Forklift Battery Market Size and Forecast (2021–2031): A Deep Dive into Global Trends and Growth Opportunities

The forklift battery market has been undergoing significant transformation, driven by technological advancements, the rising adoption of electric forklifts, and increasing demand for efficient material handling solutions across industries. According to recent market research, the global forklift battery market size was valued at US$ 5.94 billion in 2024 and is projected to reach US$ 9.23 billion by 2031, growing at a CAGR of 6.6% from 2025 to 2031.

In this blog, we provide a comprehensive analysis of the forklift battery market, exploring its key segments, emerging trends, regional dynamics, and the factors shaping its future.

Market Overview

Forklifts are essential to operations in logistics, construction, retail, and warehousing, and as these sectors continue to expand globally, so does the demand for reliable and energy-efficient battery systems. Forklift batteries are crucial components that power these vehicles, particularly electric models that are rapidly replacing internal combustion engine (ICE) forklifts due to stricter emissions regulations and sustainability goals.

The market is experiencing strong growth due to:

-

A global shift toward electrification.

-

Increased investment in warehousing and logistics post-COVID-19.

-

A growing preference for lithium-ion batteries over traditional lead-acid counterparts.

Key Market Segmentation

1. By Type

The forklift battery market is segmented into:

-

Lithium-Ion

-

Lead-Acid

-

Others (including Nickel-Cadmium, Gel batteries, etc.)

Lithium-Ion Batteries

Lithium-ion batteries are leading the market growth due to their superior performance, faster charging times, longer lifecycle, and lower maintenance needs. While traditionally more expensive than lead-acid, the total cost of ownership (TCO) has proven favorable, particularly for high-use applications such as logistics hubs and large manufacturing facilities.

Lead-Acid Batteries

Despite being an older technology, lead-acid batteries still hold a significant market share due to their lower initial costs and wide availability. They remain popular in small and medium-sized enterprises with limited budgets or less intensive forklift usage.

2. By Capacity

Forklift batteries are also segmented by capacity:

-

0–600 Ahr

-

600–1200 Ahr

-

Above 1200 Ahr

Each capacity range caters to different use cases:

-

0–600 Ahr: Ideal for light-duty applications, such as retail and small warehouse operations.

-

600–1200 Ahr: Most commonly used in general manufacturing and logistics due to their balance of power and cost.

-

Above 1200 Ahr: Suited for heavy-duty applications such as mining, large-scale manufacturing, and 24/7 warehouse operations.

3. By Application

Forklift batteries find applications in a diverse range of industries:

-

Manufacturing

-

Construction

-

Warehouse and Logistics

-

Automotive

-

Retail and Wholesale Stores

-

Others

Warehouse and Logistics

This segment is currently the largest consumer of forklift batteries. The explosive growth of e-commerce, coupled with rising demand for fast and accurate order fulfillment, has led to increased automation and a shift to electric forklifts in warehouses.

Manufacturing and Automotive

Industrial manufacturing and automotive plants are rapidly adopting electric material handling equipment to reduce carbon emissions and enhance workplace safety. This has significantly boosted the demand for high-capacity lithium-ion batteries.

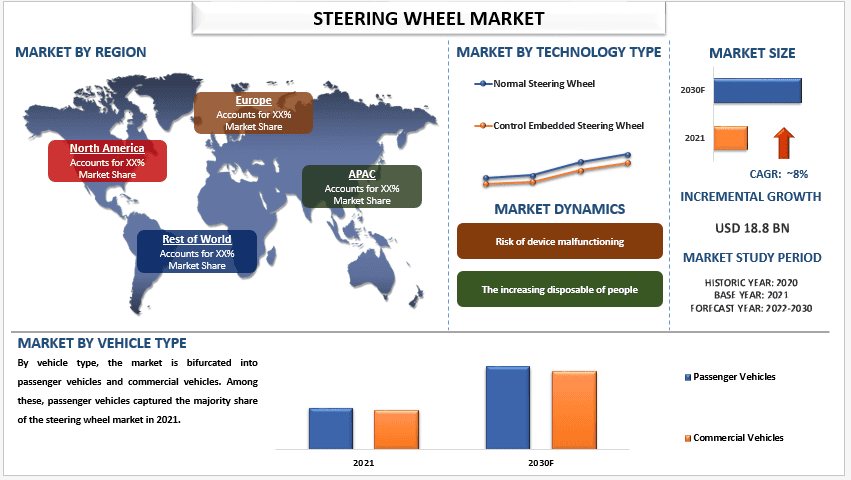

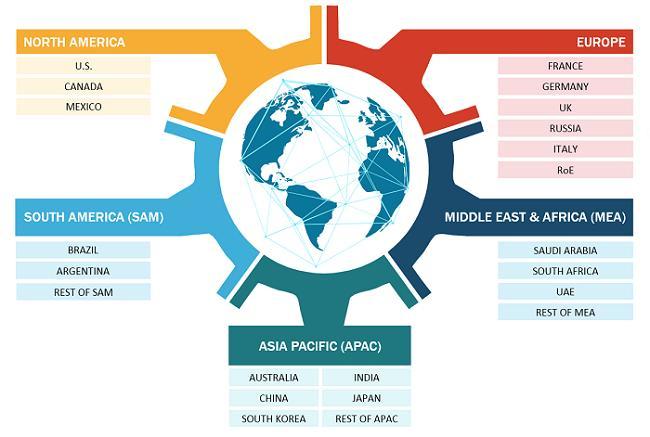

4. By Geography

The market is analyzed across major geographic regions:

-

North America

-

Europe

-

Asia-Pacific (APAC)

-

Middle East and Africa (MEA)

-

South America

Asia-Pacific (APAC)

APAC dominates the forklift battery market due to robust industrial activity in China, India, Japan, and South Korea. China, in particular, is a global leader in electric forklift production and consumption, supported by favorable government policies and rapid industrialization.

North America

The North American market is characterized by the rapid adoption of advanced technologies, sustainability initiatives, and the replacement of diesel forklifts with electric alternatives. The United States remains a key growth driver in the region.

Europe

Europe's market is shaped by strict emissions regulations and high environmental awareness. European companies are heavily investing in lithium-ion solutions, especially in Germany, France, and the UK.

Market Trends and Drivers

1. Electrification of Material Handling Equipment

As businesses strive to reduce carbon footprints and meet ESG goals, electric forklifts are replacing traditional diesel-powered ones. This transition directly fuels demand for efficient battery solutions, especially lithium-ion.

2. Technological Advancements

Battery management systems (BMS), fast-charging capabilities, and modular battery designs are becoming increasingly common. These innovations enhance battery lifespan, reduce operational downtime, and improve ROI.

3. E-Commerce Boom

The rise of e-commerce has placed immense pressure on logistics and warehousing sectors to scale operations. To meet demand, companies are investing in high-capacity electric forklifts, thereby boosting the battery market.

4. Sustainability and Regulatory Push

Governments worldwide are introducing regulations to curb emissions in industrial and transport sectors. These include subsidies and tax incentives for adopting electric material handling vehicles.

Challenges

Despite its promising outlook, the forklift battery market faces certain challenges:

-

High initial cost of lithium-ion batteries.

-

Lack of charging infrastructure in emerging markets.

-

Complex disposal and recycling of used batteries.

However, ongoing innovations and government support are likely to mitigate these barriers over time.

Growth Opportunities

1. Expansion into Emerging Markets

Countries in Southeast Asia, Latin America, and parts of Africa are witnessing increased industrial activity. As these economies grow, so does the need for modern warehousing and logistics solutions—an excellent opportunity for battery manufacturers.

2. Battery-as-a-Service (BaaS) Models

To lower upfront costs and encourage adoption, companies are exploring subscription-based battery solutions. BaaS allows users to pay only for the energy used, reducing capex and easing adoption for small and mid-sized enterprises.

3. Recycling and Second-Life Applications

With sustainability in focus, battery recycling and repurposing are gaining attention. Spent forklift batteries can be reused in less demanding applications or recycled for valuable materials, creating a circular economy.

Conclusion

The forklift battery market is at a pivotal point. With the global economy shifting toward sustainability and efficiency, industries across the board are embracing electrification and automation. The increasing reliance on electric forklifts—especially powered by lithium-ion batteries—will drive robust growth in this sector through 2031.

As technology advances and battery prices continue to decline, we can expect wider adoption, even in traditionally price-sensitive markets. Stakeholders—whether OEMs, logistics companies, or battery suppliers—must stay ahead of the curve by investing in R&D, exploring new business models, and tapping into emerging regional markets.

Also Available in :