LLC vs Sole Proprietorship vs Freelance Licence for Budget-Friendly Dubai Setup

Introduction

Ever dreamed of launching your own venture in Dubai without mortgaging your future? I’ve been there—staring at pages of legal jargon, wondering, “Is there a cheapest licence for Dubai startup that actually makes sense?” Well, buckle up. In this friendly chat, I’ll walk you through the ins and-outs of LLC vs sole proprietorship vs freelance licence Dubai, drop in my own war stories, and even dish out light sarcasm (just enough to keep you on your toes 😊).

Dubai’s business landscape dazzles with opportunities, but it can also feel like an endless buffet of confusing options. You might ask, “Why not just pick the first licence that pops up on Google?” Trust me, I get it. I once kicked off a side hustle selling graphic tees and nearly signed up for the wrong licence—imagine shipping tees to a client who never got them because I registered under a trade name that didn’t cover ecommerce. Classic rookie move, right? FYI, that little hiccup taught me to dive deep before deciding.

By the end of this guide, you’ll see why an LLC or sole proprietorship UAE guide can feel like reading a choose-your-own-adventure novel, why a freelance licence benefits Dubai more than you’d think, and how to start LLC in Dubai cheap if you’re pinching every dirham. Also, we’ll compare visa quota sole proprietorship UAE, break down UAE business licence processing time, and even peek at professional licence Dubai fees—all without using terms like “dive into” (because that feels so cliché, right?).

Ever wondered which structure gives you serious liability protection versus which gives you maximum freedom but next to zero backup from the law? Stick around. Whether you’re a budding entrepreneur, a digital nomad on the lookout for a low-cost UAE trade licence, or someone who just wants to take advantage of the free zone vs mainland freelance permit debate, this article is your one-stop shop. IMO, choosing the right structure is less about checking a box and more about matching your vision, budget, and appetite for paperwork. Ready to skip the fluff and get actionable insights? Let’s roll.

Why Picking the Right Structure Actually Matters

Picture this: you’re cruising down Sheikh Zayed Road with your business plan as your playlist, dreaming of bringing your genius idea to life. But did you know that picking the wrong UAE business structure pros and cons can trip you up faster than Dubai traffic at rush hour? Yeah, I’ve seen friends launch with a freelance permit only to realize their operations required a full-blown LLC. Oops.

Liability and Legal Protection

Choosing between LLC partner liability rules Dubai and the zero-buffer world of a sole proprietorship isn’t just semantics. An LLC practically wraps your personal assets in bubble wrap—creditors go after the company, not your savings. A sole proprietorship? You’re on the hook for everything, from supplier disputes to that one disgruntled client who thought your logo was “meh.”

Costs vs Control

Ever wondered why some creatives stick with a freelance licence even when they could register an LLC? It boils down to cost and control. Freelance permits hand you a specific list of activities—writing, editing, photography, whatever—and slap on fewer fees. But you trade off the scalability an LLC offers. You can’t exactly hire a full team or open multiple branches, at least not without extra licences.

Processing Time and Paperwork

Ask yourself: how soon do you want your licence? If speed thrills you, a sole proprietorship licence Dubai steps can take just a week. An LLC? Factor in partner agreements, MOAs, and sometimes even notarized authorizations, which can stretch to a month or more. Then there’s the UAE business licence processing time—free zones can expedite, mainland often feels like wading through paperwork in quicksand.

So, why does all this matter? Because your choice dictates how you sell, whom you hire, and how you grow. It’s not just a box on a form—it’s the backbone of your brand’s future. Ready for a deep dive into each option? Let’s break down the three contenders: LLC, sole proprietorship, and freelance licence—and figure out which one fits your budget-friendly Dubai setup like a glove.

The LLC Route: Modern Business with Protective Armor

If you’re the type who likes a safety net but still wants to play big, an LLC might be your perfect sidekick. An LLC, or Limited Liability Company, blends personal liability protection with enough flexibility to expand across Dubai’s mainland and free zones.

Dubai LLC formation requirements

• Minimum two shareholders; max fifty • Local sponsor or service agent (unless in certain free zones) • Memorandum of Association (MOA) notarized by the Dubai Courts • Office space lease agreement (even virtual offices qualify in some free zones) • Share capital deposit (varies by free zone; often symbolic)

How to start LLC in Dubai cheap

I got my LLC off the ground with a lean budget by choosing a free zone offering zero-capital setup and a Dubai mainland licence cheap option. Here’s the playbook:

-

Scout free zones that waive minimum share capital.

-

Use virtual office packages (they’re often under-the-radar deals).

-

Bundle services—some registrars throw in PRO services for free if you pay a flat fee.

-

Negotiate your MOA drafting fee; trust me, everyone’s got wiggle room.

LLC partner liability rules Dubai

LLC partners share liability only up to their share in capital. So if you invest 30% in an LLC, you risk 30% of personal assets—not your entire net worth. Talk about peace of mind.

Visa quota and expansion

An LLC opens doors to visas in your own company, but visa quotas vary. Mainland LLCs may start with two visas per licence; free zones often offer more generous packages based on the package tier.

In my experience, an LLC was worth the extra paperwork. I slept better knowing my personal savings weren’t collateral when I tested a new marketing service in Dubai Silicon Oasis. If you plan to hire staff, work with vendors, or eventually scale beyond solo gigs, an LLC offers the gears you need.

Going Sole Proprietor: Keep It Simple, Stay Naked

Sometimes the only armor you need is a café latte and a laptop. If you’re a freelancer or small-scale trader eyeing setup sole proprietorship Dubai cost and minimal fuss, this could be your cruiser.

Sole proprietorship licence Dubai steps

• Register your trade name with the Department of Economic Development (DED) • Submit copies of your passport and entry stamp • Define your activity under the professional licence Dubai fees schedule • Secure your initial approval; no MOA required • Finalize your licence by paying fees and getting your establishment card

Visa quota sole proprietorship UAE

You typically get one visa per licence—enough to put your own name on the office door, but not for building a squad. That’s why I call it “solo mode.”

Liability pitfalls

Here’s the catch: zero separation between you and the business. If a client sues, they come after your car, your house, even your future earnings. It’s like riding without airbags.

Cost breakdown

-

Licence renewal: relatively low and flat

-

Office requirement: flexi-desk or home office options exist

-

No local sponsor needed, but you can’t claim corporate tax advantages

Why do people pick this? Because it’s fast, cheap, and requires zero partners. I once set up a sole proprietorship in under a week to test a niche consulting service; it cost me less than my monthly Netflix binge. For tight budgets and low-risk ventures, it’s a no-brainer—until you outgrow it.

Freelance Licence: Freedom with Fine Print

Do you hate red tape but love a good side hustle? A freelance licence benefits Dubai by letting you operate solo under umbrella companies, focusing on creative or professional services.

Freelance permit eligibility UAE

• Bachelor’s degree or ten years of experience in your field • Sponsored by a licensed free zone or government entity • Activities limited to specified professions: media, IT, design, consulting

Freelance permit vs company licence Dubai

Think of the freelance permit as a tandem bike—you share the ride with a free zone authority, so fewer upfront costs but also limited scope and branding. With a company licence, you captain your own ship but pay full freight.

Key perks

-

No local sponsor; 100% ownership

-

Affordable initial fees and renewals

-

Quick licence issuance—sometimes under five days

-

Visa application support under umbrella free zone packages

Drawbacks to watch

• Restricted to certain activities; you can’t suddenly pivot to F&B or trading without a new licence • Limited visa quota—usually one or two • Less credibility with bigger clients who prefer dealing with LLCs

I snagged my freelance permit to test the waters as a content strategist. Within two days, I had the licence in hand and pitched my first client. No incubator fees, no local sponsor drama—just freedom. But when I tried to hire a junior writer, I hit a wall: my permit didn’t cover staffing. Lesson learned: freelance licences rock for solo pros, but they cap your growth.

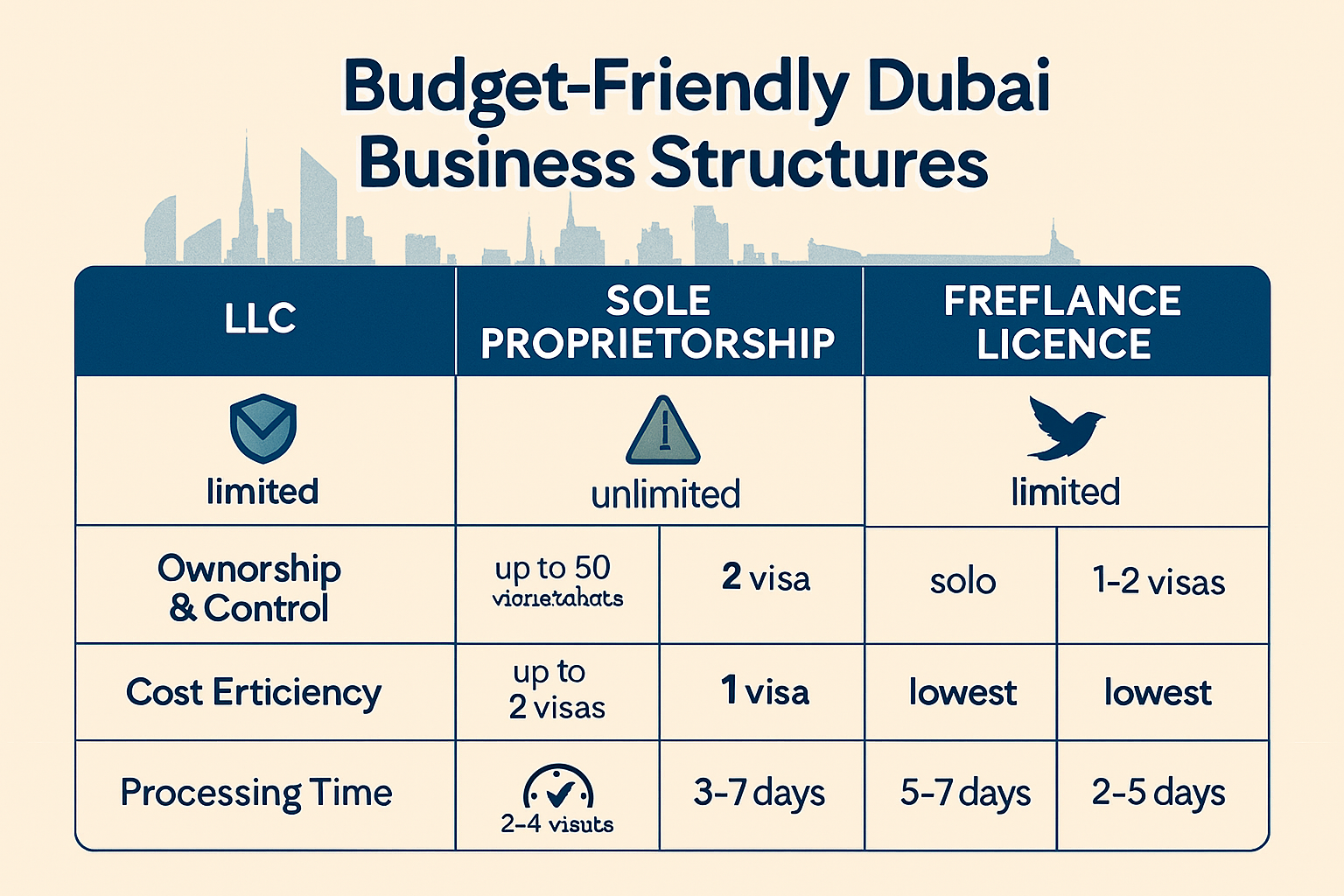

Side-by-Side Comparison: At a Glance

Wondering how these structures stack up? Here’s a quick breakdown—because who doesn’t love a good cheat sheet?

• Liability – LLC: limited to capital share – Sole Proprietor: unlimited personal risk – Freelancer: limited by umbrella sponsor

• Ownership & Control – LLC: up to 50 shareholders; local service agent for mainland – Sole Proprietor: 100% you – Freelancer: solo, but aligned with free zone authority

• Cost Efficiency – LLC: moderate; depends on free zone vs mainland – Sole Proprietor: lowest recurring fees – Freelancer: lowest setup fees, limited scope

• Processing Time – LLC: 2–4 weeks (mainland slower) – Sole Proprietor: 3–7 days – Freelancer: 2–5 days

• Visa Quota – LLC: 2+ visas; depends on office package – Sole Proprietor: 1 visa – Freelancer: 1–2 visas under umbrella

This compare business structures Dubai snapshot shows why no single option rules them all. Your ideal pick hinges on your risk tolerance, growth plans, and how quickly you need that official stamp.

Finding the Cheapest Licence for Your Dubai Startup

Is “budget-friendly” your middle name? Let’s scout out the true best budget business licence Dubai options without phantom fees or surprise charges.

If you’re trading digital products or providing online services, consider:

-

Freelance permit in two-day free zones – nearly zero capital, lightning-fast approval

-

Sole proprietorship with flexi-desk – local address, minimal annual rents

-

Free zone LLC packages under AED 5,000 – yes, they exist when combined with virtual offices

Pro tip: Don’t skip the free zone open days where licensing authorities slash prices to attract new registrations. I once snagged a Dubai Silicon Oasis LLC package with a complimentary visa slot—talk about a steal.

Lowest-Cost Routes

-

Tecom Group Freelance Permits

-

DIFC Innovation Licence

-

Ajman Media City Free Zone Virtual Office Plus Licence

Each package hides a legend: those initial fees might balloon on renewal if you tack on PRO services. So always read the fine print on UAE business licence processing time and renewal increments.

UAE Business Structure Pros and Cons

Every shining licence has its dark side. Here’s the scoop on UAE business structure pros and cons so you can decide which trade-off makes you win.

• LLC – Pros: Robust liability protection; scalable; credible to clients – Cons: Higher setup complexity; local service agent fees mainland

• Sole Proprietorship – Pros: Speedy; ultra-low fees; total ownership – Cons: Unlimited liability; harder to raise capital

• Freelance Licence – Pros: Fastest; cheapest; complete ownership; minimal paperwork – Cons: Activity restrictions; limited visas; branding constraints

Remember, no structure’s perfect. It’s about prioritizing: do you value protection over cost? Speed over scope? Ask yourself: “What’s the worst-case scenario?” Then pick your armour accordingly.

Conclusion

Alright, friend, you’ve navigated the maze of LLC vs sole proprietorship vs freelance licence Dubai and seen the real-world upsides and pitfalls of each. If you crave protection and growth lanes, an LLC stands tall. If you prioritize speed and rock-bottom fees, a sole proprietorship or freelance permit might suit you just fine.

My personal two cents? Start lean with a freelance licence to test your concept, then upgrade to an LLC once revenue and team-building become your jam. That path let me pivot quickly during my early consulting gigs, then lock in full liability protection when I brought on my first full-time hire.

Ready to make your move? Whichever route you choose, remember: the cheapest licence isn’t just about immediate savings. It’s about aligning with your vision, avoiding surprises, and building a foundation that lasts longer than my first ecommerce experiment (which, BTW, lasted about two weeks before I realized I’d registered as a food trader—oops!).

Now, grab that pen, sketch out your budget, and go claim your slice of Dubai’s booming market. Good luck, and drop me a note when you’re up and running! 😉

FAQs

What are the main differences between an LLC, a sole proprietorship, and a freelance licence in Dubai?

-

Ownership & Control: An LLC lets up to 50 shareholders share control (with a local service agent for mainland), a sole proprietorship gives you 100% ownership, and a freelance licence pairs you with a free zone authority.

-

Liability Protection: LLC partners enjoy limited liability up to their capital share; sole proprietors face unlimited risk; freelancers’ liability often ties to umbrella sponsors.

-

Cost & Setup Time: LLCs cost more and take 2–4 weeks; sole proprietorships are cheapest and can be ready in under a week; freelancing licences balance low fees with 2–5 day approvals.

-

Visa Quotas: LLCs offer multiple visas based on your package; sole proprietors get one; freelancers usually secure one or two under their free zone.

-

Activity Scope: LLCs cover trading, services, manufacturing; sole proprietorships span professional services; freelancing licences restrict you to specified fields like media or IT.

How long does it typically take to obtain each type of licence in Dubai?

-

LLC: 2–4 weeks for mainland; some free zones expedite to 7–10 days.

-

Sole Proprietorship: 3–7 days from name reservation to licence issuance.

-

Freelance Licence: 2–5 days when applying through a free zone umbrella authority.

-

PRO Services: Outsourcing PRO (approval, stamping, visa processing) can add 1–2 weeks, so plan accordingly.

-

Renewal Cycle: Annual renewals across all structures, with license-specific deadlines to avoid lapses.

Can I upgrade from a freelance licence to an LLC later on?

-

License Downgrade/Upgrade: Yes—you can migrate your freelance activities into a new LLC structure by liquidating the freelance permit and transferring assets.

-

Cost Considerations: Some free zones waive liquidation fees if you re-register within a certain timeframe; check each zone’s policy.

-

Process Steps:

-

Inform your free zone authority of your intent.

-

Clear outstanding fees and cancel your permit.

-

Draft a new MOA and submit LLC application.

-

Transfer clients/contracts to your new LLC.

-

-

Benefit: Seamless continuity for your clients and brand, with enhanced legal standing.

Which business structure offers the best balance of cost, liability protection, and scalability?

-

Best Balance: An LLC in a low-cost free zone often hits the sweet spot:

-

Costs: Affordable initial packages under AED 5,000 when bundled with virtual offices.

-

Liability: Personal assets shielded up to your capital share.

-

Scalability: Freedom to expand activities, hire staff, and open branches on the mainland.

-

-

Alternative Path: Start with a freelance licence for rapid market entry, then transition to an LLC once you validate your model.

-

Key Tip: Always compare free zone vs mainland freelance permit fees, visa quotas, and renewal terms before committing.