Herbal Smoking Products Market Size Expanding Due to Growing Interest in Chemical-Free Smoking Experiences

The herbal smoking products market is seeing significant growth as more consumers seek chemical‑free smoking experiences. Across the globe, the shift toward natural, additive‑free, and nicotine‑free alternatives is propelling the market upward. With growing health awareness, stricter tobacco regulation, and consumers demanding transparency, herbal smoking blends and related products are emerging as a favored choice for those wanting a “cleaner” smoking ritual.

What Drives Interest in Chemical‑Free Smoking

Several factors are converging to drive increased demand for herbal smoking products with minimal or no chemical additives:

-

Health Awareness & Risk Perception: Many people are becoming concerned about the long‑term impacts of inhaling chemicals, synthetic flavour additives, harsh preservatives, and nicotine. As studies and public health campaigns highlight negative effects of traditional tobacco, chemical‑free herbal alternatives are being seen as safer or less harmful options.

-

Desire for Natural & Organic Ingredients: Users now scrutinize what’s in their products – herbs grown without pesticides, blends free of artificial flavour enhancers, and minimal processing. Chemical‑free labels, organic herbs, and clean production methods are big selling points.

-

Wellness & Lifestyle Trends: The broader wellness movement — including holistic health, plant‑based diets, mindful living, and organic products — supports the rise of herbal smoking products. Many consumers view smoking less as a habit and more as a ritual or sensory experience; they gravitate toward options aligned with their values of purity, naturalness, and environmental consciousness.

-

Regulatory Pressure on Tobacco & Additives: Governments are tightening restrictions on tobacco, nicotine content, flavour chemicals, and labelling. This makes chemically heavy traditional cigarettes less appealing or more regulated, creating a gap which herbal, chemical‑free alternatives can fill.

-

Smoking Cessation & Alternative Routes: For many trying to quit tobacco or reduce nicotine dependence, chemical‑free herbal products offer a transitional tool — replicating some aspects of the smoking experience (like rituals, flavour, inhalation) without some of the worst chemicals.

-

Online & Direct‑to‑Consumer Access: One of the biggest accelerators of market size has been e‑commerce. Herbal smoking products with clean labels and chemical‑free claims are easier to find, compare, and purchase online. Direct‑to‑consumer brands, wellness marketplaces, and niche online shops are growing in importance.

Market Size Trends & Forecasts

-

The herbal tobacco‑free / nicotine‑free segments are showing strong compound annual growth rates (CAGRs). Many reports estimate growth in the high single‑digits to low double‑digits over coming years.

-

Organic and flavoured herbal blends—using herbs like mint, chamomile, lavender, lemongrass, and other botanicals—are expanding in product variety as manufacturers respond to demands for natural flavour without synthetic additives.

-

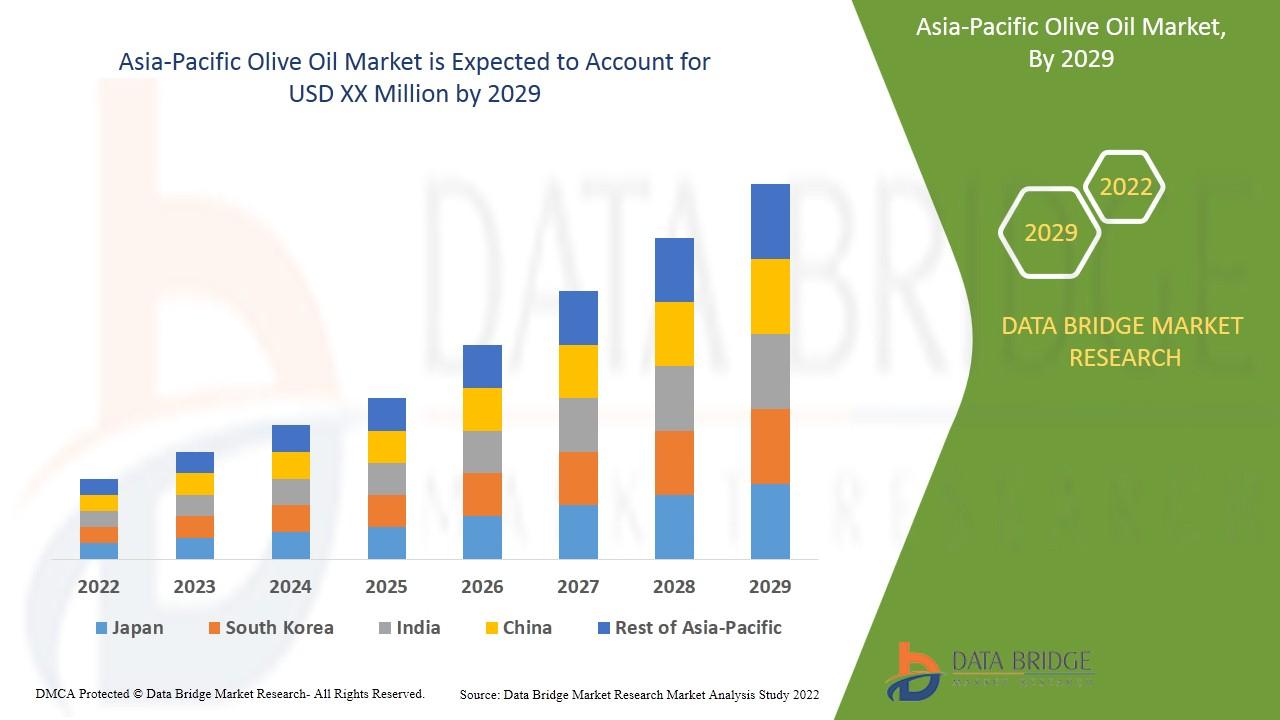

Regions such as North America and Europe lead in wellness awareness and regulatory activism, thus have strong growth. Meanwhile Asia‑Pacific, Latin America, and emerging markets are catching up as more consumers become aware of health risks of tobacco and as disposable incomes rise.

-

The market’s overall size is increasing not only in value, but diversity: more forms (herbal cigarettes, herbal shisha / hookah blends, herb rolls, heat‑sticks without additives) and wider distribution channels.

Opportunities & Innovation

To capture growth, many companies are innovating in these areas:

-

Ingredient sourcing & certification: Using organic herbs, wild‑harvested botanicals, non‑GMO herbs; certifying products (organic, chemical‑free) to provide consumer trust.

-

Product format variety: Blends, pre‑rolls, herbal wraps; also flavoured variations using natural herbs instead of artificial flavour chemicals. Some companies are also exploring alternative delivery formats (e.g. herbal heat sticks) that may reduce harmful combustion byproducts.

-

Transparent labelling & communication: Clearly stating what is not present (no nicotine, no synthetic additives), disclosing sourcing and production methods, and avoiding misleading claims.

-

Sustainable production & packaging: Eco‑friendly packaging, biodegradable materials, minimal processing, ethical cultivation are increasingly important to buyers.

-

Online marketing & wellness positioning: Brands emphasizing clean‑smoke experience, minimalistic or botanical aesthetics, wellness rituals, and aligning with holistic health movements.

Challenges & Caveats

While interest is rising strongly, there are still hurdles:

-

Misconceptions vs. Reality: Even herbal products when burnt can produce harmful compounds (tar, carbon monoxide etc.). Chemical‑free does not mean risk‑free. Consumers and regulators may push for clinical evidence or better research.

-

Regulatory ambiguity: Definitions of “chemical‑free,” “organic,” “natural,” “non‑nicotine” vary by country. Regulations may be stricter in some places, especially when health or youth protection is involved.

-

Quality control & supply chain: Sourcing organic herbs, ensuring consistency, avoiding contamination, ensuring product safety are challenging. Costs may be higher, which affects pricing.

-

Competition & alternatives: Other alternatives to tobacco (nicotine replacement therapies, e‑cigarettes, heated tobacco, smokeless products) compete for the same health‑conscious market.

Outlook: What the Future Holds

Given current trajectories, the herbal smoking products market size is likely to continue expanding robustly over the next 5‑10 years. Key trends expected to shape growth:

-

Increasing adoption of chemical‑free herbal heat‑stick and smoke‑alternative formats.

-

More standardized certification (organic, clean‑label) and perhaps regulation to define what “chemical‑free” really implies for consumers.

-

Rising penetration through online channels and wellness‑oriented retailers.

-

Stronger emphasis on sustainable, clean‑source herb cultivation, ethical sourcing, and minimal processing.

-

Greater product diversity to cater to flavour seekers, ritual users, and those seeking transitional alternatives to tobacco.