Natural Surfactants Market Forecast to 2028: A Sustainable Growth Story Fueled by Innovation and Eco-Consciousness

The global natural surfactants market is poised for significant growth over the coming years. According to a detailed market analysis, the sector is projected to expand from US$ 11,558.34 million in 2021 to US$ 16,069.28 million by 2028, growing at a CAGR of 5.0% between 2022 and 2028. This growth is being driven by several factors, including increasing consumer awareness about the environmental and health impacts of synthetic chemicals, rising demand for sustainable and biodegradable products, and a shifting regulatory landscape promoting green chemistry.

This blog dives into the key drivers, market segments, COVID-19 impact, and the long-term outlook for natural surfactants across various industries.

What Are Natural Surfactants?

Surfactants—short for surface-active agents—are compounds that lower the surface tension between two substances, such as oil and water. They are widely used in cleaning products, personal care formulations, and industrial processes.

Natural surfactants are derived from renewable plant or animal-based sources such as coconut oil, palm oil, sugar, or starch. Unlike their synthetic counterparts, natural surfactants are biodegradable, less toxic, and more environmentally friendly, making them ideal for use in "green" consumer products.

Market Segmentation: Types of Natural Surfactants

The natural surfactants market is segmented into four major types based on their ionic properties:

1. Anionic Surfactants

These surfactants carry a negative charge and are known for their excellent cleaning and foaming properties. Commonly found in household and industrial cleaning agents, anionic surfactants such as alkyl sulfates and sulfonates dominate the market due to their effectiveness and affordability.

2. Cationic Surfactants

Positively charged cationic surfactants are mainly used in fabric softeners, hair conditioners, and antimicrobial products. Their demand is steadily increasing in the personal care sector, especially in products claiming enhanced performance and safety.

3. Non-Ionic Surfactants

These surfactants do not carry any charge, making them gentler on skin and surfaces. With growing demand for mild and skin-friendly products in the personal care industry, non-ionic surfactants are gaining significant traction.

4. Amphoteric Surfactants

These surfactants can carry both positive and negative charges depending on the pH of the surrounding environment. Their versatility and low irritation potential make them ideal for baby care and sensitive skin formulations.

Applications Driving Market Demand

Natural surfactants have found wide-ranging applications across industries. Here's a breakdown of the key sectors propelling market growth:

1. Detergents

The detergent sector is the largest consumer of natural surfactants. The growing preference for eco-labeled laundry and dishwashing products, especially in Europe and North America, has significantly contributed to the demand.

2. Personal Care

Natural surfactants are essential ingredients in shampoos, body washes, facial cleansers, and cosmetics. As consumers gravitate towards clean beauty products free from sulfates and parabens, personal care brands are increasingly incorporating plant-derived surfactants into their formulations.

3. Industrial and Institutional Cleaning

From janitorial products in schools and hospitals to cleaners used in industrial plants, the need for effective yet environmentally responsible surfactants is on the rise. Government regulations promoting the use of non-toxic cleaning agents are further accelerating this trend.

4. Oilfield Chemicals

Natural surfactants are used in enhanced oil recovery and drilling operations. As oil companies seek to reduce their environmental footprint, there is growing interest in bio-based surfactants that can deliver performance without compromising sustainability.

5. Agricultural Chemicals

In agriculture, surfactants play a crucial role in pesticide and herbicide formulations. Bio-based surfactants improve the wetting and spreading properties of these chemicals, increasing their effectiveness while reducing environmental harm.

6. Others

Additional applications include textiles, paints and coatings, and food processing—industries that are all gradually adopting green chemistry practices.

COVID-19 Impact on the Natural Surfactants Market

Like many global industries, the natural surfactants market experienced short-term disruptions due to the COVID-19 pandemic. Supply chain constraints, labor shortages, and reduced manufacturing capacity temporarily impacted production and distribution.

However, the pandemic also created long-term tailwinds for the market. The surge in demand for hygiene and cleaning products highlighted the importance of effective, safe, and sustainable ingredients. Consumers became more health-conscious, prompting a shift toward non-toxic, eco-friendly alternatives across product categories. This trend, accelerated by e-commerce and digital marketing, boosted the visibility and adoption of natural surfactants.

Regional Insights

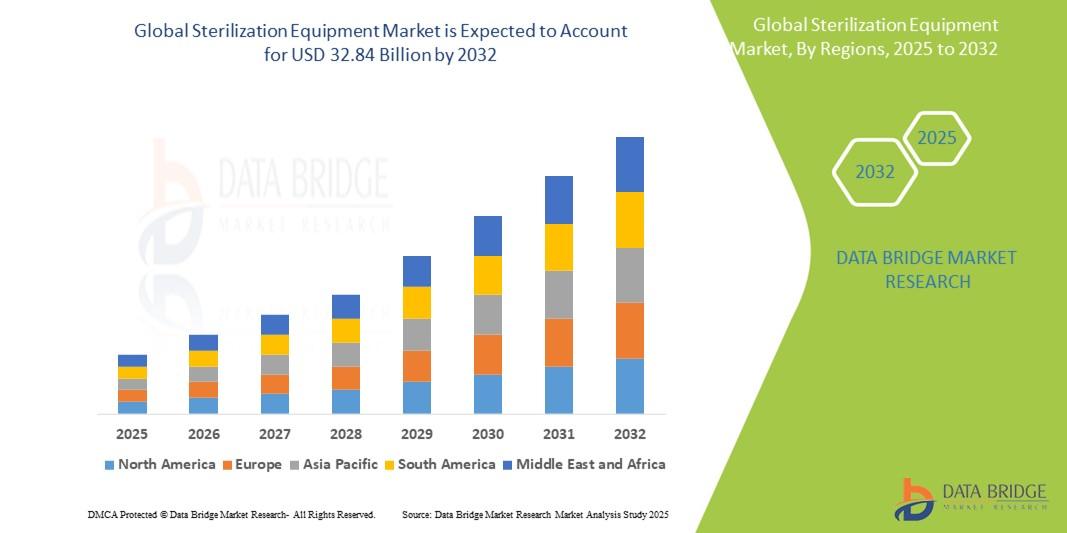

- North America and Europe dominate the natural surfactants market due to stringent regulations, mature consumer markets, and active research in green chemistry.

- Asia-Pacific is expected to witness the fastest growth, driven by rapid industrialization, urbanization, and rising disposable income in countries like China, India, and Southeast Asia.

- Latin America and the Middle East & Africa are also emerging as important markets, particularly as awareness of environmental issues grows and regulatory frameworks evolve.

Key Market Trends and Opportunities

🌱 Sustainable Product Innovation

Companies are investing heavily in R&D to develop high-performance, cost-effective natural surfactants with superior biodegradability and low toxicity. Novel feedstocks like algae, soy, and agricultural waste are being explored.

💼 Strategic Partnerships and M&A

Major players are engaging in mergers, acquisitions, and joint ventures to strengthen their product portfolios and global footprint. For example, companies like BASF, Clariant, and Croda are actively expanding their green chemistry capabilities.

🧴 Rise of Clean Label Products

Consumer demand for transparency is pushing brands to formulate with recognizable, plant-based ingredients. Certifications such as USDA Organic, ECOCERT, and COSMOS are becoming valuable differentiators.

🌍 Regulatory Support

Governments and international bodies are encouraging the shift to bio-based chemicals through subsidies, green procurement policies, and emissions targets. This support creates a favorable environment for natural surfactants.

Challenges in the Market

While the outlook is positive, the natural surfactants market faces some challenges:

- Higher production costs compared to synthetic alternatives.

- Raw material supply issues, particularly for plant-based ingredients.

- Performance limitations in certain high-demand applications.

Overcoming these hurdles requires innovation, investment in biotechnology, and scale-driven cost reductions.

Conclusion

The natural surfactants market represents a vital intersection between consumer demand for sustainability, corporate responsibility, and regulatory action. With a projected value of over US$ 16 billion by 2028, the industry is on a growth trajectory that shows no signs of slowing.

As innovation continues and economies of scale are realized, natural surfactants will become not only an ethical choice but also a commercially competitive one. Whether you're a manufacturer, formulator, or investor, the time to act is now—because the future of surfactants is green, and it's already taking shape.