Rising Healthcare Costs Drive Growth in the Global Critical Illness Insurance Market

"In-Depth Study on Executive Summary Critical Illness Insurance Market Size and Share

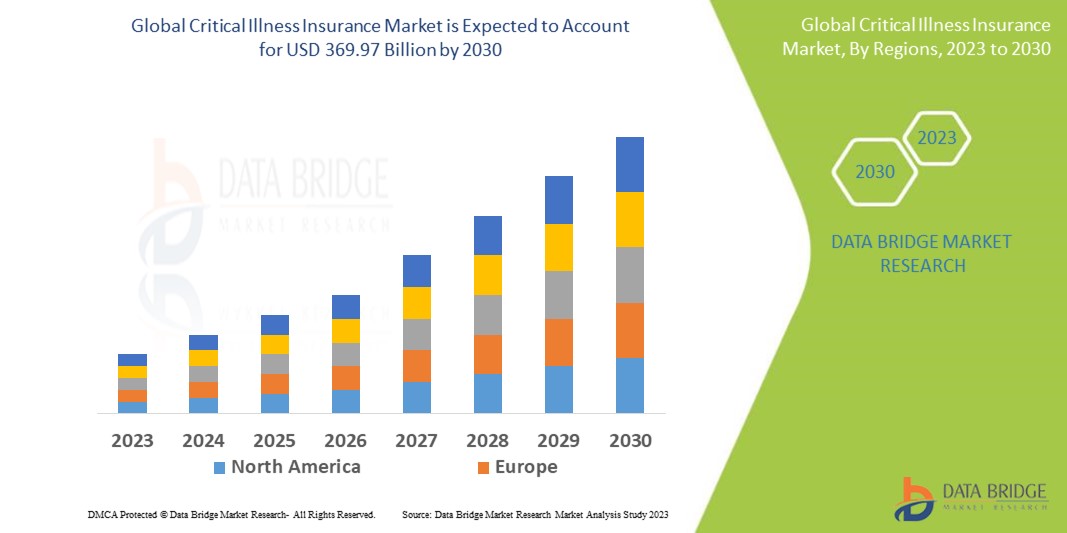

Data Bridge Market Research analyses that the critical illness insurance market, which was USD 216.5 Billion in 2022, would rocket up to USD 369.97 Billion by 2030 and is expected to undergo a CAGR of 10.40% during the forecast period.

Critical Illness Insurance Market research report acts as a very significant constituent of business strategy. This report contains important information which helps to identify and analyze the needs of the market, the market size and the competition with respect to Critical Illness Insurance Market industry. This market research report is one of the key factors used in keeping up competitiveness over competitors. When the report goes together with the right tools and technology, it helps deal with a number of uncertain challenges for the business. Critical Illness Insurance Market report assists the business to take better decisions for the winning future planning in terms of current and future trends in particular product or the industry.

Critical Illness Insurance Market research report deeply analyses the potential of the market with respect to current scenario and the future prospects by taking into view numerous industry aspects. This market report is very helpful for both regular and emerging market player in the Critical Illness Insurance Market industry as it provides thorough market insights. The report has been prepared with the experience of skilful and inventive team. Hence the outcome is a great which implies a client-focused, leading edge, and trustworthy market report. Businesses can rely with confidence upon this superior Critical Illness Insurance Market report to bring about an utter success.

Uncover strategic insights and future opportunities in the Critical Illness Insurance Market. Access the complete report: https://www.databridgemarketresearch.com/reports/global-critical-illness-insurance-market

Critical Illness Insurance Market Landscape

**Segments**

- The critical illness insurance market can be segmented based on coverage type, policy type, distribution channel, and region. In terms of coverage type, the market includes disease-specific insurance and comprehensive insurance. Disease-specific insurance provides coverage for a specific critical illness such as cancer, heart attack, or stroke, while comprehensive insurance offers coverage for a range of critical illnesses. Policy types in the market consist of individual and group policies, with individual policies tailored to single individuals and group policies extended to multiple members of a group, often employees in a workplace. The distribution channels in the critical illness insurance market encompass insurance companies, brokers, banks, and others who act as intermediaries between the insurers and customers, facilitating the sale and purchase of insurance policies.

**Market Players**

- Key players operating in the global critical illness insurance market include major insurance companies such as Allianz, AIG, Aviva, AXA, Manulife, MetLife, Ping An Insurance, Prudential Financial, and Zurich Insurance Group. These market players offer a wide range of critical illness insurance products to cater to the diverse needs of customers worldwide. Additionally, there are regional players and emerging startups entering the market, adding to the competitive landscape. These players focus on innovative product offerings, competitive pricing, strong distribution networks, and effective marketing strategies to gain a competitive edge in the market. Partnerships, mergers, and acquisitions are also common strategies employed by market players to expand their market presence and enhance their product portfolios, driving growth in the global critical illness insurance market.

The critical illness insurance market is witnessing a trend towards customization and personalization of insurance products to meet the specific needs of customers. With advancements in data analytics and technology, insurers are better equipped to analyze customer data and preferences to offer tailored solutions. This trend is driven by the increasing awareness among consumers about the importance of insurance coverage for critical illnesses and the desire for comprehensive protection. As a result, market players are focusing on designing flexible policies that can be customized based on individual health conditions, lifestyle factors, and budget constraints. This shift towards personalized insurance products not only enhances customer satisfaction but also enables insurers to mitigate risks more effectively by aligning coverage with actual needs.

Moreover, there is a growing emphasis on digitalization and online distribution channels in the critical illness insurance market. Insurers are investing in digital platforms to streamline the insurance buying process, enhance customer experience, and reach a broader audience. The shift towards digital distribution channels is driven by changing consumer behavior, with more individuals preferring to research, compare, and purchase insurance policies online. Insurers are leveraging digital technologies such as mobile apps, online portals, and artificial intelligence to offer seamless and convenient insurance services to customers. This digital transformation is reshaping the competitive landscape of the critical illness insurance market, with companies that embrace technology gaining a competitive advantage over traditional players.

Another key trend in the critical illness insurance market is the integration of wellness programs and preventive healthcare initiatives into insurance offerings. Insurers are partnering with healthcare providers, wellness companies, and technology firms to incentivize policyholders to adopt healthy lifestyle choices and proactively manage their health. By promoting preventive care and early detection of illnesses, insurers aim to reduce the incidence of critical illnesses and lower claims costs. Wellness programs may include services such as telemedicine consultations, health screenings, fitness tracking, and personalized health recommendations. These value-added services not only differentiate insurance products in a crowded market but also contribute to the overall well-being of policyholders, leading to long-term customer loyalty and retention.

In conclusion, the critical illness insurance market is evolving rapidly, driven by changing consumer preferences, technological advancements, and the increasing focus on personalized healthcare solutions. Market players that can adapt to these trends, embrace innovation, and collaborate with strategic partners are poised to succeed in this competitive landscape. As the demand for critical illness insurance continues to grow globally, insurers must continue to innovate and diversify their product offerings to meet the evolving needs of customers and ensure long-term sustainability in the market.The critical illness insurance market is experiencing significant growth and transformation due to various key trends and factors shaping the industry landscape. One notable trend is the increasing focus on customization and personalization of insurance products to meet the specific needs of individual customers. Insurers are leveraging data analytics and technology to offer tailored solutions that align with customer preferences, health conditions, and budget constraints. This trend is driven by rising consumer awareness regarding the importance of insurance coverage for critical illnesses, leading to a shift towards flexible policies that cater to diverse needs. As a result, market players are enhancing customer satisfaction, reducing risks, and driving overall market growth through personalized offerings.

Furthermore, digitalization and online distribution channels are playing a significant role in reshaping the critical illness insurance market. Insurers are investing in digital platforms to streamline the insurance buying process, improve customer experiences, and expand market reach. With a growing number of consumers preferring online research and purchase of insurance policies, companies that embrace digital technologies such as mobile apps, online portals, and artificial intelligence are gaining a competitive edge. This shift towards digital channels is not only enhancing operational efficiency but also enabling insurers to adapt to changing consumer behaviors and preferences in the digital age.

Moreover, the integration of wellness programs and preventive healthcare initiatives into insurance offerings is another key trend influencing the critical illness insurance market. Insurers are collaborating with healthcare providers and technology firms to incentivize policyholders to adopt healthy lifestyle choices and proactive health management practices. By promoting preventive care and early detection of illnesses, insurers aim to reduce claims costs and improve long-term health outcomes for policyholders. These wellness programs differentiate insurance products, drive customer loyalty, and contribute to the overall well-being of individuals. As the demand for holistic healthcare solutions grows, insurers incorporating wellness initiatives are better positioned to meet evolving customer needs and ensure sustained market success.

In conclusion, the critical illness insurance market is evolving rapidly, driven by trends such as customization, digitalization, and wellness integration. Market players that adapt to these trends, embrace innovation, and forge strategic partnerships are likely to thrive in this competitive landscape. By continuing to offer personalized solutions, leveraging digital technologies, and promoting preventive healthcare, insurers can differentiate their offerings, enhance customer satisfaction, and drive long-term sustainability in the dynamic critical illness insurance market.

View comprehensive company market share data

https://www.databridgemarketresearch.com/reports/global-critical-illness-insurance-market/companies

Global Critical Illness Insurance Market: Strategic Question Framework

- What is the historical size of the Critical Illness Insurance Market?

- What are the future projections for Critical Illness Insurance Market expansion?

- How is the Critical Illness Insurance Market segmented by product type?

- What are the latest acquisitions in this market?

- Which companies are investing heavily in R&D?

- What environmental factors are influencing Critical Illness Insurance Market dynamics?

- What are the consumer preferences in key regions?

- What market entry strategies are most effective?

- How fragmented or consolidated is the Critical Illness Insurance Market?

- What pricing trends are observed across regions?

- Which segment is forecasted to grow the fastest in Critical Illness Insurance Market?

- How do government policies affect the Critical Illness Insurance Market?

- What is the Critical Illness Insurance Market outlook for the next decade?

- How resilient is the market to global Critical Illness Insurance Marketdisruptions?

Browse More Reports:

Middle East and Africa Dish Antennas Market

Netherlands Dental Implant Market

Belgium and Netherlands Dental Implant Market

Middle East and Africa Dental Implant Market

China Instrument Cluster Market

Europe Instrument Cluster Market

Asia-Pacific Instrument Cluster Market

Middle East and Africa Instrument Cluster Market

North America Instrument Cluster Market

Asia-Pacific Surgical Operating Microscopes Market

Europe Surgical Operating Microscopes Market

Middle East and Africa Surgical Operating Microscopes Market

North America Surgical Operating Microscopes Market

Asia-Pacific Deep Brain Stimulation Systems Market

Middle East and Africa Deep Brain Stimulation Systems Market

Global Arachidonic Acid Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"