Saudi Arabia Fuel Station Market Size, Share, Trends & Research Report, 2033 | UnivDatos

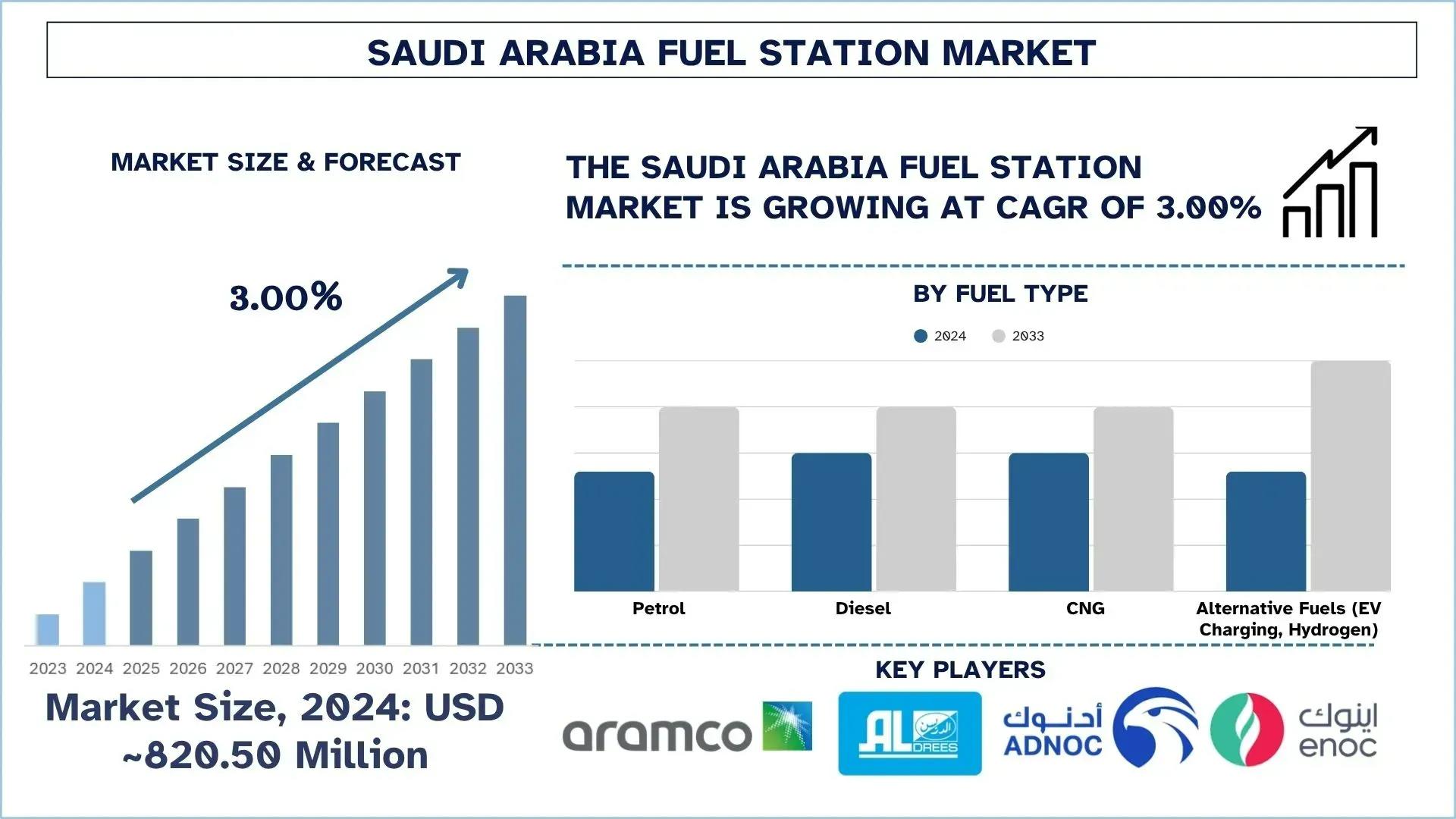

According to the UnivDatos, Government investment in infrastructure, growing vehicle ownership, tourism growth under Vision 2030, logistics and freight expansion, urbanization and population growth, integration of convenience retail, and adoption of alternative fuels drive the Saudi Arabia Fuel Station market. As per their “Saudi Arabia Fuel Station Market” report, the market was valued at USD 820.50 Million in 2024, growing at a CAGR of about 3.00% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

The fuel station market in Saudi Arabia is undergoing a radical change. The traditional petrol pumps are becoming smart and multifunctional energy centers. Vision 2030 is facilitating the diversification of the economy, and the industry is turning to digitalization, alternative resources, and business models. The traditional fuel infrastructure and EV-charging networks are in the process of receiving investment, and the situation is competitive.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/saudi-arabia-fuel-station-market?popup=report-enquiry

Funding and Fuel-Tech Innovation

The country of Saudi Arabia is experiencing a wave of both private and institutional investments occasioned by modernization in the fuel retail sector. The companies are also concentrating on incorporating digital payment solutions, smart fuel management, and predictive analytics to improve their operational efficiencies. The innovations are time-saving in transactions, enhance fleet management, and also appeal to tech-savvy buyers. The investing tendency can also be observed in the oil giants and technology providers' partnerships as the shift to the technology-powered energy ecosystem emerges.

On June 30, 2025, Jadwa Investment, a leading investment management and advisory firm in the Middle East, announced it had led a USD 50 million investment round in PetroApp, Saudi Arabia’s leading fuel management platform, through its flagship blind-pool vehicle, Jadwa GCC Diversified Private Equity Fund. Bunat Ventures, a regional venture capital firm, also participated in the round.

On June 24, 2023, Aramco and TotalEnergies awarded Engineering, Procurement, and Construction (EPC) contracts for the USD 11 billion "Amiral" complex, a future world-scale petrochemicals facility expansion at the SATORP refinery in the Kingdom of Saudi Arabia. This expansion is expected to attract more than $4 billion in additional investment in a variety of industrial sectors (carbon fibers, lubes, drilling fluids, detergents, food additives, automotive parts, and tires) and create around 7,000 direct and indirect jobs in the country.

EV-Charging Revolution

The deployment of EV-charging stations in urban areas and on highways should be a critical pillar of transformation. This goal aims at a substantial increase in EV penetration by 2030, set by the government, which drives operators to equip existing and new stations with fast-charging capability. These charging stations are installed in heavily traveled corridors, retail districts, and service centers so that early EV users can find convenience. The approach does not just expand the sources of revenue of station owners only, but it also supports the Kingdom in its efforts toward decarbonization.

On 23 March 2025, EVIQ, Saudi Arabia’s leading EV infrastructure provider, inaugurated its first highway EV charging station located at SASCO Aljazeera on the Riyadh-Qassim highway. This expansion forms part of a broader strategy to establish a comprehensive, nationwide EV charging network that will facilitate long-distance travel and stimulate the adoption of electric mobility across Saudi Arabia.

This significant milestone marks the first of many highway stations that are part of EVIQ’s rollout plan to cover KSA, and its commitment to deploying more than 5,000 fast chargers by 2030, and its continuous efforts to provide reliable, accessible, and high-performance charging solutions that align with the sustainability goals of the Kingdom’s Vision.

OEM Moves & EV Entry

Car companies are also making an entry into Saudi Arabia by introducing new variants of electric vehicles and strategic partnerships. By partnering with local companies, global EV players will be able to provide service, distribution, and after-sales services to customers, and guarantee them platforms to use in terms of vehicles and supporting infrastructures. The increased presence of OEMs facilitates the entire electrification ecosystem and inspires consumers to transition to sustainable means of moving over the coming decade.

On Apr 13, 2025, Tesla officially launched in Saudi Arabia, marking a new chapter in the company's global expansion after Elon Musk's troubled relationship with the kingdom, but the Middle East country's extreme heat could pose a challenge for its electric vehicle performance and battery efficiency.

Musk and Saudi Arabia have had a complicated history. Back in 2018, the Tesla CEO claimed he had secured funding from the kingdom's sovereign wealth fund to take the company private. That deal never happened, leading to lingering tensions.

Click here to view the Report Description & TOC https://univdatos.com/reports/saudi-arabia-fuel-station-market

Powering the Future: Beyond Fuel to Full-Service Energy Hubs

The Saudi fuel station market is transitioning toward a multi-dimensional energy and retail ecosystem away from the traditional fueling market. Furthermore, innovative technologies, EV infrastructure, and convenience services are reshaping the value proposition in the industry. That is no longer merely selling fuel, but what is becoming increasingly important is ensuring that they provide energy in all forms, coupled with the creation of an integrated customer experience. Those operators who are open to this hybridization of digitization, sustainability, and diversified services will be the source of the next wave of expansion in the energy transformation landscape of the Kingdom.

Related Report:-

Hydrogen Fuelling Station Market: Current Analysis and Forecast (2023-2030)

Natural Gas Refueling Stations Market: Current Analysis and Forecast (2023-2030)

Middle East Hydrogen Fuelling Station Market: Current Analysis and Forecast (2022-2030)

Hydrogen Fuel Cell Electric Vehicle Market: Current Analysis and Forecast (2023-2030)

Hydrogen IC Engine Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/