SPARK Matrix : Key Trends Driving BFS Risk and Compliance IT Services

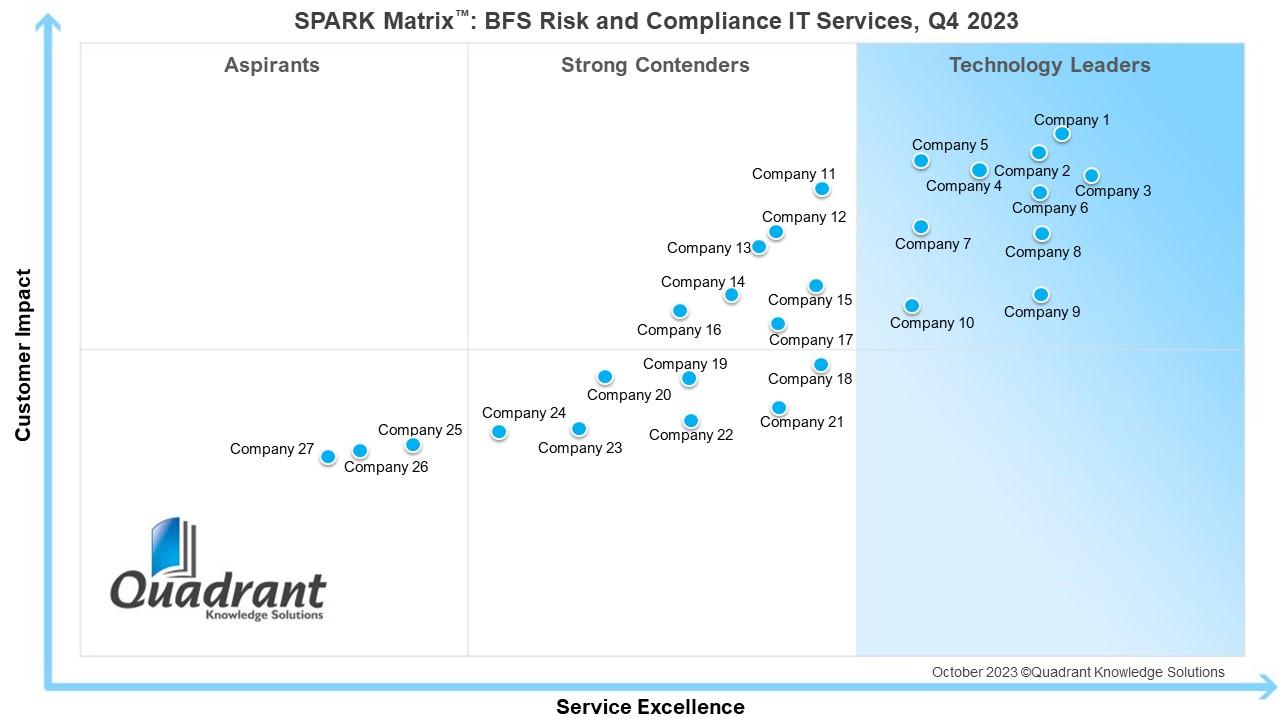

OKS Group’s BFS Risk and Compliance IT Services market research delivers an in-depth examination of the global landscape, highlighting both short-term and long-term growth opportunities, key market dynamics, evolving trends, and the overall future outlook. The study provides critical strategic insights designed to help technology vendors strengthen their understanding of the market environment, refine growth strategies, and align their service offerings effectively. At the same time, it enables end-users to evaluate vendors’ strengths, technological capabilities, competitive advantages, and overall market positioning.

A core component of the research is the competitive benchmarking and vendor assessment conducted through Quadrant’s proprietary SPARK Matrix™ framework. This framework offers a visual representation of market leaders, innovators, and emerging players by ranking and positioning them based on technology excellence and customer impact at a global level. The SPARK Matrix for BFS Risk and Compliance IT Services features comprehensive evaluations of leading vendors, including Accenture, Atos, Birlasoft, Capgemini, CGI, Cognizant, Deloitte, DXC Technology, EY, Happiest Minds, HCL Technologies, Hitachi Vantara, IBM, Infosys, KPMG, LTIMindtree, Maveric Systems, Mphasis, NSEIT, NTT DATA, PwC, Sopra Steria, TCS, Tech Mahindra, Virtusa, Wipro, and Zensar.

Analyst at OKS Group’s, BFS Risk and Compliance IT Services are purpose-built to meet the specific needs of the Banking and Financial Services (BFS) sector, with a strong focus on risk management and regulatory compliance. These services play a crucial role in helping financial institutions navigate today’s complex and constantly evolving regulatory landscape. They not only support compliance with existing rules but also provide the flexibility to adapt to new and emerging requirements.

The offerings encompass a wide range of critical areas, including Know Your Customer (KYC), Anti-Money Laundering (AML), risk assessments, cybersecurity, financial crime detection and prevention, and enterprise-wide risk management frameworks. By leveraging advanced IT solutions, BFS institutions can significantly enhance their compliance posture, reduce regulatory risks, and strengthen their overall governance structure. Ultimately, these services empower financial organizations to build resilience, maintain trust, and achieve sustainable growth in a highly regulated environment.

#BFSI #BankingAndFinance #FinancialServices

#RiskManagement #Compliance #RiskAndCompliance