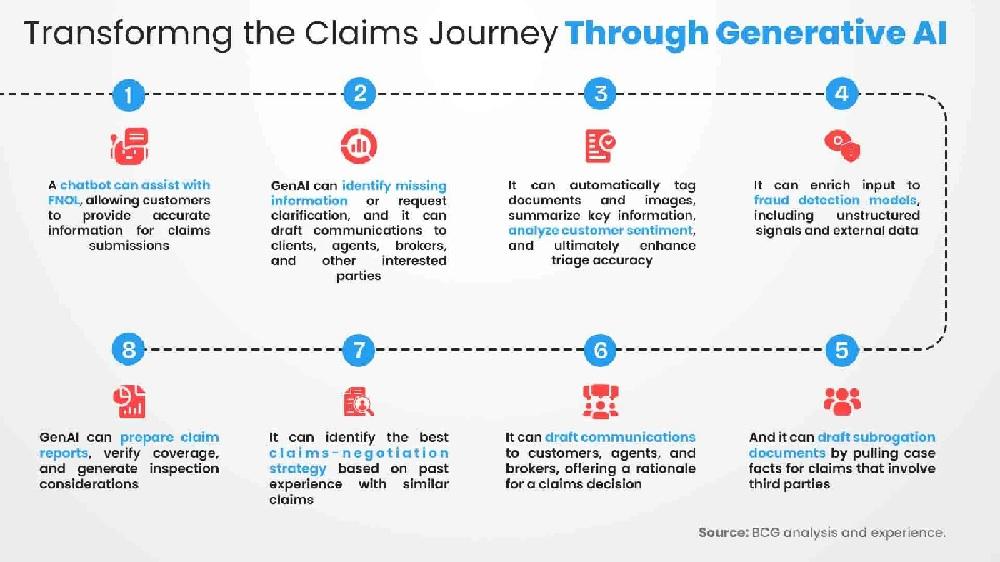

Proven Use Cases for Integrating Generative AI in Claims Processing

Fraud Detection: Enhancing Claims Accuracy with Generative AI

Anyone who's spent time in the world of insurance claims has likely encountered every type of fraud imaginable—from exaggerated injuries to carefully staged accidents. Fraudsters, whether acting alone or as part of organized groups, are always looking for new ways to exploit the system—and they’re getting more sophisticated by the day.

Even seasoned adjusters who are well-versed in spotting red flags still deal with a constant influx of suspicious claims. According to Forbes, around 20% of insurance claims involve some form of fraud, making it the second most expensive white-collar crime in the United States after tax evasion. The financial impact is massive, costing insurers billions each year and driving up premiums for honest customers.

Traditional fraud detection methods typically use rule-based systems and historical data to flag questionable claims. While these tools have their merits, they often fall short against today’s increasingly advanced fraud tactics. That’s where generative AI makes a significant difference.

Unlike older systems, generative ai applications evolves by learning from both structured and unstructured data. It uncovers patterns and anomalies that might go unnoticed by human eyes or static algorithms.

Here’s how it works:

-

It cross-checks claims against external sources like public databases and previous claim histories to uncover discrepancies.

-

It analyzes images, videos, and written reports to detect inconsistencies in accident details, timestamps, and injury narratives.

-

It applies deep learning models to recognize subtle behavioral patterns often linked to fraudulent activity.

Take State Farm, for example. The insurer has rolled out an AI-powered system that analyzes claim information alongside past fraud data, social media behavior, and accident reports. If someone submits multiple claims under various policies, the AI flags it for further investigation—helping to minimize fraudulent payouts significantly.

Virtual Damage Assessment: Faster, Smarter Inspections

Traditionally, assessing damage from auto or property claims required a physical inspection, which could be time-consuming and costly. Now, generative ai applications is reshaping that process by enabling virtual assessments using images and video footage, whether captured by policyholders or drones.

In cases like wildfire damage, drones can scan affected areas while generative AI processes the visuals in real time. Unlike traditional AI, which simply recognizes patterns, generative AI compares new imagery with historical claims and simulation data to create a comprehensive damage analysis. Insurers like State Farm and Farmers Insurance already use drone-based AI solutions to assess severity, estimate repair costs, and recommend payouts.

generative ai applications also integrates data from drones, satellites, and pre-disaster property records to evaluate changes in structural integrity. It can build 3D reconstructions of buildings to pinpoint the extent of damage from fire, smoke, or water. Companies like Allstate and Liberty Mutual are using these capabilities to prioritize high-risk claims and streamline case triaging.

Looking ahead, generative AI is being integrated into predictive models and geospatial analytics. This opens the door to future applications like fully autonomous claims assessments—where AI doesn’t just analyze the data but can also pre-authorize payouts based on coverage terms and compliance rules. Swiss Re and Munich Re are already exploring such innovations to better prepare for large-scale catastrophes.

While generative AI isn't brand new, tools like ChatGPT have recently demonstrated just how practical and transformative it can be. Insurance leaders are taking notice. Just as automation has become essential in today’s digital environment, generative AI is proving to be more than a passing trend—it’s fast becoming a foundational part of modern claims processing.

- Religion & Spirituality

- Politics

- Lifestyle

- Arts & Culture

- Parenting & Family

- Opinion

- Travel

- Business & Finance

- Science & Tech

- Food & Drink

- Nations

- Education & Learning