Artificial intelligence agents are changing security in cryptocurrency transactions by introducing advanced protection, efficiency, and scalability in a perpetually complex digital environment. Since the cyber threats have become extremely intelligent, the blockchain ecosystems have grown quite complex. AI systems will, therefore, assume a vital role in crypto operations, ensuring security and streamlining the processes involved with transactions. Let’s look at how AI transforms security, efficiency, and compliance in the cryptocurrency space.

Real-Time Monitoring and Fraud Detection

AI agents have continuously monitored blockchain networks and cryptocurrency transactions in real-time. These agents use advanced machine learning algorithms to analyze transaction patterns and user behavior to identify anomalies that might point to phishing attacks, identity theft, and other forms of fraud, such as double-spending. They detect anomalies quickly to flag potential threats, such as sudden changes in transaction volumes or deviations from typical user activity.

Learn and adapt to newer fraud techniques to increase the detection rate and reduce false positives over time.

AI agents respond rapidly to threats with deep learning models compared to traditional security mechanisms. This reduces damage from security breaches and can eliminate unauthorized access. These are among the various capabilities that protect users against scams, hacks, and even insider attacks.

Enhanced KYC and Identity Verification

It’s also changing how Know Your Customer processes are carried out, something rather important in money laundering and fraud prevention in space. Active AI agents can now efficiently:

check identities by analyzing biometric data, such as facial recognition and fingerprint scanning, besides traditional documents like passports and ID cards;

cross-check data with global databases, sanction lists, and criminal records for correct verification.

Automating the KYC process, reducing manual reviews, and speeding up the process can improve onboarding times.

These changes to the KYC systems ensure that the business remains compliant with major global financial regulations. They also greatly enhance the user experience through easier verification processes while keeping security intact.

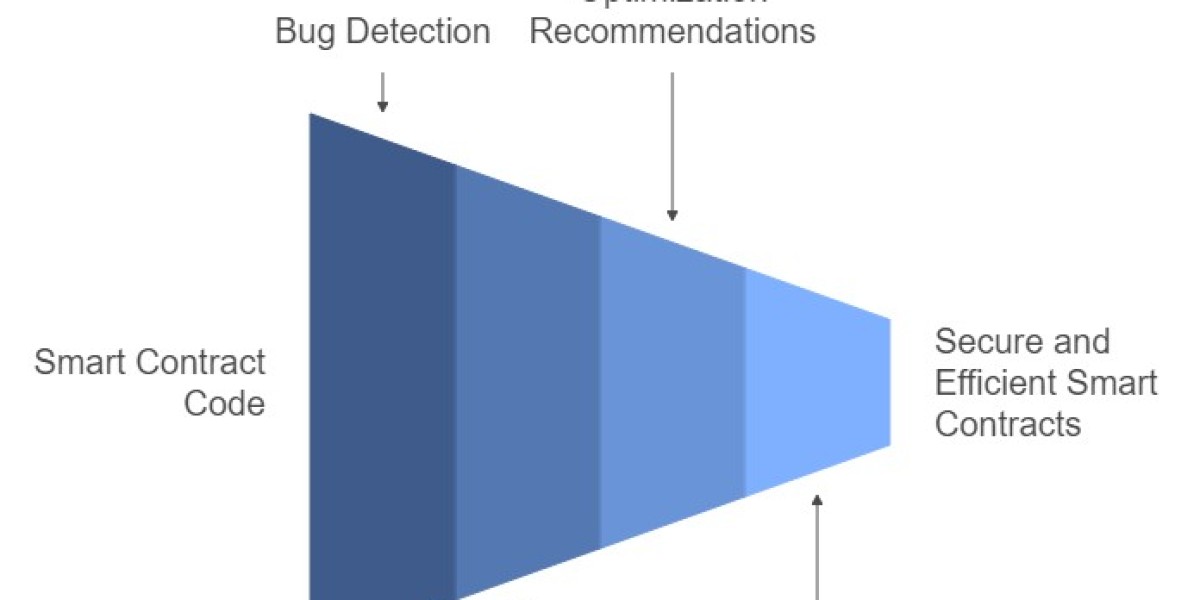

Smart Contract Analysis and Optimization

Smart contracts form the backbone of decentralized applications and cryptocurrency transactions. However, they are prone to coding errors and potential exploits. AI agents have become quite critical in the following ways:

They analyze smart contracts for bugs, vulnerabilities, and other threats before their actual deployment on the blockchain.

Recommend optimizations that streamline the execution of contracts, making them far more efficient and secure.

Automate code audits, minimize human error, and enhance the functionality of smart contracts to avoid issues related to reentrancy attacks or overflow bugs.

As smart contracts become mainstream in DeFi, AI-driven analysis of contracts has indeed kept them robust and secure and mitigated most risks associated with their execution.

Regulatory Compliance and Anti-Money Laundering

Regulatory compliance in cryptocurrency transactions is increasingly becoming a priority, without which it would not have been possible to automate any of these processes using AI agents. AI systems now replace :

Real-time monitoring of transactions for patterns usually consistent with money laundering, terrorist financing, and many other illegal activities.

Enhance various aspects of AML systems to flag unusual or suspicious transactions informed by historical data and sophisticated pattern recognition.

Automate regulatory reporting and submissions promptly, minimizing human error and ensuring complete adherence to all local and international financial regulations.

AI agents help crypto exchanges, wallets, and DeFi platforms comply with ever-complex regulations without requiring high human interference and associated costs.

Predictive Analysis for Risk Management

AI agents are not just reactive but proactive in handling risks that may come forth within the cryptocurrency ecosystem. By leveraging historical data and market trends, AI can:

Predict potential security vulnerabilities likely to occur based on past incidents, helping the organization take precautionary measures in advance.

Understanding past market manipulations, such as pump-and-dump schemes or flash crashes, can help forecast the possibility of future market anomalies.

Spot the failures of smart contracts and volatile conditions in the market that expose businesses and independent traders to risk, thus being able to react more aptly against these risks.

This would enable enterprises and independent traders to make better decisions by estimating the risks of crypto trading in a volatile world.

Secure AI-to-AI Transactions

The most futuristic of developments could be that AI agents conduct autonomous, secure transactions amongst themselves independently of human intervention. Such transactions also have several advantages, including:

Eliminating human error in the transaction process: An AI agent can securely check and execute a transaction in less than an instant.

Through cryptographic techniques, the AI agents would validate one another before the actual transaction to ensure trust.

Wholly autonomous financial operations, whereby AI agents buy resources, compensate for services rendered, and settle accounts with their peers using cryptocurrency, a frictionless and efficient machine economy.

This next wave of AI-to-AI interaction will give way to autonomous, decentralized markets where machines can interact and transact with minimal human intervention, enabling industries to achieve unparalleled efficiency.

Challenges and Considerations

However, several challenges must be encountered when integrating AI with cryptocurrency transactions. A few significant issues include:

Adversarial attacks on AI models: Some adversaries trick the AI agents into making mistakes in some decisions, ultimately creating insecurity in the transaction.

A few algorithms in AI are opaque; thus, this feature directly clashes with a few of the essential features of blockchain, viz., transparency and decentralization.

It will also include privacy concerns and algorithmic bias since data used by AI agents could create unintended biases or user privacy violations, especially when the system is decentralized. The convergence of AI and crypto calls for carefully addressing these challenges if both technologies complement each other.

Conclusion

AI agents are bound to flip the security landscape around cryptocurrency transactions through enhanced, real-time monitoring, fraud detection, better Know Your Customer processes and optimization of smart contracts. These intelligent systems make crypto transactions more secure; at the same time, compliance and risk management will become easier. Integrating AI in crypto will set a new milestone in digital finance, characterized by machine-to-machine transactions and fully autonomous systems. This synergy between AI and crypto is bound to play a significant role in crafting a secure, efficient, and highly scalable digital economy in the years to come.