Why Business Risk and Credit Reports Are Essential for Company Due Diligence

In today’s complex business environment, every partnership, investment, or acquisition carries potential risks. Companies cannot rely solely on trust or reputation when entering into agreements. Proper due diligence is crucial to safeguard financial stability, ensure compliance, and make informed decisions. Among the most critical tools in this process are Business Risk Reports and Business Credit Reports. Together, they provide a comprehensive assessment of a company’s operational and financial health.

Understanding Business Due Diligence

Due diligence is a systematic process of evaluating a company before entering into a business relationship. It aims to identify potential risks, financial vulnerabilities, and operational weaknesses that could impact future business outcomes. The process typically includes analyzing:

-

Financial statements and creditworthiness

-

Operational efficiency and internal controls

-

Legal compliance and regulatory adherence

-

Market positioning and reputation

Business Risk Reports and Business Credit Reports are integral components of this evaluation, ensuring that no aspect of potential risk is overlooked.

The Role of Business Risk Reports

A Business Risk Report evaluates the operational and market-related threats a company might face. It includes:

-

Management and operational assessment

-

Industry and market exposure

-

Compliance and legal risk analysis

-

Potential internal and external threats

By providing a holistic view of potential vulnerabilities, risk reports allow companies to anticipate challenges and make informed decisions. They are particularly useful in identifying:

-

Suppliers or partners with operational inefficiencies

-

Companies exposed to regulatory or legal risks

-

Market volatility or competitive threats

When used in due diligence, Business Risk Reports reduce uncertainty, ensuring that partnerships and investments are strategically sound.

The Role of Business Credit Reports

While risk reports focus on operational and market threats, a Business Credit Report provides insight into financial stability. Key aspects include:

-

Credit scores and ratings

-

Payment history with suppliers, vendors, and financial institutions

-

Outstanding debts and financial liabilities

-

Legal defaults or bankruptcies

For lenders, investors, and corporate decision-makers, credit reports reveal whether a company is financially reliable. They are critical for:

-

Extending loans or credit safely

-

Evaluating investment risks

-

Assessing the financial credibility of potential partners

A company with a positive credit report is more likely to honor financial commitments, reducing exposure to defaults or losses.

Why Both Reports Are Essential for Due Diligence

Conducting due diligence with only one type of report can lead to incomplete analysis. Here’s why using both is critical:

-

Comprehensive Risk Assessment

While credit reports assess financial risk, risk reports cover operational, market, and compliance threats. Together, they provide a full picture. -

Informed Decision-Making

Decision-makers can make strategic choices based on verified financial and operational insights rather than assumptions. -

Minimized Exposure to Fraud or Defaults

Identifying both financial and operational weaknesses reduces the likelihood of entering risky agreements. -

Enhanced Negotiation Power

Understanding a company’s complete risk profile allows for better contract terms and safer investment decisions.

By integrating these reports into due diligence, businesses ensure that their decisions are both informed and secure.

Practical Applications in Company Evaluation

Business Risk and Credit Reports are used across various due diligence scenarios:

-

Mergers and Acquisitions: Identify potential liabilities and financial vulnerabilities before acquisition.

-

Partnerships and Joint Ventures: Assess operational reliability and creditworthiness to ensure smooth collaboration.

-

Supplier or Vendor Onboarding: Verify the stability and trustworthiness of suppliers to prevent disruptions.

-

Investment Decisions: Evaluate startups, SMEs, or large corporations for financial and operational viability.

These applications help companies mitigate risk while fostering confidence in strategic decisions.

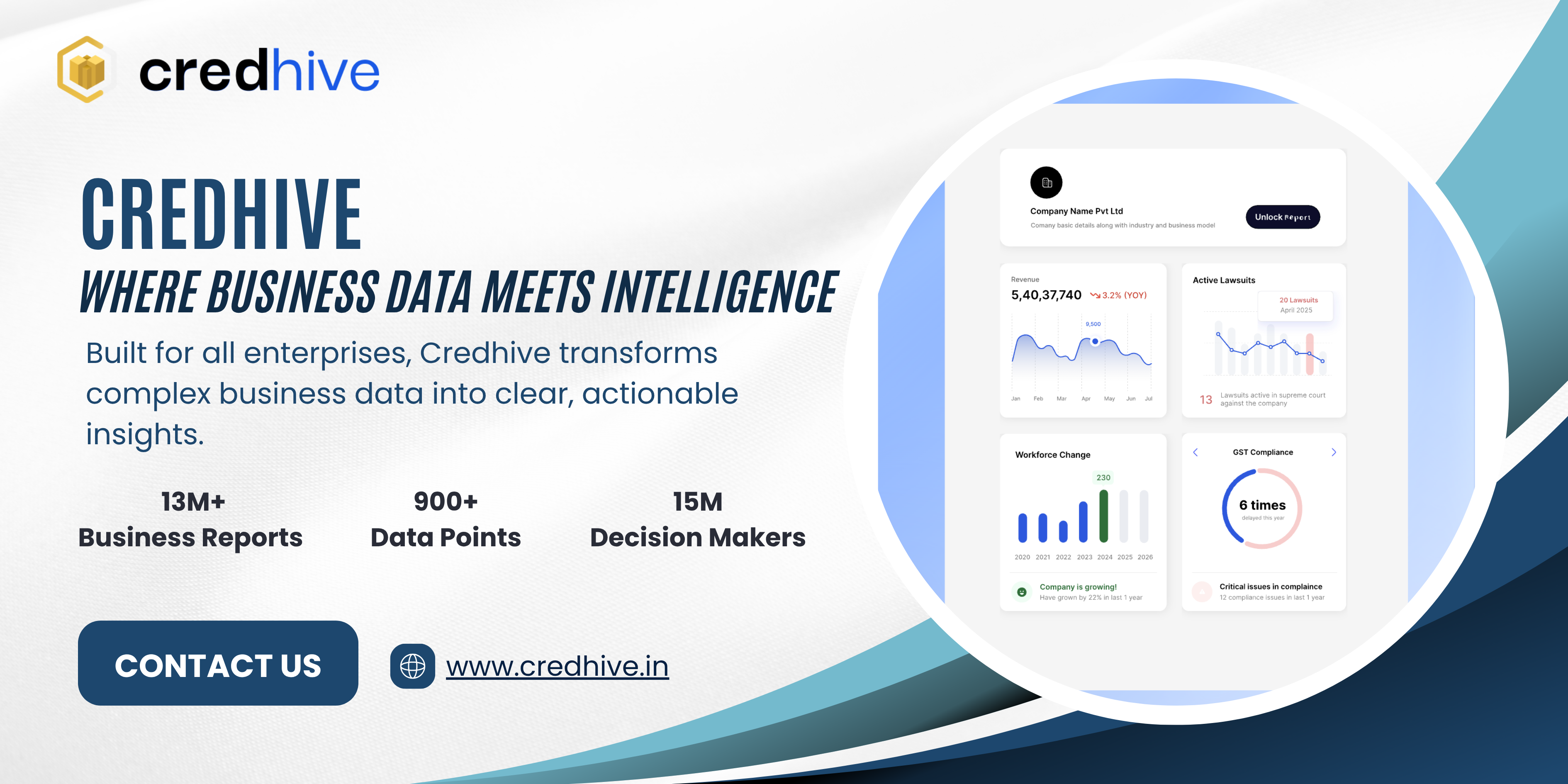

Technology-Driven Solutions for Efficient Due Diligence

Digital platforms have transformed the due diligence process. Platforms like Credhive provide access to verified Business Risk Reports and Business Credit Reports, enabling:

-

Real-time access to comprehensive company data

-

AI-driven analytics for accurate risk evaluation

-

Centralized dashboards for easy comparison and decision-making

-

Verified Indian Company Information for reliable insights

Such technology reduces the time and cost associated with manual due diligence while increasing accuracy and reliability.

The Benefits of Using Both Reports Together

-

Reduced Uncertainty: Companies can identify both operational and financial risks before committing.

-

Improved Strategic Planning: Insights from both reports support long-term business strategies.

-

Stronger Corporate Trust: Stakeholders gain confidence knowing that thorough due diligence has been conducted.

-

Enhanced Compliance: Ensures that partnerships or investments align with legal and regulatory requirements.

The integration of Business Risk Reports and Business Credit Reports strengthens the due diligence process, safeguarding companies from potential setbacks.

Conclusion

In an increasingly complex business landscape, relying on partial information can lead to costly errors. Business Risk Reports and Business Credit Reports are essential tools for conducting thorough due diligence. While risk reports focus on operational and market vulnerabilities, credit reports provide a clear picture of financial stability.

Together, these reports provide a complete understanding of a company’s profile, enabling informed decisions, reducing risk, and enhancing corporate trust. Platforms like Credhive streamline this process by offering reliable, verified, and easily accessible reports. For any organization looking to enter partnerships, invest, or expand, integrating both reports into the due diligence process is not just advisable—it is indispensable.