialising in automotive aftersales and spare parts, raised USD 2.5 million in a seed funding round, spearheaded by Sadu Capital and supported by Wa’ed Ventures by Aramco, Raz Holding, Techstars, and a group of angel investors.

Click here to view the Report Description & TOC https://univdatos.com/reports/saudi-arabia-automotive-spare-parts-market

Advancing Toward a Digitally Integrated and Locally Driven Spare Parts Ecosystem

The automobile spare parts market in Saudi Arabia is undergoing significant changes due to the introduction of technology, a rise in national production, and strategic investments. Additionally, with digitization, the use of telematics, and Artificial Intelligence-powered inventory services, the way spare parts are supplied, shipped, and received is being transformed. With the backing of Vision 2030 and efforts by both the government and the business community, the market is gradually being transformed to rely more on itself and improve its operation. The current developments should make Saudi Arabia a major center of innovation and production in the automotive aftermarket within the region.

Related Report:-

Automotive Sprocket Market: Current Analysis and Forecast (2025-2033)

Automotive Aftermarket: Current Analysis and Forecast (2022-2028)

Automotive Chain Tensioner Market: Current Analysis and Forecast (2025-2033)

Indian Auto Components Market: Current Analysis and Forecast (2021-2027)

Automotive Starter Motor Market: Current Analysis and Forecast (2023-2030)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/