Urea Formaldehyde Market Trends, Growth, and Forecast 2025-2033

Market Overview:

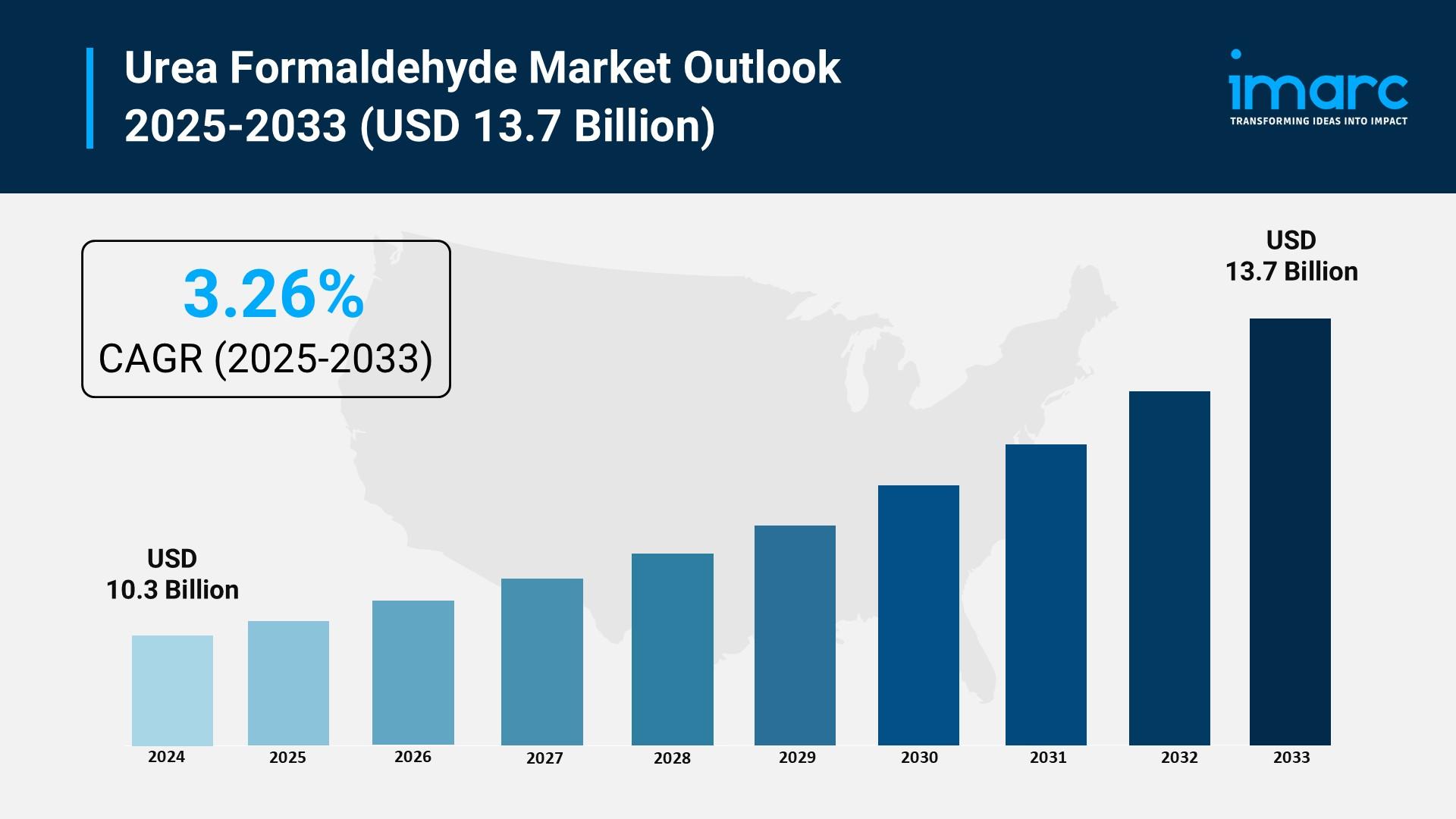

The urea formaldehyde market is experiencing rapid growth, driven by rising demand in construction and furniture industries, government policy and subsidies fueling agricultural uptake, and fast-track industrialization and technological expansion. According to IMARC Group’s latest research publication, “Urea Formaldehyde Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the global urea formaldehyde market size reached USD 10.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.26% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/urea-formaldehyde-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Urea Formaldehyde Market

- Rising Demand in Construction and Furniture Industries

One of the biggest forces behind the growth in the urea formaldehyde market is the booming construction and furniture sectors, especially in Asia-Pacific. In countries like China and India, surging population and rapid urbanization are driving robust housing demand and massive infrastructure investment. China alone accounts for about 20% of global construction investments, with a significant share directed toward residential buildings, public housing, and major infrastructure. This building boom ramps up the need for engineered wood products such as plywood, particle board, and medium-density fiberboard (MDF)—all of which rely heavily on urea formaldehyde-based adhesives. As a result, North America reported a 5% rise in plywood production, leading to a 3.8% increase in resin consumption over the past year. Furniture manufacturing also leans heavily on urea formaldehyde for its affordability and durable bonding, making the material a go-to solution for value-focused, high-volume furniture lines worldwide.

- Government Policy and Subsidies Fueling Agricultural Uptake

Another major growth engine comes from policies and subsidies supporting urea-based fertilizers, particularly in developing agricultural economies. For instance, the Government of India’s Urea Subsidy Scheme ensures that farmers pay just Rs.242 for a 45kg bag of urea, with the state covering the rest through targeted subsidies to both local and imported suppliers. Such schemes make urea products like urea-formaldehyde resins highly accessible—an important factor, given that fertilizers represent 91% of the current market share. Similar support systems exist in many Asian and African countries, where ensuring affordable fertilizers is critical to food security. These programs drive bulk adoption of urea formaldehyde as a slow-release nitrogen source, valued for efficiency on large farms and flexibility in various soil conditions. Government-backed minimum pricing and distribution policies reinforce demand and underpin the steady expansion of the agricultural end-use segment.

- Fast-Track Industrialization and Technological Expansion

Industrial production and adoption of new manufacturing technologies are also powering market growth, with the Asia-Pacific region leading the charge. Fast-track industrialization in China and India has resulted in a thriving manufacturing base for everything from electronics to automobiles, fueling the need for urea formaldehyde resins in adhesives, molding compounds, and composite materials. Automotive output in China hit more than 30 million units last year, and India’s vehicle production surged by about 25%, both of which directly increased the demand for wood composites and interior components made using urea formaldehyde-based products. Companies are also scaling up research and development to improve product performance and reduce emissions, appealing both to industry regulations and eco-savvy consumers. These industrial upgrades and expanded R&D activities are raising product standards, boosting output, and unlocking new segments in electronics, construction, and advanced manufacturing.

Key Trends in the Urea Formaldehyde Market

- Surge in Low-Emission and Eco-Friendly Resins

A major trend reshaping the global urea formaldehyde market is the rapid development and adoption of low-emission and eco-friendly resin variants. Tougher environmental regulations in regions like North America and Europe are prompting manufacturers to innovate, creating urea formaldehyde resins with significantly reduced formaldehyde content. In fact, over 15% of resin companies launched modified, environmentally compliant urea formaldehyde products in the past year alone. These greener alternatives are now widely used in premium furniture and building materials, helping companies meet stringent certification standards and capitalizing on growing consumer demand for sustainable goods. As regulations continue to tighten, the push for even safer and cleaner resins is leading to a flurry of new product launches and R&D investments.

- Growing Applicability in Automotive and Electronics

Automotive and electronics manufacturers are discovering new uses for urea formaldehyde, thanks to its versatility, strength, and cost-effectiveness. In the automotive industry, the ongoing shift toward lighter, more fuel-efficient vehicles has driven up demand for composite materials made with urea formaldehyde. This past year, Asia-Pacific’s automotive sector saw a 7.5% jump in composite usage, translating into an 8% revenue boost for resin suppliers. Similarly, the electronics sector is embracing urea formaldehyde for casings, boards, and insulation, spurred by government incentives like India's Electronics Development Fund, which channel significant investments into domestic electronics manufacturing. These broader applications are expanding the market well beyond its traditional base, opening up lucrative new avenues for resin producers.

- Shift Toward Smart Manufacturing and Automation

Smart manufacturing and process automation are rapidly making inroads in the urea formaldehyde sector, setting a new bar for efficiency and product quality. Industry leaders are integrating AI-driven monitoring systems and robotics into their production lines, resulting in reduced waste, faster curing times, and more consistent resin quality. This approach is particularly evident in advanced factories across North America and Europe, where automated systems are helping companies seamlessly adapt to changing regulations and market needs without compromising output. Companies investing in these innovations report substantial gains in operational efficiency and product performance, while also slashing energy costs and environmental impact—a win-win that appeals both to customers and regulators.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging urea formaldehyde market trends.

Leading Companies Operating in the Global Urea Formaldehyde Industry:

- AB Achema (Koncernas Achemos Grupe)

- Acron Group

- Asta Chemicals Sdn. Bhd.

- BASF SE

- Borealis AG (OMV AG)

- Foresa

- Gruppo Frati S.p.A

- Hexion Inc.

- Mansoura for Resins & Chemical Industries Co. (MRI)

- Metafrax Chemicals

Urea Formaldehyde Market Report Segmentation:

By Type:

- Urea Formaldehyde Powder

- Urea Formaldehyde Solution

By Application:

- Particle Board

- Medium Density Fibreboard

- Plywood

- Adhesives and Coatings

- Molding Compounds

- Others

By End Use Industry:

- Furniture

- Building and Construction

- Transportation

- Electrical and Electronics

- Others

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to a large market for urea formaldehyde driven by rapid urbanization.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302