Top 10 Benefits of Accounts Payable Business Process Outsourcing

Managing accounts payable (AP) effectively is critical to the financial health of any organization. However, as companies grow and deal with increasing invoice volumes, vendor management complexities, and compliance challenges, handling AP in-house can become time-consuming and costly.

That’s where accounts payable business process outsourcing (AP BPO) comes in.

This strategic move allows companies to hand over their AP functions to specialized service providers who bring in advanced technology, skilled professionals, and process optimization. The result? Reduced costs, improved accuracy, better compliance, and much more.

In this article, we’ll explore the top 10 benefits of accounts payable business process outsourcing and why more businesses are adopting this approach to modernize their finance operations.

1. Cost Savings

One of the most obvious benefits of accounts payable business process outsourcing is cost reduction. Managing AP in-house involves staff salaries, software subscriptions, hardware maintenance, training, and office space.

Outsourcing eliminates or significantly reduces these overhead costs. With a BPO provider, you only pay for the services you need — often at a fraction of the cost of maintaining an internal AP department.

2. Increased Efficiency and Speed

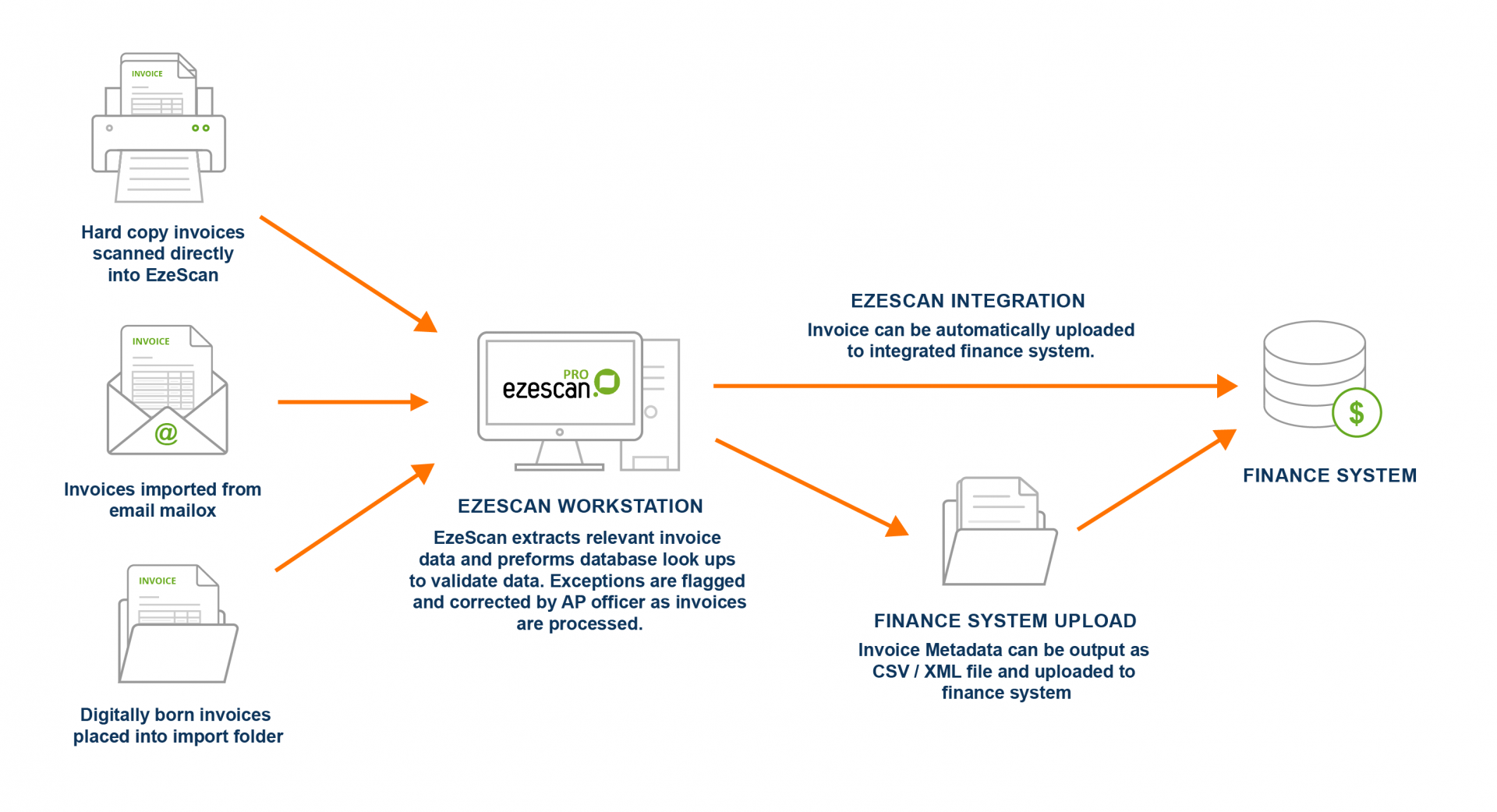

Manual AP processes are often slow, prone to delays, and reliant on paper-based workflows. Outsourcing partners use automation tools and streamlined processes to speed up the invoice-to-payment cycle.

This means:

-

Faster invoice approvals

-

On-time or early payments

-

Improved cash flow forecasting

-

Fewer payment penalties

Efficiency gains translate into significant time savings for your internal finance team.

3. Access to Skilled Professionals

When you outsource AP, you gain access to trained finance professionals who specialize in managing complex accounts payable processes across industries. These experts bring best practices, process knowledge, and industry compliance experience — reducing your need to constantly train and upskill internal staff.

This is especially helpful for small or mid-sized businesses that may not have the budget for a large in-house finance team.

4. Scalability and Flexibility

As your business grows, so does your volume of invoices, vendors, and payment workflows. With in-house AP, scaling up often requires hiring more staff, upgrading software, or restructuring processes.

With accounts payable business process outsourcing, scaling is seamless. Whether you're expanding rapidly, entering new markets, or experiencing seasonal volume spikes, your provider can easily adjust to meet your needs — without adding fixed costs to your business.

5. Enhanced Accuracy and Reduced Errors

Manual data entry is one of the biggest sources of errors in the AP process — from duplicate payments and missed invoices to incorrect vendor details.

AP outsourcing providers use automation and AI-driven tools to:

-

Validate invoice data

-

Match invoices to purchase orders

-

Flag duplicates

-

Reduce human error

-

Ensure proper approvals

The result is cleaner books, accurate reporting, and fewer costly mistakes.

6. Improved Vendor Relationships

Timely payments and clear communication are key to maintaining strong supplier relationships. Outsourced AP providers help ensure that:

-

Invoices are paid on time

-

Disputes are resolved quickly

-

Communication is documented and professional

-

Vendors receive timely updates and remittance details

Happy vendors often offer better payment terms and discounts, ultimately benefiting your bottom line.

7. Better Compliance and Audit Readiness

Compliance with tax regulations, vendor contracts, and internal controls is a growing concern for finance teams. AP BPO providers maintain strict adherence to local and international financial regulations and offer:

-

Detailed audit trails

-

Secure document storage

-

Standardized approval workflows

-

Regulatory reporting support

This makes your business more audit-ready and reduces the risk of fines or compliance violations.

8. Access to Advanced Technology and Tools

Implementing automation tools, AI, and analytics software internally can be costly and complex. When you outsource AP, you benefit from the technology stack your provider already uses — including:

-

Invoice scanning and OCR (Optical Character Recognition)

-

AP automation platforms

-

Payment gateways

-

Real-time dashboards

-

AI-powered fraud detection

This gives your company a competitive edge without the need for additional investment in software or infrastructure.

9. Improved Cash Flow Management

With accurate and timely AP data, you can:

-

Monitor outstanding payables in real time

-

Plan cash outflows more effectively

-

Take advantage of early-payment discounts

-

Avoid late fees and penalties

By outsourcing, you gain clearer visibility into your financial obligations, enabling better cash flow control and forecasting.

10. Allows Focus on Core Business Activities

Handling AP in-house can take valuable time and attention away from your core business operations. By outsourcing, your finance and leadership teams can focus on:

-

Strategic planning

-

Revenue generation

-

Customer experience

-

Business development

Letting experts handle routine AP tasks allows your team to concentrate on growing your business.

Final Thoughts

As organizations seek leaner, smarter, and more strategic operations, accounts payable business process outsourcing stands out as a high-impact solution.

From cost savings and efficiency to compliance and scalability, the benefits of AP outsourcing are hard to ignore — especially for companies aiming to modernize their back-office functions without heavy investment.

Whether you're a mid-sized business looking to optimize your finance team or a growing enterprise needing support for expansion, outsourcing AP can help you reduce complexity and drive performance.