India Electric Motor Market Outlook 2025–2034

The electric motor industry in India is entering a transformative growth phase, supported by rapid industrialization, electrification, and the rising adoption of electric vehicles. In 2024, the market size stood at around INR 118.30 billion, and projections suggest that it will nearly triple to INR 335.90 billion by 2034, expanding at a healthy CAGR of 11% between 2025 and 2034.

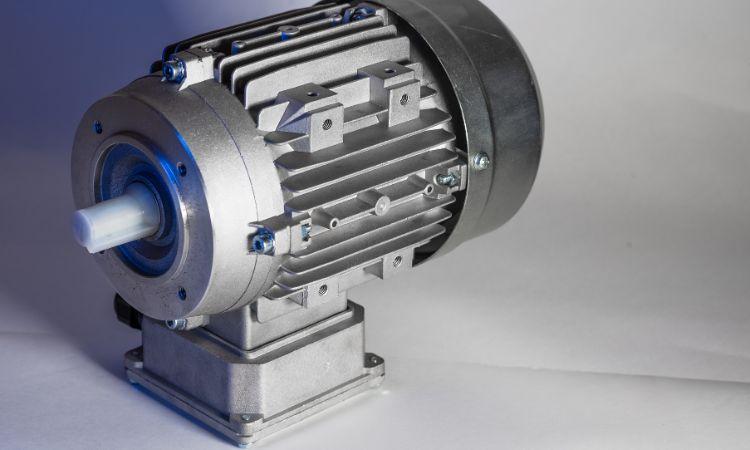

Electric motors are the backbone of modern industry, powering everything from household appliances to large-scale manufacturing plants. With the Indian government’s strong push toward renewable energy, electric mobility, and industrial automation, the demand for efficient, high-performance motors is expected to climb sharply in the coming decade. This blog explores the segmentation, regional dynamics, competitive landscape, and future trends shaping India’s electric motor market.

Market Segmentation by Type

AC Motors

AC motors dominate the Indian market due to their versatility and widespread application across residential, commercial, and industrial segments. They are commonly used in fans, pumps, compressors, and HVAC systems. As industries adopt automation and as energy-efficient appliances gain popularity, demand for advanced AC motors is expected to rise further.

DC Motors

DC motors are gaining traction, especially with the government’s ambitious EV adoption targets. Their ability to provide high starting torque and speed control makes them ideal for electric vehicles, robotics, and precision machinery. With India positioning itself as a global EV manufacturing hub, the demand for DC motors will continue to accelerate.

Others

Beyond AC and DC motors, emerging technologies such as brushless motors and stepper motors are carving out niche applications in electronics, aerospace, and medical devices. These specialized motors are expected to expand their footprint as India advances in high-tech sectors.

Market Segmentation by Voltage

Low Voltage

Low-voltage motors are widely used in small appliances, domestic electronics, and light commercial machinery. India’s growing middle-class population and the surge in household appliance consumption ensure a steady rise in this segment.

Medium Voltage

Medium-voltage motors find applications in manufacturing, processing, and construction. Infrastructure projects and industrial growth across India are expected to drive significant demand in this segment.

High Voltage

High-voltage motors are crucial for heavy-duty operations in mining, power plants, and oil & gas. As India continues investing in energy infrastructure and large-scale projects, the market for high-voltage motors is set to expand steadily.

Market Segmentation by Rated Power

Fractional Horsepower Motors

These motors are commonly found in small appliances such as washing machines, fans, and other consumer goods. With urbanization and rising disposable incomes, demand for fractional horsepower motors is growing rapidly.

Integral Horsepower Motors

Integral horsepower motors, capable of handling heavy-duty applications, are essential in industrial machinery, pumps, and compressors. Their adoption is expected to increase with the expansion of India’s manufacturing base and smart factories.

Market Segmentation by Weight

-

Lightweight Motors: Used in electric vehicles, drones, and portable devices. The booming EV market makes lightweight motors one of the fastest-growing categories.

-

Heavyweight Motors: Essential for large machinery and industrial use, they remain the backbone of energy and infrastructure projects.

Market Segmentation by Speed

-

Low-Speed Motors: Suitable for applications requiring heavy torque, such as conveyors and crushers.

-

High-Speed Motors: Critical for EVs, automation, and compressors, these motors are in high demand as industries shift toward high-performance applications.

Market Segmentation by Magnet Type

Permanent Magnet Motors

These motors are known for their efficiency and compact design, making them highly sought after in EVs, renewable energy equipment, and advanced appliances. Their popularity is expected to grow in line with India’s clean energy initiatives.

Non-Permanent Magnet Motors

Non-permanent magnet motors continue to dominate traditional industries due to their cost-effectiveness. They are widely used in pumps, fans, and industrial systems.

Market Segmentation by Application

-

Automotive: Electric and hybrid vehicles are driving unprecedented demand for motors, with India emerging as a key EV production hub.

-

Industrial: Robotics, automation, and machinery use are boosting demand for powerful and efficient motors in factories.

-

Residential: Home appliances, HVAC systems, and consumer electronics ensure steady consumption.

-

Energy: Motors play a vital role in renewable power generation, especially in wind and solar systems.

-

Others: Sectors like aerospace, defense, and healthcare are adopting advanced motor technologies for specialized uses.

Market Segmentation by End Use

-

Residential: Driven by appliance adoption and urban household demand.

-

Commercial: Offices, retail spaces, and hospitality sectors require motors for HVAC and equipment.

-

Industrial: The largest segment, fueled by automation, smart factories, and industrial upgrades.

-

Utilities and Infrastructure: Growth driven by power generation, water management, and construction.

Regional Analysis

North India

The northern states are witnessing growth in automotive hubs and infrastructure projects. With Delhi-NCR emerging as a center for EV innovation, the region is set to become a key market.

South India

Known for its IT, electronics, and automobile manufacturing, South India (particularly Tamil Nadu and Karnataka) is at the forefront of electric motor adoption, especially in EVs and industrial automation.

West India

Maharashtra and Gujarat lead in industrial manufacturing and automotive production. With significant investments in EV and renewable energy projects, western India holds a dominant share of the market.

East India

Though relatively underdeveloped compared to other regions, East India is seeing rising demand in mining, energy, and infrastructure, opening up opportunities for motor manufacturers.

Competitive Landscape

The Indian electric motor market is highly competitive, with domestic manufacturers and international players both vying for market share. Companies are focusing on innovation, energy efficiency, and localization to gain an edge. Government initiatives like “Make in India” and PLI (Production-Linked Incentive) schemes are encouraging manufacturers to scale operations locally. Strategic collaborations, R&D investments, and expansion into EV-specific motor production are shaping the competitive landscape.

Key Trends and Developments

-

EV Boom: The rise of electric vehicles is the single biggest growth driver for DC and permanent magnet motors.

-

Energy Efficiency: Demand for motors that consume less power and align with India’s energy-saving standards is increasing.

-

Renewable Energy Integration: Motors used in solar and wind projects are expanding their share.

-

Automation and Industry 4.0: Adoption of smart motors in robotics and manufacturing is picking up pace.

-

Government Policies: Supportive initiatives for electric mobility and renewable energy continue to boost market confidence.