How More Crypto Holders Are Taking Control of Their Keys?

In the wake of high-profile exchange collapses and escalating regulatory scrutiny, the crypto community is witnessing a powerful resurgence of an old idea: true self-custody. While the allure of convenience once pushed many traders to trust centralized exchanges with their assets, recent failures have made it painfully clear that trusting third parties can be a costly mistake. As we move deeper into 2025, more crypto enthusiasts are returning to Bitcoin’s original promise financial freedom through self-sovereignty.

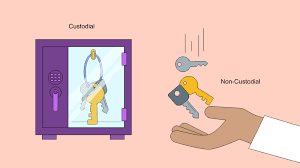

This shift has transformed how users research storage options. While debates rage on Reddit and Twitter about the best bitcoin wallet, one thing is becoming universal: people want full control over their keys and funds. Non-custodial wallets are no longer just for die-hard cypherpunks; they’ve become essential for anyone serious about securing their assets against hacks, mismanagement, or sudden exchange bankruptcies.

Why Centralized Exchanges Lost Trust?

To understand the self-custody boom, we need to revisit the repeated failures that fueled it. Back in the early 2010s, Mt. Gox famously lost over 850,000 bitcoins due to poor security and internal fraud. Many thought the industry had learned its lesson. Then came 2022: FTX, once the world’s second-largest crypto exchange, collapsed practically overnight, freezing billions in user deposits. Users worldwide learned the harsh truth if you don’t control your private keys, your coins are never really yours.

These incidents didn’t just damage investor portfolios; they shattered trust in centralized intermediaries. According to a 2024 report by Chainalysis, more than 30% of crypto holders now use self-custody wallets exclusively up from just 8% in 2021. It’s not just about risk mitigation; it’s about aligning with the ethos of decentralization.

The New Face of Self-Custody

Fortunately, self-custody tools have matured dramatically over the past few years. Gone are the days when managing your own keys required deep technical knowledge and a tolerance for command-line tools. Today’s leading wallets prioritize user-friendly design, mobile-first access, and robust security layers.

Key developments include:

-

Multi-Signature Security: Users can require multiple devices or people to sign off on transactions, dramatically reducing the risk of single-point failure.

-

Biometric Authentication: Many mobile wallets now integrate fingerprint or facial recognition, offering secure yet intuitive access.

-

Social Recovery: If a user loses access to their wallet, trusted contacts can help recover it—without handing over full control.

These advancements have turned self-custody into a practical choice for everyday investors, not just hardcore technologists.

How DeFi Fuels the Trend?

The explosive growth of decentralized finance (DeFi) has also pushed more users toward non-custodial wallets. Popular DeFi apps like Uniswap, Aave, and Compound require users to connect directly with their wallets to trade, lend, or borrow crypto. There’s no middleman holding your funds; smart contracts execute everything automatically.

This means that anyone hoping to tap into DeFi’s yields or liquidity pools must understand self-custody basics. According to DappRadar’s 2024 industry overview, DeFi smart contract usage grew by 45% year-over-year, while centralized exchange volumes shrank by nearly 20% during the same period. The message is clear: users want more control and fewer intermediaries.

Mobile-First Custody: Convenience Without Compromise

One major catalyst for self-custody adoption is the rise of powerful mobile wallets. These apps put a fully functional crypto vault right in your pocket. Compared to clunky desktop solutions of the past, today’s mobile wallets offer easy backups, hardware wallet integrations, and real-time portfolio tracking.

This convenience has changed user expectations. Whether swapping tokens on the go, staking coins directly from their phone, or scanning QR codes for payments, holders demand security without sacrificing usability. Developers are responding with streamlined onboarding, educational prompts, and features like in-app phishing detection.

Common Mistakes to Avoid When Going Non-Custodial

While self-custody empowers users, it also comes with serious responsibility. Without a recovery phrase or backup plan, a lost wallet can mean lost assets forever. Here are a few rookie mistakes every holder should watch for:

-

Ignoring Backups: Always store your recovery phrase offline, preferably in multiple secure locations.

-

Falling for Phishing: Scammers often impersonate wallet providers or support teams. Never share your seed phrase—ever.

-

Neglecting Updates: Keep your wallet software up to date to benefit from the latest security patches and features.

-

Overlooking Multi-Factor Security: If your wallet supports multi-sig or hardware wallet integration, use it. Redundant security beats regret.

Education is just as vital as technology. Even the best wallets can’t protect users who don’t follow basic best practices.

Regulation: Friend or Foe for Self-Custody?

Governments worldwide are scrambling to regulate crypto, but self-custody remains a thorny area. Some policymakers argue it enables illicit activity; others see it as a cornerstone of personal freedom. In the EU and parts of Asia, new proposals would require wallet providers to comply with stricter identity checks, even for non-custodial solutions.

However, the crypto industry is pushing back. Organizations like Coin Center and the Electronic Frontier Foundation argue that restricting self-custody is tantamount to banning private ownership of cash. The next few years will likely see an intense tug-of-war between regulators aiming for oversight and users defending financial privacy.

The Path Ahead: Self-Custody as a Default

All signs point to self-custody moving from an optional best practice to the default standard. It’s not just about avoiding another FTX disaster it’s about realizing crypto’s original vision: censorship-resistant, permissionless money.

To thrive in this new era, crypto users must become their own banks in the truest sense. The good news? They’re not alone. Modern wallets, educational resources, and decentralized protocols are making it easier than ever to stay safe while staying sovereign.

So whether you’re a seasoned holder or just getting started, one principle stands strong: your keys, your coins. And that might be the most important lesson the crypto community has learned one wallet at a time.