Vietnam Loan Market Size, Share, Trends & Research Report, 2033 | UnivDatos

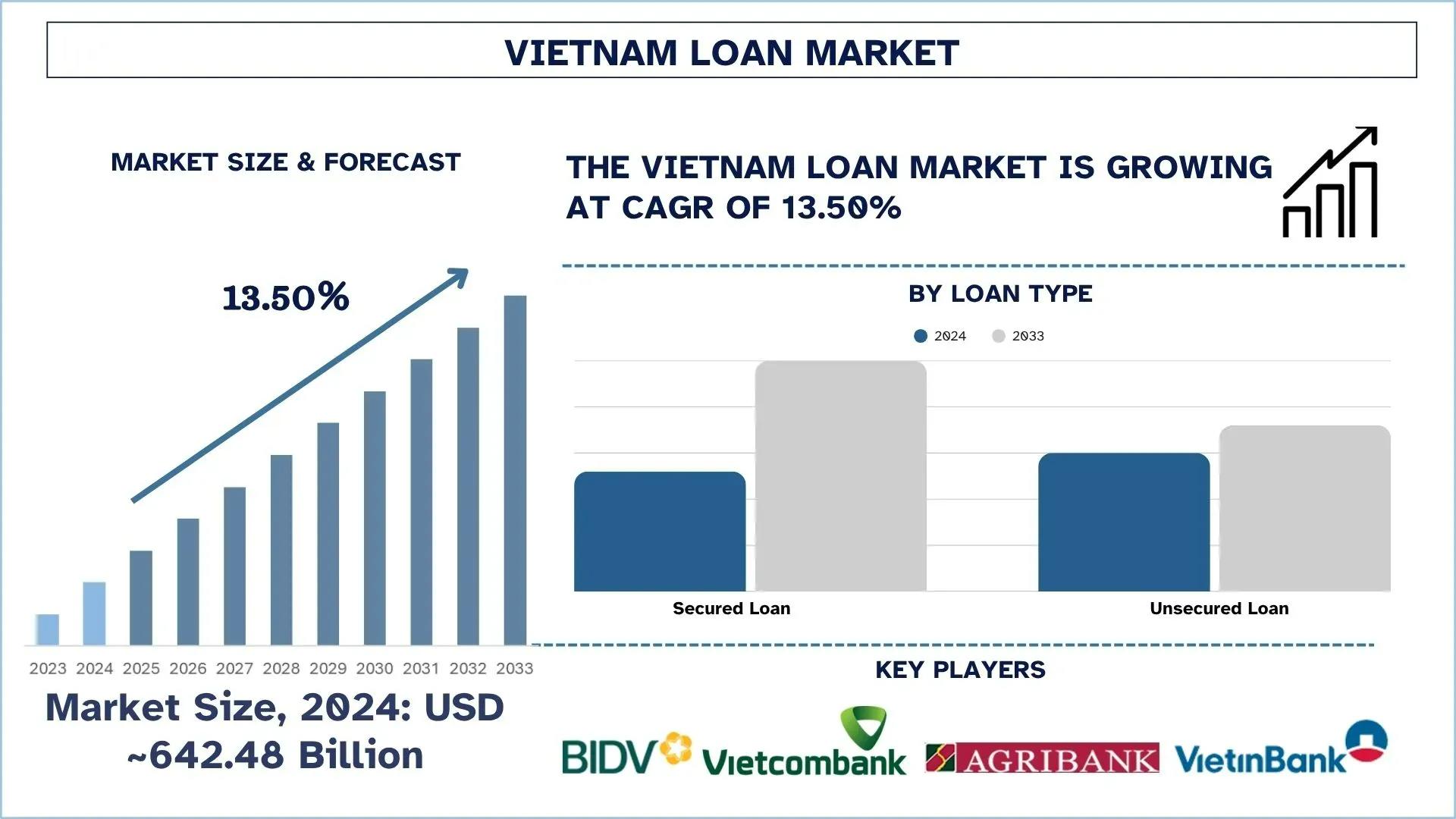

According to the UnivDatos, rising disposable income and middle-class growth, government push for financial inclusion, rapid urbanization and housing demand, expanding SME sector, digital transformation in banking, low banking penetration in rural areas, and a young demographic profile are driving the Vietnam Loan market. As per their “Vietnam Loan Market” report, the Vietnam market was valued at USD ~642.48 billion in 2024, growing at a CAGR of about 13.50% during the forecast period from 2025 - 2033 to reach USD billion by 2033.

In Vietnam, the financial sector is undergoing a period of significant transformation, as two key drivers are emerging: the growth of green financing and an increasing number of SME loans. These developments present enormous lending and investment opportunities to interested parties who are keen on leveraging the country's fast-growing economy and the growing belief in sustainable development among its people.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/vietnam-loan-market?popup=report-enquiry

Green Financing: Harmonizing the Sustainability and Growth

The growth of green financing in Vietnam has undergone advances towards achieving its environmental and climate targets. Government's effort to achieve net-zero emissions by 2050 has prompted financial institutions to develop products that finance renewable energy projects, energy-efficient buildings, and sustainable infrastructure. Additionally, green loans offer companies and individuals affordable financing to support green projects, including solar installations, eco-friendly homes, and low-carbon transportation.

The Vietnam green finance initiative is also supported through credit lines and technical advice being offered to local banks by international investors and multilateral organizations. These initiatives are also used to fill the financing gap of the green projects that are capital-friendly.

For example,

· On August 28, 2024, Vietnam’s central bank announced changes to its sustainable banking framework in a bid to boost access to green credit for companies, in a fast-growing Asian economy that is seeking to wean itself off coal and ramp up renewable energy production.

· On July 31, 2024, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) and the French Agency for Development in Vietnam (AFD Vietnam) signed a €50 million (USD 58.83 million) climate credit line agreement. This new funding will support projects focused on climate change mitigation, adaptation, and sustainable development.

· In June 2022, DFDL was honored by LegalOne for its key role in a historic deal to secure cross-border financing for a solar energy farm in Vietnam – the country’s first-ever “Green loan.” Members of DFDL’s Energy, Mining and Infrastructure practice acted as legal counsel in Vietnam for B.Grimm Power Plc, which secured a USD 186 million loan from the Asian Development Bank (“ADB”) and other key lenders, and its Vietnamese subsidiary Phu Yen TTP Joint Stock Company.

SME Financing: A Way to Economic Potential

The Small and Medium Enterprises (SMEs) constitute more than 95% of Vietnamese businesses and contribute immensely to employment and GDP. Nevertheless, these businesses are facing great challenges regarding accessibility to affordable financing. SMEs often find it challenging to access timely loans, as traditional banks typically favor using collateral and lengthy credit assessment procedures.

This situation has created an essential opportunity for non-banking financial companies (NBFCs) as well as fintech lenders. The digital platforms also provide a quick turnaround in loan processing, reduced documentation, alternative credit scoring criteria such as transactional history, and virtual behavior. A government-sponsored lending and credit guarantee program is an additional means to boost lending to SMEs and make lending risk-free for financial institutions, thereby allowing businesses to expand. On April 26, 2024, the Government of Vietnam issued Decree 45/2024/NĐ-CP, which amends Decree 39/2019/NĐ-CP of May 10, 2019, on the organization and operation of the country’s Small and Medium-Sized Enterprise Development Fund (SME Fund). The aim of the new decree is to generate broader economic benefits under the SME Fund.

On 12 June 2024, the Asian Development Bank (ADB) and Lien Viet Post Joint Stock Commercial Bank (LPBank) signed a financing package of up to USD 80 million to expand access to finance for a women-owned small and medium-sized enterprises (WSMEs) project in Viet Nam.

The Convergence: Green loans to SMEs

The trend in Vietnam is the combination of green financing and SME lending. Most of the small enterprises in the manufacturing, agronomic, and retailing sectors have been trying to go green but have limited access to green funds, and thus have not been able to do so. This gap can be filled when banks and NBFCs provide specialized green loan products to the SMEs so that they can invest in energy-efficient equipment, renewable energy options, and greener production processes. The combination is a win-win situation precisely because SMEs take a lower-cost operating model with a reduced environmental footprint; in parallel, lenders cultivate a distinct loan book at the same time as pursuing ESG goals.

Click here to view the Report Description & TOC https://univdatos.com/reports/vietnam-loan-market

Shaping the Future of Loans in Vietnam

The future would rely on the sustainable management of the economy in Vietnam, and the financial sector is the core of the transformation. Furthermore, technology enables financial institutions to offer customized green products and develop SME-oriented solutions, as it helps financial organizations establish a competitive edge in this evolving market. The combination of green financing and SME lending should be viewed not only by investors and enterprises as a growth process, but also as a road towards long-term resilience and global competitiveness.

Related Report:-

India Personal Loan Market: Current Analysis and Forecast (2025-2033)

Micro Lending Market: Current Analysis and Forecast (2022-2028)

India Buy Now Pay Later Market: Current Analysis and Forecast (2025-2033)

India Fintech Market: Current Analysis and Forecast (2024-2032)

Neo Banking Market: Current Analysis and Forecast (2023-2030)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/