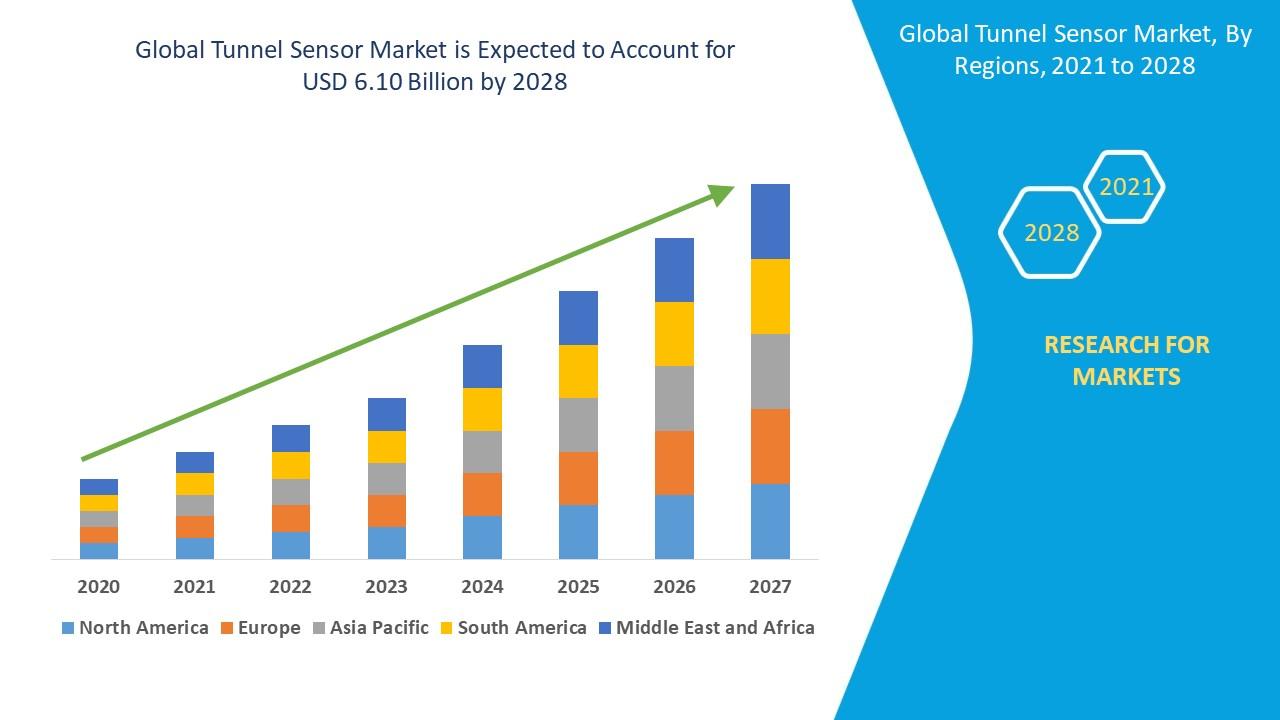

How Transfer Rates Affect Your Family’s Finances: A Comparison Guide

Sending money home is more than just a transaction; it's a lifeline. It’s for school fees, monthly bills, a special birthday gift, or simply showing you care from miles away. But have you ever paused to think if the full value of your hard-earned money is actually reaching your loved ones? The hidden details in transfer rates and fees can make a surprising difference.

Understanding how this works is the first step to maximizing every dollar you send. Let's break it down in a simple way to ensure your family gets the most out of every transfer.

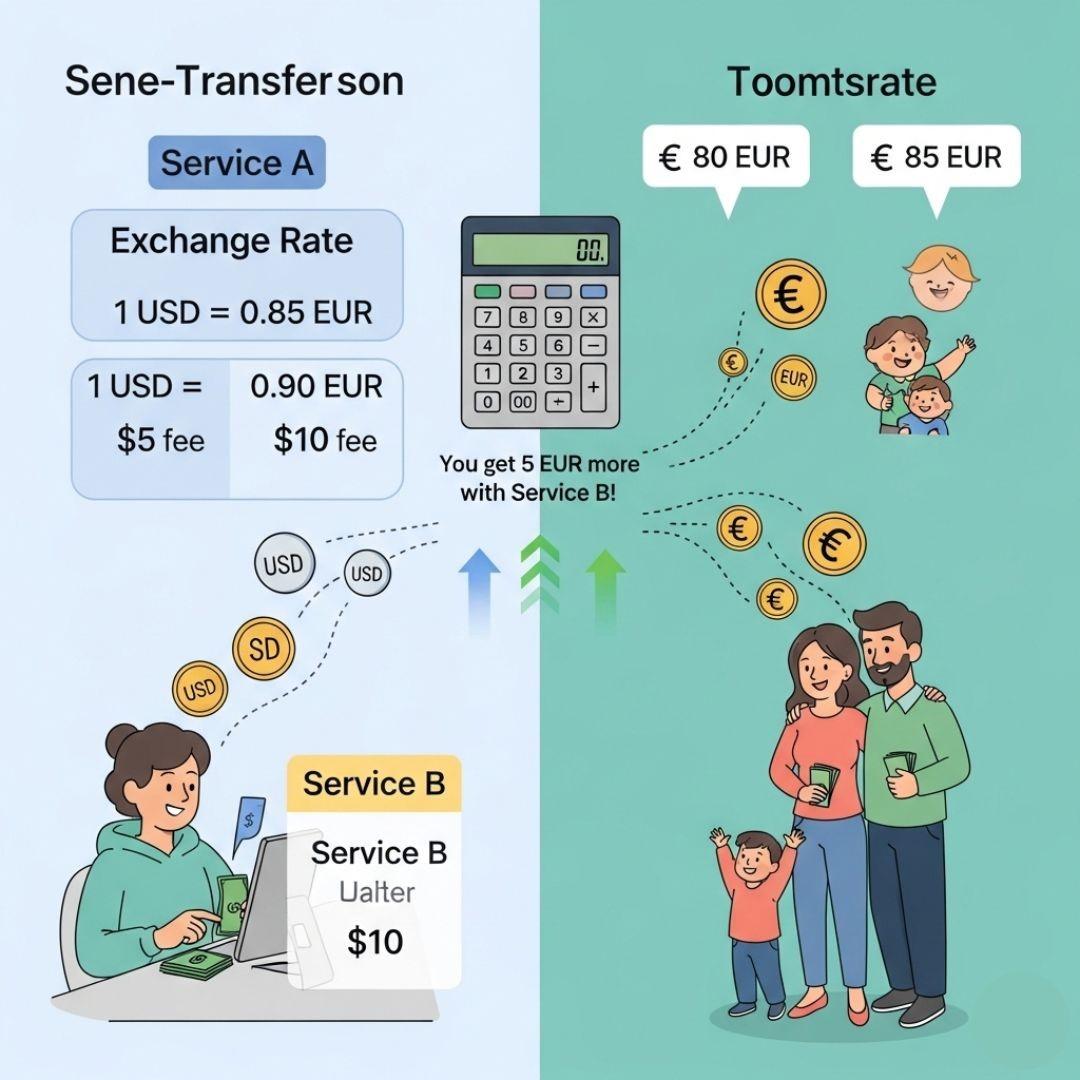

The Two Key Players: Exchange Rates and Transfer Fees

When you send money internationally, two main factors determine how much your family receives: the exchange rate and the transfer fee. Think of them as two separate price tags on your transaction.

-

The Exchange Rate: This is the value of one country's currency compared to another. Imagine you're trading apples for oranges. On Monday, one apple might get you two oranges, but by Friday, it might only get you one and a half. Exchange rates work similarly; they fluctuate constantly. A "stronger" or more favorable rate means your money converts into more of the local currency for your family.

-

The Transfer Fee: This is a straightforward service charge for moving your money from point A to point B. It can be a small, flat fee or a percentage of the total amount you're sending. It's often the most advertised number, but it only tells half the story.

How Rates and Fees Impact Your Wallet (And Your Family's!)

It’s easy to be drawn in by a service advertising a very low transfer fee. However, a less favorable exchange rate can quietly take a much bigger bite out of your funds. Let's look at a quick example.

Imagine you want to send $1,000 to your family.

-

Service A has a low $5 fee but offers an exchange rate where your family receives 80 units of their local currency for every dollar.

-

After the fee, you're sending $995.

-

Calculation: $995 * 80 = 79,600 units of local currency.

-

-

Service B has a $15 fee but offers a better exchange rate where your family gets 82 units for every dollar.

-

After the fee, you're sending $985.

-

Calculation: $985 * 82 = 80,770 units of local currency.

-

Despite the higher fee, Service B puts an extra 1,170 units of currency into your family's hands. That could be a week's worth of groceries, a new schoolbook, or a utility bill paid in full. This shows why a proper money transfer rate comparison is about looking at the total picture, not just one advertised number.

Your Smart Guide to Comparing Transfer Services

Finding the best value doesn't have to be complicated. By focusing on the right details, you can make an informed choice every time. The goal is to compare transfer fees and rates effectively to see who offers the best final value.

Focus on the Final Payout Amount

This is the single most important number. Before you commit to a transfer, use the provider's calculator. Enter the amount you want to send and see the exact figure your recipient will get in their local currency after all fees and exchange rate conversions are applied. This number cuts through all the marketing and tells you the true value of the service.

Look Beyond the Headline Fee

As our example showed, the lowest fee does not always equal the best deal. Always weigh the fee against the exchange rate. A service might absorb its cost into a less favorable rate, so a comprehensive rate comparison for money transfers is essential.

Consider Speed and Convenience

How quickly does your family need the money? Some services offer instant transfers, while others might take a few business days. Also, consider the method. Is a mobile app more convenient for you? Does your family prefer to pick up cash at a local agent? Choose a service that fits both your needs and theirs.

Why a Good Rate Matters More Than You Think

Choosing a service with a competitive rate isn't just about saving a few dollars; it's about empowering your family. The small differences add up over time. The money saved through a better money exchange rate comparison can contribute to long-term goals like savings, education, or small business investments. It transforms a simple transaction into a more powerful gesture of support.

By being mindful of how you send money, you ensure your hard work translates into maximum support for the people who matter most.

Conclusion

Sending money abroad is a profound act of love and responsibility. By taking a few moments to look past the advertised fees and compare the final receiving amount, you can make a significant financial impact. The key is to find a service that offers a fair exchange rate and transparent fees. Make your next transfer an informed one, and rest easy knowing you've made the best choice for your family's finances.

FAQs

Q1: What is the main difference between an exchange rate and a transfer fee?

The transfer fee is the service charge you pay to the company for moving your money. The exchange rate is the rate at which your money is converted into the recipient's currency. Both affect the final amount your family receives.

Q2: Is the cheapest money transfer service always the best one to use?

Not necessarily. A service with a zero or low fee might offer a less competitive exchange rate, which could mean your family receives less money overall. It's always best to check the final payout amount.

Q3: How often do exchange rates change?

Exchange rates can change every few minutes throughout the day based on global financial market activity. That's why it's a good idea to check the current rate each time you plan to send money.

Q4: How can I find the best deal for my money transfer?

The best way is to use the provider's calculator before sending. Input the amount you're sending and select the destination country. The calculator should show you the exact amount your recipient will get after all costs. Compare this final number across different services to find the best value.