Vietnam Used Car Market Report 2025, Share, Growth, Trends and Forecast Till 2033

Vietnam Used Car Market Overview

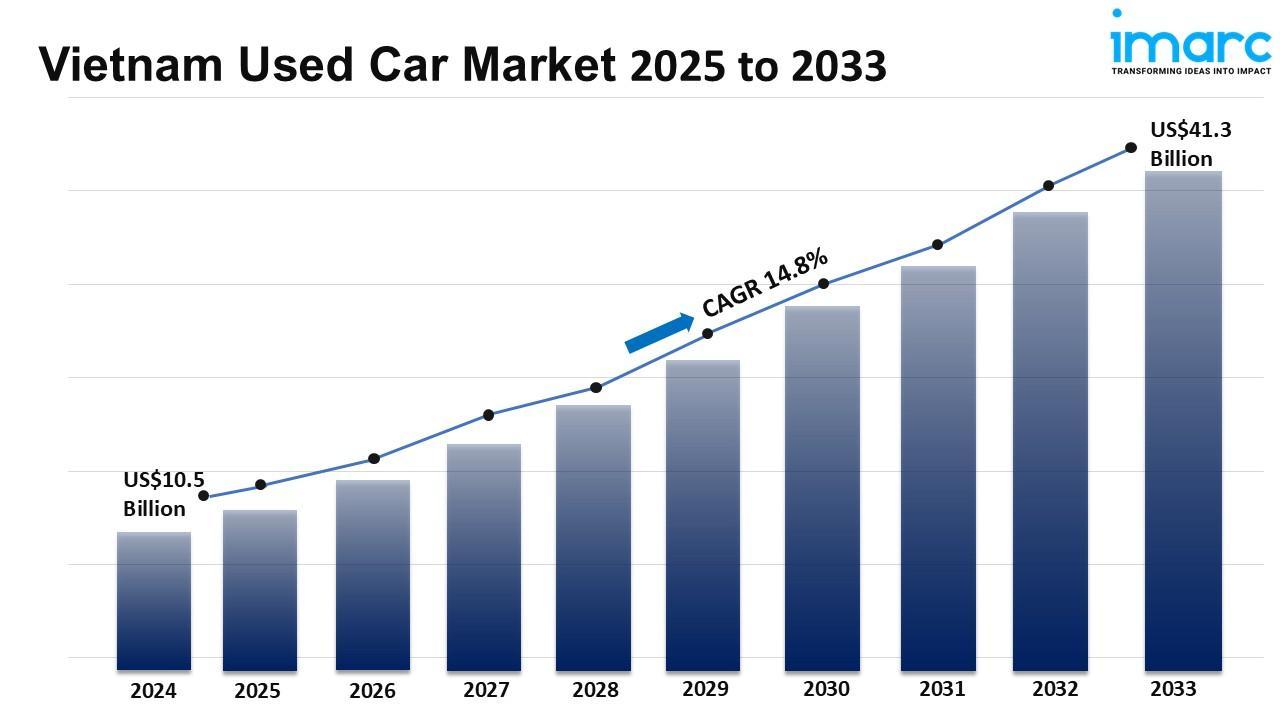

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 10.5 Billion

Market Forecast in 2033: USD 41.3 Billion

Market Growth Rate 2025-2033: 14.8%

Vietnam used car market size reached USD 10.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 41.3 Billion by 2033, exhibiting a growth rate (CAGR) of 14.8% during 2025-2033. The rising awareness of environmental issues, lower car ownership costs, rising preference for private transportation, favorable government policies, and ongoing trend of people moving to urban areas represent some of the key factors driving the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-used-car-market/requestsample

Vietnam Used Car Market Trends and Drivers:

The Vietnamese used car market is undergoing a deep structural shift into a consolidated, digitally-transparent ecosystem, which moves away from fragmented, informal peer-to-peer sales. Aggressively expanding integrated online marketplaces as well as advanced retail platforms that assure buyers comprehensively mainly drive this transformation. These platforms create new industry standards plus offer strict multi-point inspection certifications, transparent vehicle history reports, and fixed pricing models without haggling since they are not simply listing services. A meaningful trend shows rapid consumers will adopt these digital showrooms because recent internal industry data suggests that over 60% of urban buyers now exclusively search for used cars through these trusted channels. Growing demand for convenience along with security fuels this surge, since these services often include streamlined financing options, flexible return policies, and warranty packages integrated directly into the purchasing adventure. This model creates great trust within an opaque market so physical dealerships must join digital leaders or use technology standards to compete. Digital verification as well as a smooth online-to-offline (O2O) experience as fundamental consumer expectations permanently raise the bar for quality plus for transparency across the entire sector, as the future trajectory points to that market.

A rapidly growing consumer appetite defines the current market for late-model used vehicles often called “near-new” cars only one to three years old. Economic factors that include a burgeoning middle-class and faster ownership cycles among wealthy urbanites fuel this trend. Consumers tactically choose these nearly new models for avoiding a brand-new car's important first-year depreciation. They still acquire a vehicle with contemporary technology as well as safety features, plus most of its original factory warranty still intact. This demand is being met due to the fact that the supply increases correspondingly because the vehicle leasing sector grows, company fleets refresh inventories, and individual owners upgrade personal vehicles on an exceptionally frequent basis. Observers in industry note that the average age of a transacted used car decreased by about 18 months. This decrease here, when it is compared to figures from before the pandemic, indicates people markedly prefer a newer inventory. Dealers must for now focus their procurement strategies on the sourcing of these high-demand units because of that shift. Consumer expectations happen to be mirrored closely in an energetic sub-market that is created within the used car industry through the premium these units command and faster turnover than older vehicles.

Vietnam's used car market can grow later if useful financing solutions also develop with a stronger regulatory framework too. For used vehicles, auto loans are becoming increasingly available and advanced though they were previously a meaningful barrier because financial institutions and captive lenders from new car manufacturers are designing tailored products for second-hand purchases. Current estimations seem to show that financing now gets into over 35% of all used car deals. Such penetration was virtually unheard of until just a few years ago. Democratizing credit unlocks the market for a larger population segment since it grows overall volume and fuels growth. Improved regulations are strongly pushed simultaneously by government bodies with industry stakeholders to formalize the market. This covers steps for making a vehicle history database that is standard and national to fight hidden accident damage and odometer fraud. In this, clearer policies concerning ownership transfer as well as consumer rights are included. Access of a more easy kind to capital as well as regulatory clarity of a greater kind synergize so as to build a market foundation that is more stable and more trustworthy. This evolving ecosystem protects consumers while it gives lenders greater confidence. Because the ecosystem is one that creates such a virtuous cycle, it promises that it will be for support of sustained market expansion and also long-term viability.

Vietnam Used Car Market Industry Segmentation:

Vehicle Type Insights:

- Hatchbacks

- Sedans

- Sports Utility Vehicles (SUV) and Multi-Purpose Vehicles (MPVs)

Fuel Type Insights:

- Gasoline

- Diesel

- Others

Booking Type Insights:

- Online

- Offline

Vendor Type Insights:

- Organized

- Unorganized

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=13624&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302