Vietnam Pharmacy Retail Market Size, Share, Trends & Research Report, 2033 | UnivDatos

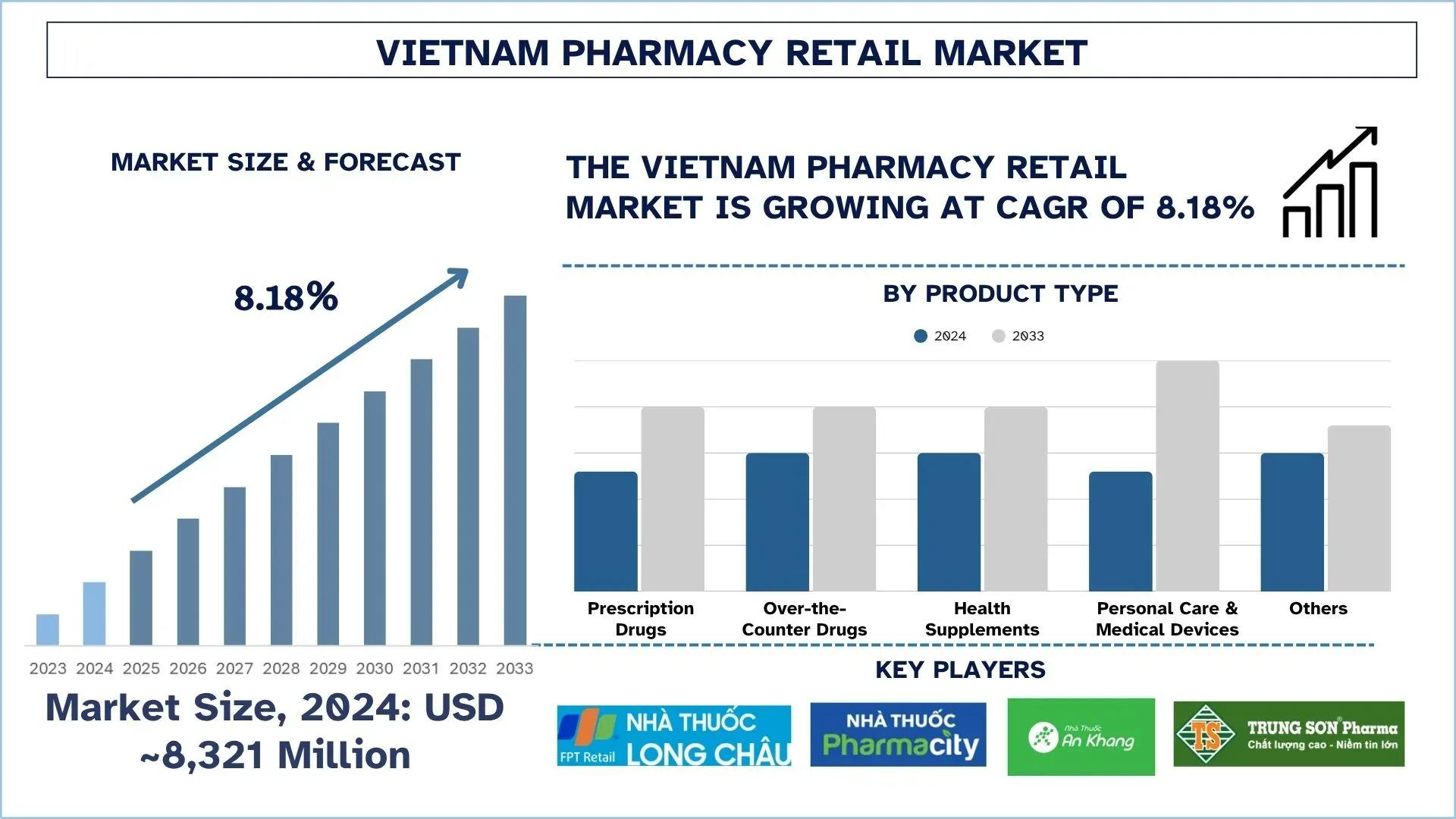

According to the UnivDatos, rising healthcare awareness, growing prevalence of chronic diseases, rapid urbanization, higher disposable income, expansion of organized pharmacy chains, government push for digitalization, and e-prescriptions are driving the Vietnam Pharmacy Retail market. As per their “Vietnam Pharmacy Retail Market” report, the Vietnam market was valued at USD ~8,321 million in 2024, growing at a CAGR of about 8.18% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The Vietnamese pharmacy retailing market is experiencing a transition at a high rate due to changes in regulations and technological advancements. The e-prescriptions mandate of the government is changing the face of pharmacies, and the industry is shifting to the digital world and more efficient practices. Meanwhile, increasing investment in large companies and private equity groups further enhances the move towards organized chains at the expense of traditional stores. This combination of policy and capital is predetermining a new experience in modern pharmacy retailing in Vietnam.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/vietnam-pharmacy-retail-market?popup=report-enquiry

Digital Health Revolution: The E-Prescription Mandate

On July 7, 2025, the Ministry of Health of Vietnam announced an extended deadline, requiring all hospitals nationwide to switch to using electronic prescriptions (e-prescriptions) by October 1, marking the third extension of the requirement and resulting in further prolonged delays. The requirement is included in a new circular that contains regulations of outpatient treatment prescriptions and the use of chemical drugs and biologicals, and came into force on July 1, 2025. According to the circular, hospitals must fully implement the e-prescribing system by October 1, 2025, and other healthcare institutions, including clinics and individual practices, by January 1, 2026.

This regulatory step is an update that goes beyond compliance it is a transformational step. E-Prescriptions remove the threats of human error, stop prescription fraud and simplify information assimilation amongst doctors, pharmacies and insurance companies. In the case of pharmacies, this shift is associated with updating systems, use of secure software, and education of the employees on how to work with digital procedures.

Why It Matters for Pharmacy Retail Chains

The e-prescription requirement is a good fit for the digital-first plans of organized players, such as Pharmacity, FPT Long Chau, or An Khang. The chains are already operating sophisticated POS systems, online ordering applications, and inventory automation; therefore, greater integration will not be required compared to thousands of individual stores that continue to use paper-based systems.

What this implies is consolidation. Smaller, independent pharmacies, which could not afford to pay high digital update prices, would be defeated by giant chains that offer convenience, compliance, and the use of technology in their services. The advantages to consumers stand clear: improved quality in terms of speed of service, reduced time spent waiting, and better prescription monitoring.

Investments Are Flowing In

Vietnam’s pharmacy retail used to be a disparate business, but now it’s real money. As the industry reports have suggested, the organized chains are being perceived as big bets by the private equity players as well as corporate investors. In June 2021, SK Group invested USD 100 million in Vietnam's largest pharmacy chain, Pharmacity, as part of the South Korean conglomerate's efforts to tap into the fast-growing retail and healthcare markets in Southeast Asia. SK Group, South Korea's third-largest business group, is now reviewing the detailed terms of an investment in Pharmacity, according to investment banking sources.

Collaborations are also transforming the landscape. On November 13, 2023, Pharmacity partnered with Fundiin to introduce a Buy Now Pay Later (BNPL) solution, marking a significant step toward financial flexibility for consumers. With nearly 1,000 outlets, Pharmacity’s integration of BNPL not only boosts affordability but also builds trust, offering interest-free pay-later options. Likewise, foreign demand is on the increase as healthcare expenditure in Vietnam aligns with international retail trends. The fact that the country has digital infrastructure and health awareness, combined with investor appetite, is an indication that Vietnam is about to experience a retail health boom.

Click here to view the Report Description & TOC https://univdatos.com/reports/vietnam-pharmacy-retail-market

Shaping the Future of Pharmacy Retail in Vietnam

The transition to e-prescriptions and a high level of investment drive promise a new age of digitization of the pharmaceutical retail market of Vietnam. Structured chains will be taking the lead as technology can play a major role in raising compliance, efficiency, and customer experience. The future of smaller independents is not an easy one, but as the big picture goes, modernization and innovativeness will be the key elements that set the market leaders. It is time for businesspeople and investors to take advantage of the changing healthcare retail environment in Vietnam.

Related Report:-

Pharmacy Market: Current Analysis and Forecast (2022-2028)

Pharmaceutical Management System Market: Current Analysis and Forecast (2022-2028)

Compounding Pharmacies Market: Current Analysis and Forecast (2024-2032)

GCC E-Pharmacy Market: Current Analysis and Forecast (2021-2028)

e-Pharmacy Market: Current Analysis and Forecast (2021-2027)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/