Credhive – Revolutionizing Credit Intelligence for Businesses in India

In the fast-paced world of business, every decision counts. One wrong move, especially in financial dealings, can have long-lasting repercussions. Whether you’re a small startup, a mid-sized company, or a large enterprise, understanding the creditworthiness of your clients, suppliers, or partners is critical. This is where Credhive comes into play.

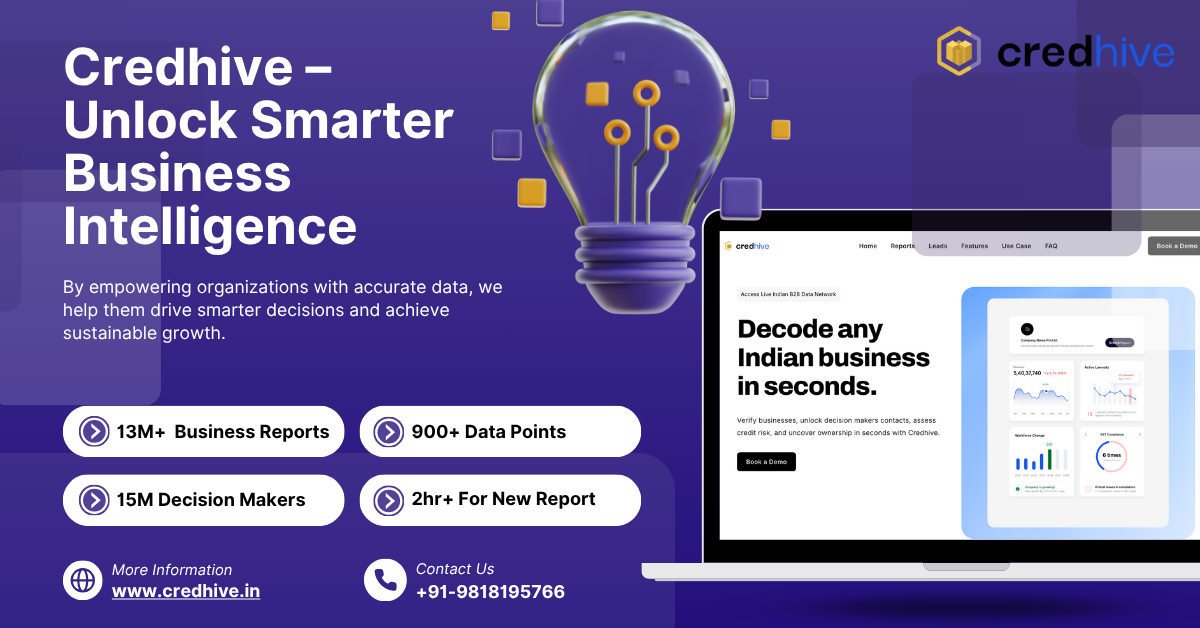

Credhive is an AI-powered fintech platform based in India that simplifies credit intelligence and business risk assessment. By providing comprehensive, real-time insights into a company’s financial health, Credhive empowers businesses to make data-driven decisions with confidence. In this blog, we’ll explore how Credhive works, its benefits, and why it’s becoming a must-have tool for businesses across India.

Understanding the Need for Credit Intelligence

Before diving into Credhive, let’s understand why credit intelligence matters.

In any business, cash flow is king. Delayed payments or defaulting clients can seriously disrupt operations. Traditionally, assessing a client’s creditworthiness involved going through financial statements, credit reports, and manual verification—a process that is time-consuming, cumbersome, and prone to errors.

The modern business landscape demands speed, accuracy, and reliability. Companies need tools that can provide instant insights into the financial health of their partners and minimize the risk of non-payment. This is exactly what Credhive offers.

What is Credhive?

Credhive is a cutting-edge platform that merges artificial intelligence, big data, and financial analytics to provide businesses with actionable credit intelligence. It enables businesses to:

-

Instantly assess a company’s creditworthiness

-

Track outstanding payments and financial obligations

-

Identify potential risks before entering into contracts

-

Make informed decisions backed by reliable data

Unlike traditional methods, Credhive doesn’t just provide raw data—it analyzes, interprets, and presents insights in a way that is easy to understand, even for non-financial professionals.

How Credhive Works

Credhive operates using AI-driven algorithms and integrates data from multiple verified sources to give a 360-degree view of a company’s credit profile. Here’s a breakdown of its core functionalities:

1. Comprehensive Company Profiles

Credhive provides detailed company profiles including financial statements, credit history, pending loans, and legal records. This allows users to assess the overall health of a business at a glance.

2. Credit Risk Assessment

The platform uses sophisticated AI models to evaluate the risk associated with extending credit or entering into financial agreements. It assigns credit risk scores that help businesses decide whether to proceed, negotiate terms, or decline engagement.

3. Real-Time Updates

Businesses operate in a dynamic environment, and financial statuses change frequently. Credhive ensures that all data is updated in real-time, allowing businesses to make decisions based on the latest information.

4. User-Friendly Dashboard

Even if you’re not a financial expert, Credhive’s dashboard makes it easy to interpret complex financial data. Insights are presented clearly with intuitive charts, risk scores, and actionable recommendations.

Benefits of Using Credhive

Using Credhive brings multiple advantages to businesses looking to manage credit and financial risk:

1. Faster Decision Making

With instant access to company profiles and credit scores, businesses can make faster decisions without waiting days or weeks for manual verification.

2. Reduced Risk

By understanding the financial health of clients and partners upfront, businesses can reduce the risk of late payments or defaults, protecting their cash flow.

3. Improved Cash Flow

Knowing which clients are reliable payers allows companies to prioritize and manage receivables efficiently, ensuring smooth cash flow.

4. Time and Resource Savings

Credhive eliminates the need for manual credit checks, multiple phone calls, and paperwork, saving time and resources that can be redirected toward core business activities.

5. Strengthened Business Relationships

By relying on factual credit intelligence rather than assumptions, businesses can negotiate better terms while maintaining professional relationships with clients and partners.

Who Can Benefit from Credhive?

Credhive is designed for a wide range of users across industries:

-

Small and Medium Enterprises (SMEs): Helps startups and growing businesses manage credit risk effectively without hiring a dedicated credit team.

-

Large Corporates: Assists large organizations in managing high-volume client portfolios with data-driven insights.

-

Financial Institutions: Banks and lending agencies can use Credhive for pre-loan assessments and risk mitigation.

-

Suppliers and Vendors: Enables suppliers to evaluate buyers’ creditworthiness before extending goods or services on credit.

Credhive vs. Traditional Credit Assessment

Traditional credit assessment methods often involve:

-

Manual review of financial documents

-

Time-consuming verification processes

-

Reliance on outdated or incomplete information

Credhive transforms this process by offering:

-

AI-driven analysis for accuracy and speed

-

Real-time data updates

-

Comprehensive insights in a user-friendly interface

This not only saves time but also ensures businesses make informed decisions backed by reliable data.

Credhive’s Role in Risk Management

One of the most important aspects of business is risk management. Non-payment, defaults, or financial instability of clients can severely impact operations. Credhive helps businesses identify potential risks before they materialize.

By providing credit scores, historical data, and predictive analytics, Credhive enables proactive decision-making. Companies can decide whether to extend credit, negotiate payment terms, or avoid risky partnerships altogether. This minimizes financial losses and strengthens overall business stability.

Real-Life Use Cases

Let’s look at how businesses can leverage Credhive:

-

Startup Expanding Client Base: A small IT firm wants to onboard a new corporate client. Using Credhive, they check the client’s credit score and payment history before signing the contract, ensuring a safe business decision.

-

SME Managing Receivables: A manufacturing company has multiple clients with pending invoices. Credhive helps prioritize collections based on risk assessment, improving cash flow and reducing overdue payments.

-

Financial Institution Loan Assessment: A bank uses Credhive to evaluate the financial stability of potential borrowers, reducing the risk of loan defaults and improving portfolio quality.

Why Credhive is the Future of Business Intelligence

In a world driven by data, businesses can no longer rely on assumptions or incomplete information. Credhive bridges the gap between raw financial data and actionable insights, making credit risk assessment faster, smarter, and more reliable.

Its combination of AI technology, real-time updates, and user-friendly dashboards ensures that businesses of all sizes can make informed decisions without hiring large credit teams or spending weeks on analysis.

Credhive doesn’t just provide information—it empowers businesses to act confidently, minimize risks, and focus on growth.

Managing credit risk and understanding the financial health of clients is no longer optional—it’s essential for business success. Credhive provides an intuitive, AI-powered platform that simplifies credit intelligence and debt risk management for businesses across India.

By offering instant insights, real-time updates, and actionable analysis, Credhive helps businesses make smarter decisions, improve cash flow, reduce bad debts, and grow sustainably.

Whether you are a startup, SME, or large corporation, Credhive is your trusted partner in navigating financial risks and securing business success.