Is It Time to Outsource Accounts Payable? A Retailer’s Checklist

In the fast-moving world of retail, managing finances efficiently is critical—especially when it comes to handling vendor payments, invoices, and returns. For many growing businesses, the accounts payable (AP) process becomes overwhelming, error-prone, or too costly to manage in-house. That’s why more retailers are exploring how to outsource accounts payable services as a smart, scalable solution.

But how do you know if it's the right time for your retail business to make the switch? This guide breaks down a practical checklist to help you evaluate whether AP outsourcing makes sense, what the benefits are, and how to move forward.

✅ What Does It Mean to Outsource Accounts Payable Services?

When you outsource accounts payable services for retailers, you hand over the management of invoice receipt, processing, payment scheduling, and vendor communication to a third-party provider. These providers use software automation, finance professionals, and streamlined workflows to manage your AP function more efficiently.

Rather than hiring, training, and equipping an in-house AP team, your provider does it all—typically for a predictable monthly or per-invoice fee.

📊 Why Retailers Are Turning to AP Outsourcing

Retailers, especially those with physical locations and online stores, manage a high volume of:

-

Vendor invoices

-

Purchase orders and receipts

-

Seasonal inventory fluctuations

-

Returns, credits, and disputes

-

Multi-location or multi-currency payments

Keeping all of this under control requires skilled staff, strong systems, and constant oversight. That’s why AP outsourcing is becoming a popular solution—it reduces workload, cuts costs, and improves accuracy.

📝 The Retailer’s Checklist: Is It Time to Outsource Accounts Payable?

Here’s a comprehensive checklist to help you decide.

1. Are You Struggling with Manual Processes?

If your team still processes invoices manually—receiving paper or emailed invoices, entering data into spreadsheets, and physically routing approvals—this is a major red flag. Manual AP increases the risk of:

-

Duplicate payments

-

Missed deadlines

-

Vendor disputes

-

Fraud or unauthorized payments

✅ If yes: Outsourcing brings automation, centralization, and faster processing—freeing your team for strategic work.

2. Do You Have High Invoice Volume or Seasonal Spikes?

Retailers often experience surges in purchases around holidays, sales events, or inventory restocking. If your team can’t keep up during peak seasons, it might be time to consider outsourcing.

✅ If yes: AP service providers can scale to match your volume without requiring you to hire and train temporary staff.

3. Are Vendor Relationships Being Strained by Late Payments?

Delayed payments or miscommunications can damage supplier relationships—leading to lost discounts, delayed shipments, or even contract termination.

✅ If yes: A dedicated AP partner ensures on-time payments and consistent communication with vendors.

4. Is Your In-House Team Overloaded or Understaffed?

If your team is constantly putting out fires, spending hours reconciling invoices, or dealing with vendor complaints, it may be time to bring in external help.

✅ If yes: Outsourcing gives your team breathing room to focus on analysis, planning, and core retail operations.

5. Are You Missing Early Payment Discounts?

Many vendors offer early payment discounts (e.g., 2% if paid within 10 days). If you miss these because of internal delays, you’re leaving money on the table.

✅ If yes: AP outsourcing partners use automation to prioritize and execute payments within optimal windows.

6. Do You Lack Real-Time Visibility into Cash Flow?

Retailers need to know exactly what’s coming in and going out. Delayed invoice processing and scattered AP systems can hide upcoming obligations.

✅ If yes: Outsourcing providers often include dashboards and reporting tools that give instant access to AP data, helping you forecast cash flow accurately.

7. Are You Concerned About Fraud or Compliance?

Weak internal controls can expose you to fraud, duplicate payments, or regulatory penalties—especially when handling hundreds of vendor transactions each month.

✅ If yes: Reputable outsourcing firms implement strict controls, audit trails, and compliance frameworks to minimize risk.

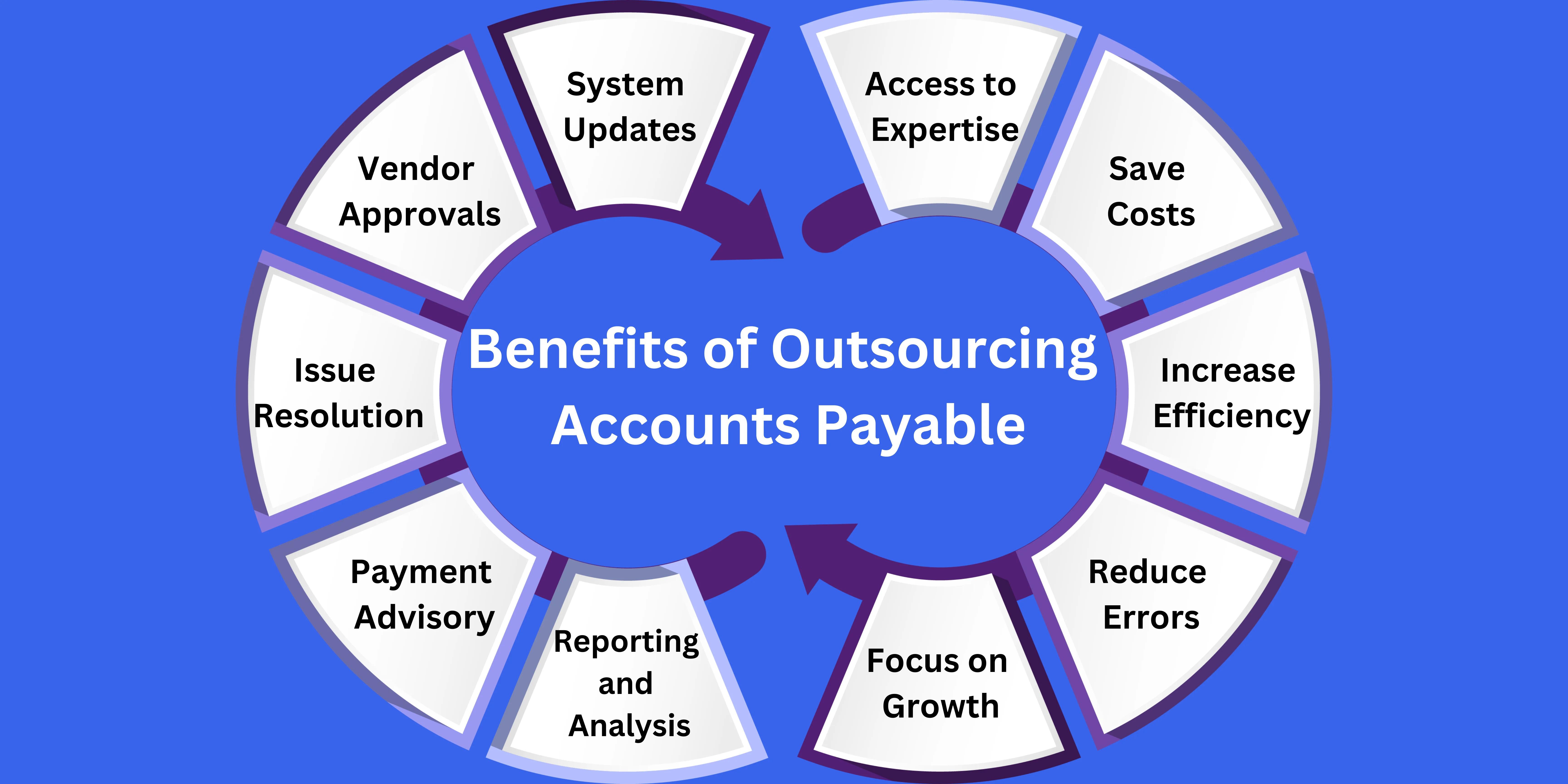

💡 Key Benefits of AP Outsourcing for Retailers

If you checked off several of the above, outsourcing could offer the following advantages:

1. Cost Efficiency

You reduce the need for full-time AP staff, software licensing, training, and error correction. This can significantly lower your per-invoice processing cost.

2. Faster Turnaround

Invoices get processed, approved, and paid quicker—avoiding late fees and unlocking early payment savings.

3. Improved Accuracy

With automated data capture and verification, you’ll reduce data entry errors, mismatches, and payment mistakes.

4. Scalability

Whether you’re opening new stores or launching seasonal promotions, outsourced AP can scale to match your needs instantly.

5. Better Vendor Management

Vendors are paid on time, disputes are handled professionally, and communication is centralized—improving long-term partnerships.

6. Enhanced Security & Compliance

Outsourcing partners use secure systems, role-based access, audit trails, and compliance checklists to protect your financial data and meet legal requirements.

🤝 What to Look for in an AP Outsourcing Partner

When choosing a provider to outsource accounts payable services for retailers, consider:

-

Retail-specific experience

-

Cloud-based or ERP-integrated systems

-

Automation and AI capabilities

-

Real-time reporting and dashboards

-

Multi-currency, multi-location support

-

Clear service-level agreements (SLAs)

-

Data security and compliance protocols

🔄 Transition Tips: Moving from In-House to Outsourced AP

-

Map your current AP workflow: Identify bottlenecks, pain points, and approval processes.

-

Start with a pilot: Outsource a portion of your invoices or a specific region before going full-scale.

-

Ensure integration: Choose a provider that integrates easily with your accounting or POS systems.

-

Train internal stakeholders: Communicate new workflows and responsibilities clearly.

-

Monitor performance: Use KPIs like invoice cycle time, error rate, vendor satisfaction, and cost per invoice to measure ROI.

📌 Final Thoughts

For many retail businesses, the decision to outsource accounts payable services is no longer a question of "if"—but "when." If your current AP process is inefficient, error-prone, or limiting your ability to scale, outsourcing could unlock huge benefits in cost savings, vendor satisfaction, and cash flow control.

Use the checklist above to evaluate your readiness. If multiple items apply, it might be time to take the leap and modernize your retail finance operations.