Ethylene Market Growth, Size, Analysis, Trends And Forecast to 2028

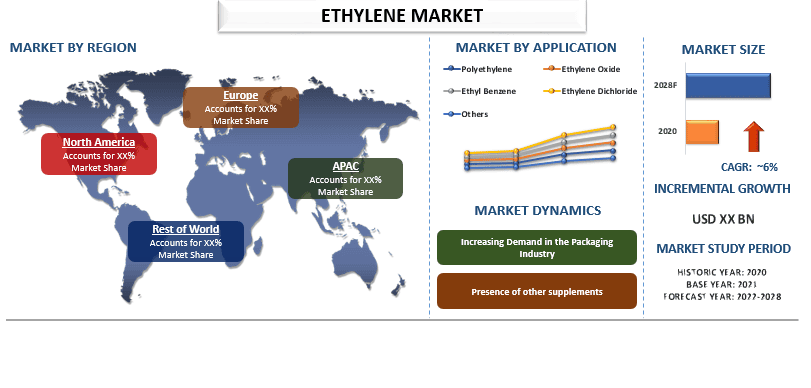

The Global Ethylene Market is projected to reach USD 218.73 billion by 2030, growing at a CAGR of nearly 6%, according to a new report by UnivDatos. Ethylene, one of the most widely used petrochemicals, continues to see strong demand across industries including packaging, construction, automotive, and electronics.

Market Overview

Ethylene is a key raw material in the production of polyethylene and other derivatives widely used in consumer and industrial goods. The rising consumption of low-density polyethylene (LDPE), known for its flexibility, corrosion resistance, and non-toxic properties, is a major growth driver. LDPE is increasingly used in packaging films, garbage bins, floor tiles, mailing envelopes, and dropper bottles. Its electrical insulating properties have also boosted demand across industries.

The packaging sector is one of the biggest contributors to market growth, supported by the global expansion of organized retail, branding, and e-commerce. With polyethylene being a primary packaging material, ethylene demand is rising steadily.

Market Segmentation

Based on applications, the ethylene market is segmented into:

- Polyethylene (HDPE & LDPE)

- Ethylene Oxide

- Ethyl Benzene

- Ethylene Dichloride

- Others

Among these, LDPE is expected to witness the highest adoption due to its widespread use in films and sheets for packaging. LDPE’s lightweight and durable nature also make it suitable for tubes, vessels, dosing bottles, and laboratory equipment.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/ethylene-market?popup=report-enquiry

Key Growth Drivers

- Expanding packaging industry fueled by retail and e-commerce growth.

- Rising demand for PET fibers, bottles, and packaging materials.

- Increased construction activities driving PVC usage.

- Strategic investments and alliances across the ethylene value chain.

Strategic Investments and Developments

The ethylene industry has seen several major investments in recent years:

- ExxonMobil & SABIC (2018): Announced construction of the world’s largest ethylene plant with an investment of USD 1.4 billion.

- Braskem (July 2023): Increased production capacity of its bio-based ethylene plant in Brazil by 30%, with an investment of USD 87 million to meet global demand for sustainable products.

- Shell (November 2022): Began operations at its new polymer plant in Pennsylvania with an annual capacity of 1.6 million tonnes of polyethylene, expected to reach full capacity by mid-2023.

These developments reflect growing demand in emerging markets, especially China, where rising middle-class consumption and infrastructure development are driving ethylene adoption.

Sustainability Trends in Ethylene Production

Sustainable ethylene production is gaining momentum as industries and governments emphasize carbon reduction. Renewable energy sources such as wind, solar, and biomass are increasingly being utilized for ethylene production. Bio-ethylene, derived from biomass but chemically identical to conventional ethylene, is gaining traction as a greener alternative.

Currently, Brazil and India operate the first bio-ethylene plants, accounting for about 0.3% of global capacity, with production reaching up to 200 kilotons annually. China and other regions are also planning large-scale bio-ethylene plants, highlighting strong growth prospects for the biopolymer market.

Conclusion

With global production exceeding 140 million tons annually, ethylene remains the world’s largest bulk chemical. Its dominance in plastics manufacturing, coupled with rising demand in packaging, automotive, and construction, ensures steady market growth. As sustainability trends accelerate, the shift toward bio-ethylene and renewable-based production will play a pivotal role in shaping the future of the industry.

The combination of rising demand from emerging economies, packaging innovations, and sustainable production technologies positions the global ethylene market for substantial growth in the years ahead.

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com